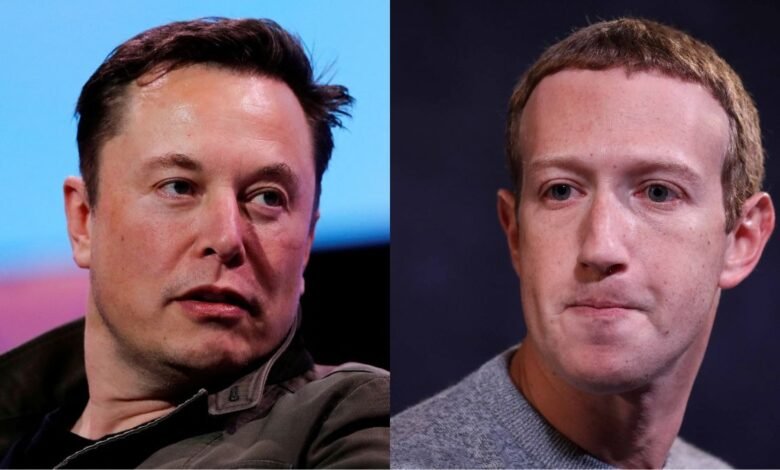

‘Shaking investor trust’: Trump’s ‘discounted’ reciprocal tariffs spark $42.6 bn wipeout for Musk, Bezos, Zuckerberg

Elon Musk, Jeff Bezos, and Mark Zuckerberg made a collective loss of $ 42.6 billion after introducing a new tariff by US President Donald Trump. This “reduced” mutual tariff has greatly affected the global markets, which led to one of the worst trading days since the Covid-19s.

The CEO of Meta Zuckerberg faced the worst loss, as his wealth decreased by $ 17.9 billion. Jeff Bezos, the founder of Amazon, closely followed with a decrease of $ 16 billion, while Elon Musk, CEO of Tesla, witnessed a decrease of $ 8.7 billion in his net wealth. Moreover, the cumulative losses of Musk for 2025 now exceeded $ 110 billion, mainly driven by this customs tariff and other market factors.

According to the Bloomberg Billionails Index, Musk became the sixth largest loser of wealth on Monday, after losing $ 4.4 billion due to the decrease in Tesla shares, raising its total wealth to $ 297.8 billion. This represents the first time that the pure Musk value has decreased to less than $ 300 billion since November.

During Thursday and Friday, Musk’s wealth has already decreased by $ 31 billion, which pushed its total losses this year to 134.7 billion dollars.

Financial turmoil highlighted the fluctuations of intense market and the invested fear surrounding these definitions.

Analysts described the market turmoil as more than “technical correction”, attributing it to changes in the aggressive policy that “shook the investor’s confidence”. The joint losses of the best 500 public companies have reached approximately $ 2.4 trillion, as they face technology giants such as Meta, Amazon and Tesla decreases in stock prices. Meta shares decreased by 9 %, 6 % amazon, and Tesla by 5.5 %.

President Trump unexpectedly declared definitions using the IEEPA Economic Forces law (IEPA), which imposes a 10 % basic tariff on imports of major commercial partners. Despite Trump’s claims that “markets will flourish”, this step was met with both investors and analysts.

Legal experts expect challenges to the definitions, with reference to UBS, “The White House’s executive authority is likely to be challenged in the courts in the coming weeks.” In addition, UBS expects a 50 % chance to reduce customs tariffs under pressure from companies and legislators.

This customs tariff raised concerns about the potential global recession, characterized by increasing inflation and stopping economic growth. Market analysts fear that the broader economic effects may deepen, which affects not only the technology sector but global trade as a whole.

2025-04-08 07:39:00