10 days and a $10 trillion market swing: How Trump’s tariffs changed the global economy, and what comes next

In American financial history, there are weeks that live in a state of shame-such as the collapse of the “Black Tuesday” securities for the year 1929, or the bankruptcy of Lehman Brothers for the year 2008, or the shock caused by Kofid for the year 2020. We can to this list add “liberation day” that led to the supervision of president Donald Trump on assembly holidays over the past two weeks.

The damage that followed was tremendous, as panic investors sold both US stocks and treasury, which led to an erasure of $ 10 trillion in global stocks between April 2 and April 9, when the president stopped some customs tariffs. While the markets have recovered many of these losses by Friday, most of the main stock indicators are still in a correction area, and they remain in a state of turmoil determined by land fluctuations, as many traders fear that there will be more economic damage.

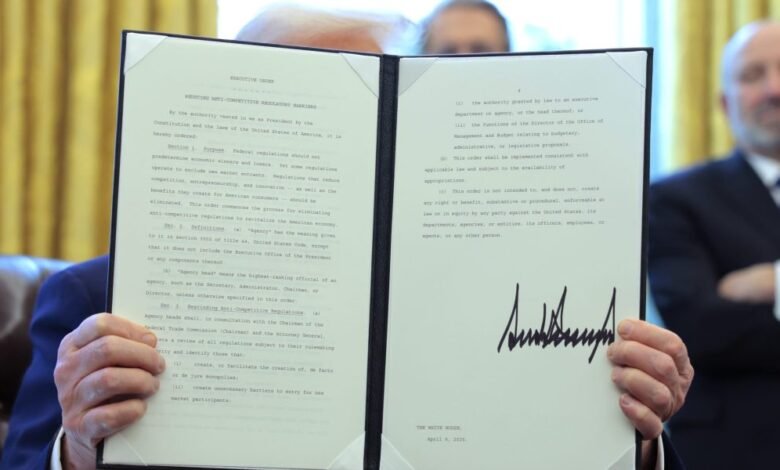

Amid permanent chaos, the clearest picture shows what happened, and what the possible effects can be in the long run. It is clear, of course, that the same definitions caused the collapse, for the first time in nearly a century, the United States government abandoned free markets in favor of commercial experiences. In addition to this fire, Trump poured gasoline from uncertainty, and he launched customs duties in the name of increasing American industrial production, but implementing them in random ways, then he suddenly reflected his decisions. Nobody knows what to do next; The communication between the White House and business leaders was minimal.

Capital markets showed that she does not like what is happening. In the most disturbing development, the reaction of many investors by selling US Treasury bills – a origin that represented for decades for the most safe havens. For the first time in living memory, some players have lost confidence in the American financial system and are seeking security instead in Europe and Asia.

this Not only is the erosion of confidence in the Selling of T-BILS, but in the sudden diving of the US dollar. Business leaders, who have been silent mostly until the repercussions of the liberation day, have begun to cool down on the long -term harm to the American economy, while companies are scrambling to address the supply chains of the future and plan for the future. Meanwhile, the definitions are widely of inflation, and consumers are increasingly afraid because they realize that the cost of eggs does not decrease, and that cars and many other commodities can be expensive, if not completely far from their reach.

In these unprecedented economic conditions, how should executive managers and investors interact? To provide some directions, luck She benefited from the experience of veteran business journalists to provide a sharp analysis – such as an overview of the “Murder of Killing” in the bond market that prompted Trump to overcome his last tour of the customs tariff – and the practical advice. We have sponsored some of our best modern coverage in a special report, Economy in the crisis.

Our guidelines include a view of how some common assets perform, including gold and bitcoin, and advice on how to adjust your portfolio to calculate the decline in the dollar and other potential permanent transformations in the financial scene. We report how to modify the Walmart, Apple and other Fortune 500 companies with a climate that can no longer be considered free of charge across the border. The stories together help explain what happened in the 10 days on the market in the market for years, and you have a feeling of what can happen after that in an endless economic storm. Read -continued – and a clip.

This story was originally shown on Fortune.com

2025-04-12 13:00:00