30 Congress members support bill to block political insider trading after Maduro Polymarket controversy

Thirty members of congress supported a bill that would prevent federal officials and political staff from using prediction markets that could be influenced by inside information.

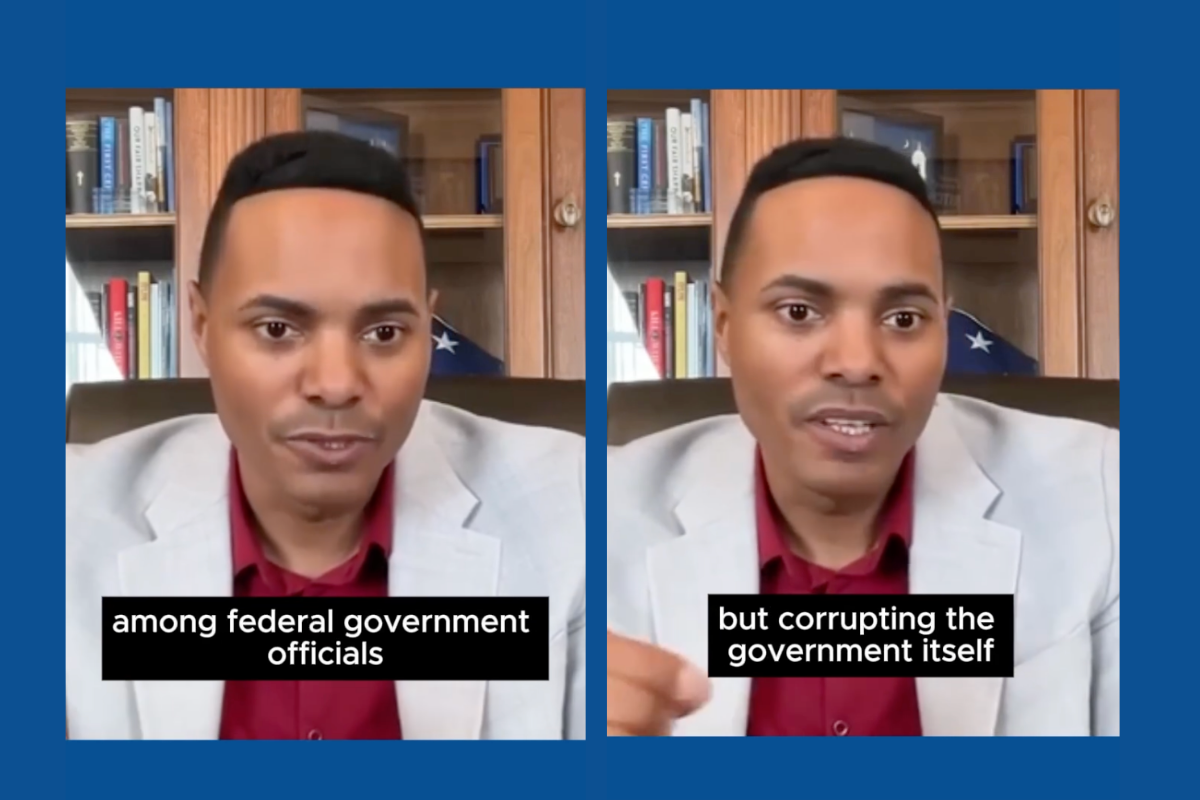

After an anonymous Polymarket user cashed out more than $400,000 in a trade related to the impeachment of Venezuelan President Nicolas Maduro, concerns were raised that the bet was placed using inside information. Now in a statement seen by ReadWrite, Rep. Ritchie Torres has introduced the Public Integrity in Financial Prediction Markets Act of 2026 in the House of Representatives, garnering support from 30 members of Congress.

The bill would prohibit federal elected officials, political appointees, executive branch employees, and congressional employees from buying, selling, or exchanging predictive market contracts related to government policy, government actions, or political outcomes when they are privy to nonpublic information or could reasonably obtain such information through their employment.

Calci CEO, Tariq Mansour, previously said he would support a draft law prohibiting government officials from using prediction markets.

Congress’s support comes from the left

Support for the bill comes from Democrats, with co-sponsors including Speaker Nancy Pelosi among others.

“Perhaps the most corrupt corner of Washington, D.C., is the intersection of prediction markets and the federal government, where insider trading and self-dealing are no longer imagined risks but clear risks,” said Rep. Torres. “We ignore this obvious corruption at our own peril. Imagine for a moment that a member of the Trump administration was betting on the prediction of an event like the impeachment of Nicolás Maduro.

“As a government insider and participant in prediction markets, this individual would face a perverse incentive to advance policies that are in their own pocket. Profiting in the prediction market by government insiders must be prohibited – period.”

Torres went on to specifically mention President Donald Trump “who uses cryptocurrencies to enrich himself and his family.”

He continued: “There is reason to fear that Trump or his cronies might do the same when it comes to prediction markets.” “No elected official is elected to benefit from his elected office. Government is not a for-profit institution; it is a public trust. It does not belong to elected officials. It belongs to the people who elect them.”

In light of the recent betting activity surrounding the arrest of President Nicolas Maduro, I have serious concerns about this @polymarketAbility and willingness to comply @Koftak Systems.

I’m demanding answers from the CEO of Polymarket @shayne_coplan Regarding guarantees… pic.twitter.com/fHpjLpsykG

— Dina Titus (@repdinatitus) January 9, 2026

Meanwhile, Democratic Rep. Dina Titus, who has been pushing to reform gambling laws through the FAIR BET Act, sent a letter to Polymarket CEO Shane Coplan asking some tough questions. She wants to know what safeguards the company has put in place to stop insider trading and ensure its markets are managed fairly and transparently.

“In the days leading up to the arrest of Venezuelan President Nicolas Maduro, traders at Polymarket placed large bets on a contract predicting whether Maduro would leave office before the end of January 2026. One bet, said to be worth $32,000, resulted in profits exceeding $400,000,” she wrote in correspondence. “While it remains unclear whether these bets constitute insider trading, their timing raises serious questions and highlights the need for robust oversight,” she wrote in correspondence. compliance, and monitoring mechanisms.”

Featured Image: Polymarket / Wikimedia Commons licensed under CC BY-SA 4.0

The post Thirty Members of Congress Support Bill to Prevent Insider Political Trading After Maduro Polmarket Controversy appeared first on ReadWrite.

Don’t miss more hot News like this! Click here to discover the latest in Technology news!

2026-01-12 10:59:00