‘The Sell America Trade’: Who’s behind the sinking of the U.S. dollar

- The US dollar fell about 9 %, a year so far. The return on the cabinet remained high despite the decrease in the stock market – contrary to what investors usually expect. Some blame Japan and China for selling American bonds, which would harm the dollar. Others believe that hedge funds that benefit from bond positions may be responsible. But analysts and economists tell luck As long as the White House continues to generate economic uncertainty, everyone will flee from the dollar.

The value of the US dollar ascended yesterday after president Trump played and said he had no intention to launch Jerome Powell, the Federal Reserve Chairman. It was a rare news from the “reserve currency” in the world, with a value of 9 % from a year to date against the DXY index of foreign currencies.

This asks a question: Who sells the dollar – or selling the assets that lead the dollar – and why?

Initial doubts targeted Japan and China. After all, they both see their export markets that are hurt by Trump’s trade war, the first and second largest foreigners of US Treasury bonds. Perhaps those countries were trying to send a message to Trump: Remember, we can harm you too!

However, you tell the sources luck There is little evidence that any of the countries deliberately require tanks.

Perhaps it is surprising, there is not much evidence that the hedge funds with liquidity issues suddenly were forced to relax on the bets on American bonds, which forced the last sale that the dollar withdrew with, as these sources say.

Instead, the blame lies with anyone else

Trump’s economic statements have generated a lot of global uncertainty that investors of all assets-stocks, bonds and currency-simply withdraw from the United States until he returns again to appear.

Japan sells a lot of everyone Foreign bonds – recently $ 20 billion in “US Treasury bonds,” according to Oxford’s economic analyst John Cannavan. “Since the cabinet is a large part of the Japanese foreign bond possessions, it is generally seen as a good agent.”

But he says: “It is not clear that China and/or Japan have been responsible for selling the cabinet market and the last fluctuations. It is difficult for evidence to come in both cases. Data on foreign transactions and treasury debts tend to launch with a delay, so they could play a role, but it does not seem to be the primary factor.”

Not hedge boxes

CANAVAN was also not keen on the hedging box theory.

“Early doubts that imposing periods of the large foundation deals that were on the basis of benefiting did not seem to be incorrect. CFTC data obligations during the past two weeks have not provided any evidence of any commercial basis for trade.” luck.

His colleagues in Goldman Sachs agree partly.

In a memorandum of customers who were published on April 22, analysts Kamakchia Trevidy and Dominic Wilson said: “We have not seen much support either in the” fingerprint “across the markets or in the flow data of the big foreign sales theories, although there is more evidence of relaxation (especially the sharp step in spreading the swap) played a role.”

In fact, China and Japan have a firm interest in not selling American bonds because this only harms their need for stable assets and will make their currencies rise, which will harm their export markets in turn.

“Take China, for example,” says Kevin Ford, FX & Macro Strategist at Convera.

“As the second largest foreign creditor in America after Japan, it possesses about $ 780 billion in the securities of the Treasury. While the market movements are closely monitored, it seems that a huge sale is not likely, because it will enhance the yuan due to the effects of the return home, and currently benefit from its effects to confront the opposition.”

“The hedge boxes, on the other hand, may have added fuel to the fire. With the sale of bonds, momentum gained, the margin calls could have been forced money to liquidate the cabinet to raise funds, especially those who use bond bond deals.” luck.

Everyone wants to remove hell from Dodge

In fact, there is a simpler interpretation: the dollar in a decrease and achieves the return on American bonds to remain high because everyone – literally everyone On this planet – he wants to remove hell from Dodge now.

This includes stocks, bonds and currency. With Trump’s change in his mind around the clock on commercial policy and bullying from his central bank on a daily basis, investors of all kinds are simply of their exposure to the nation that they now consider risk assets instead of a safe haven.

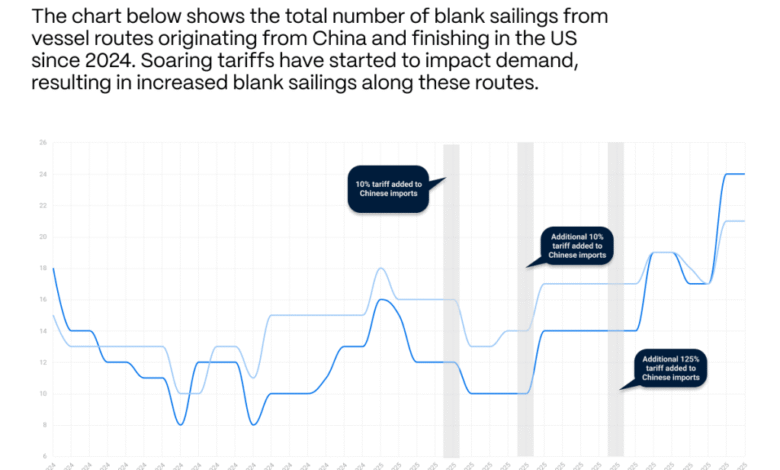

This aversion to the United States has begun to appear in the charging methods. With the restrictions of definitions that restrict trade, the number of “empty sailing” of the United States has doubled by Ocean Reaves since February, according to the data followed by Project44, which is the supply chain platform. The empty sailing occurs when the charging line touches a path and then completely abolishes it or exceeds an outlet on this road.

The company says: “The East Coast is scheduled to witness a peak of 24 empty sails last week of May, an increase of 100 % since the new definitions began in February, with the western coast closure in 21, or an increase of 31 %,” the company says.

Although shipping does not directly affect the dollar, it is – most likely – clear symptoms of a world that withdraws from dealing with the United States

Wedbush analyst Daniel Eve, which covers the technology market, has even his name. In a note of customers historians on April 22, it was called “the sale of America’s trade”.

“This tariff/trade war reduces American technology on the knees and helps Steamroll China Tech in the future,” he wrote.

And as long as the trade war continues, the dollar will continue to decline, according to Coldman Sachs.

“We believe that rethinking the risks and rewards of the dollar assets has a space to operate and expects the US dollar to extend its decline over time,” said Goldman from Trevidy and Wilson.

This story was originally appeared on Fortune.com

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-04-23 12:49:00