7 Effective Ways To Prepare for a Recession

Many Americans are afraid to face stagnation in the back half of 2025 due to many economic factors – including definitions. If you are concerned that economic contraction may harm your money, learn to manage your money better and build a safety network is now very important.

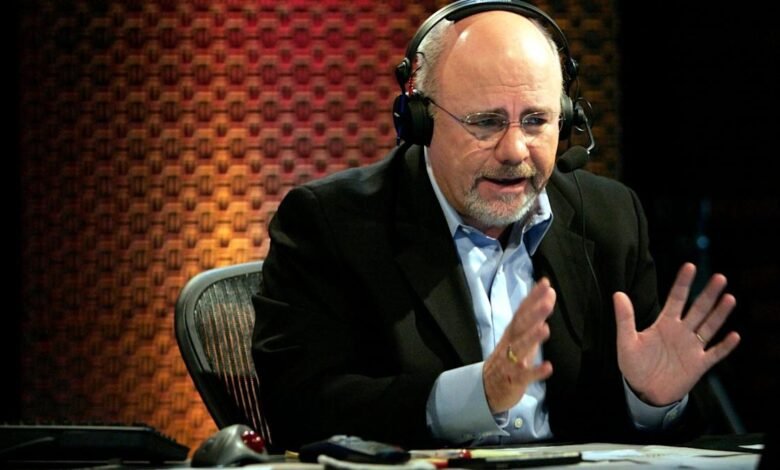

It is now heading: Dave Ramsey says this is the best way to pay off debts

For you: 5 brands for cars called the lowest reliable cars in 2025

Dave Ramsey, famous personal finance expert, radio and author, known for his advice on debt freedom and creating good money habits. You have provided these seven stagnation tips that you must consider.

Just hearing a potential stagnation may make you feel very anxious – or even make you do unseen money movements.

Ramsey’s suggestion is to remember that you always control your money, even if the economy is not in good condition. By maintaining a quiet and clear mind, you can focus on improving your financial position now so that you can ride the recession more easily.

Discover: This is the reason for a desire to invest your retirement savings in Roth 401 (K)

Before you make additional money, you should know where your financial resources are currently standing. Ramsey recommends that all your origins, debts and monthly bills are determined so that you have the information available easily. By knowing the amount you saved, what you owe and what you must pay every month, you will know where your money needs to improve.

Even in the event that the recession does not occur, your financial resources can easily get out of control if you lack the budget. You need one that recounts all your monthly income and your expenses in detail – and your remaining money appears as soon as the expenses are calculated. If you end up with a negative number, this is a sign to find costs to reduce them immediately.

While the simple budget budget schedule can work, RAMSEY recommends its free application for every everydollar because it deals with accounts. You can also get a distinct version of this app with many financial planning tools. Whatever the option you choose, make sure to follow the budget actually and do not use debts to cover a cash deficiency.

While the emergency fund is useful for any large unexpected account, it is especially important during stagnation, when the loss of the job occurs. As part of “7 Steps of the Child”, Ramzi is advised from a $ 1,000 emergency box. In the end, you will want to get at least three to six months of expenses, but Ramsey suggests getting rid of all your debts before building a larger emergency box.

2025-08-30 15:05:00