Wall Street cheers end of Trump’s Greenland drama; hopes Supreme Court will kill the other tariffs

The S&P 500 index closed 0.55% higher yesterday on good news about US GDP growth and president Trump backing away from his plan to invade Greenland. The S&P rose back above 6,900 and within 1% of its all-time high. Gold hit another record yesterday as well.

But index futures fell 0.24% before the opening bell in New York and markets in Europe saw slight selling this morning after Asia closed mixed, a sign that traders are taking profits after yesterday’s rally.

On the macro front, Wall Street analysts are optimistic. It’s a marked change from the charged mood of the past few days, when investors were anticipating another transatlantic tariff war.

In fact, Trump’s tariffs turned out to be a much smaller economic deal than “previous worst-case concerns,” says JPMorgan Chase. Companies adjusted their prices and supply chains, with the result that “the realized tariff rate was much lower at approximately 11% (versus expectations of 15%),” according to Dubravko Lakos-Bojas and his team. “Only 14% of S&P 500 companies are highly sensitive to tariffs.”

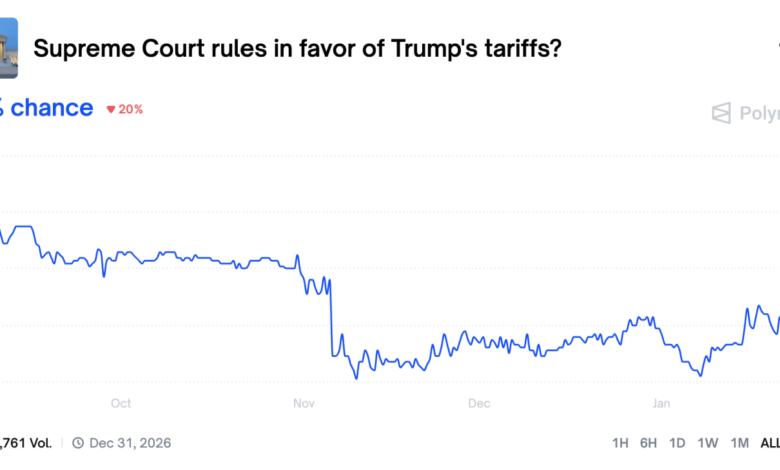

The bank says things could improve if the US Supreme Court rules against the president.

“Prediction markets are assigning odds of over 65% that the Supreme Court will rule against the government, and those odds have always been against the government, especially after the Supreme Court’s oral arguments in November,” Lakos-Bogas told clients.

Source: Polymarket

Analysts were also cheered by a new upward revision to US GDP for the third quarter of 2025, at 4.4%.

“The 4.4% real growth rate is well above normal and will likely moderate over the course of the year, but if we can stay above 3% for the full year, it could lead to double-digit returns in the stock market,” Chris Zaccarelli, chief investment officer at Northlight Asset Management, said in an email seen by me. luck.

EY-Parthenon chief economist Gregory Daco was singing from the same hymnbook. “Momentum was driven by resilient consumer spending, robust equipment and AI-related investments, a big boost from net international trade, and a rebound in federal government expenditures,” he said in a note. “The U.S. economy is neither overheating nor stalling; it is adjusting.”

All of this explains the calm we are witnessing in the markets today.

“For some assets, it was as if the sell-off had never happened, with the VIX volatility index (-1.26 points) back at 15.64 points, below its levels before Saturday’s tariff announcements,” said Jim Reed and his team at Deutsche Bank.

Here’s a quick snapshot of the markets before the opening bell in New York this morning:

- Standard & Poor’s 500 Futures were down 0.24% this morning. The last session closed at an increase of 0.55%.

- Stokes Europe 600 It decreased by 0.22% in early trading.

- FTSE 100 index in the United Kingdom It fell by 0.11% in early trading.

- Japan’s Nikkei 225 It rose by 0.29%.

- China CSI 300 Decreased by 0.55%.

- South Korea Cosby It rose by 0.76%.

- India Nifty 50 Decreased by 0.95%.

- Bitcoin It was flat at $89.9K.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2026-01-23 11:48:00