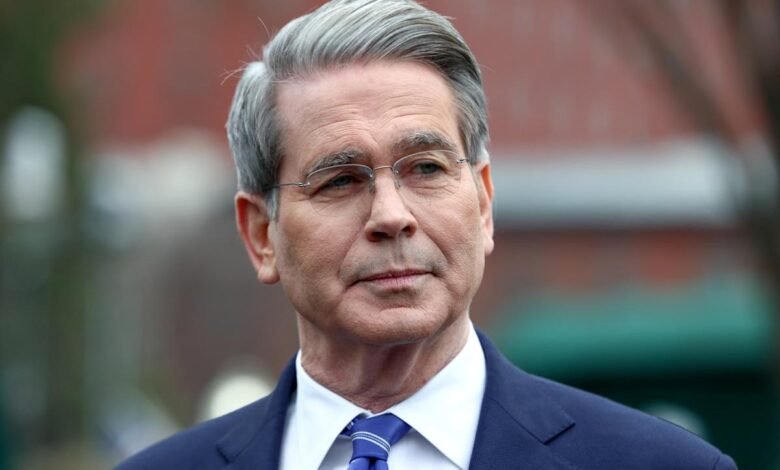

Bessent says ‘convulsions’ in bond market not ‘systemic’

On Wednesday, Treasury Secretary, Scott Payet, attributed the chaos in the bond market to “some of the very big players” who suffer from losses, but he said it was “nothing systematic.”

He also issued some new warnings to China with the escalation of a trade war with the United States, saying it should not try to reduce the value of its currency and that all policy options are possible.

“Everything on the table,” said while appearing on “Morning with Maria” on the Fox business network, when asked whether the United States can remove Chinese companies from the American stock exchanges.

“It is unfortunate that the Chinese in reality do not want to come and negotiate because they are the worst criminals in the international commercial system.” What Beijing should not do is trying to reduce the value of this path to get out of this. “

This week, the strategists have developed multiple theories about the reason for the high revenue of bonds this week amid what some call “fire of fires” in the treasury. It ranges from investors who seek to get more liquidity within a volatile market to bond dealers, and may feel more confident that the American economy can avoid recession.

The revenue jumped for 10 years (^TNX) 17 basis points to start the week, which is 34 points 34 basis basis from a decrease of 3.87 % to a rise of 4.21 %. The revenue extended these gains on Tuesday, as it climbed approximately 11 basis points to hover at about 4.26 %.

Likewise, the return on 30 years (^Tyx) jumped 12 other basis points on Tuesday after seeing her greatest move to the upward trend since March 2020. As of the market, the return was traded for 30 years by 4.72 %.

The increase in treasury revenue is a challenge to the declared Bessent goal of decreasing borrowing costs as part of its larger economic plan, which also includes tax cuts and disruption.

It also raises questions about whether these bonds are actually a safe haven through chaos in the current market resulting from president Trump’s tariff.

Read more: How to protect your money during economic turmoil, stock market fluctuations

Bessin, on “Al -Sabah with Maria”, refused to speculate that China could be a large seller of the treasury at the present time. He said: “This is one of these unavailable spasms” that occur in the fixed income market, and added that it was taking place between “very big players suffering from losses.”

Risk managers “click on people on the shoulders, and ask them to drop their books – which happens every two years with the accumulation of financial lever.”

“I think there is nothing systematic about this – I think it is uncomfortable but normal, it happens in the bond market,” said Pesint.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-04-09 13:29:00