US corporate bond spreads tighten to 4-week low as trade war calms

UBS administrative director and director of a great portfolio Jason Katz on president Donald Trump’s influence on Wall Street and the profits and commercial deals that can be expected.

The spread of American companies ’bonds has been tightened to the four -week low level in late last week, as the concerns surrounding a global trade war seemed close to one month were calming.

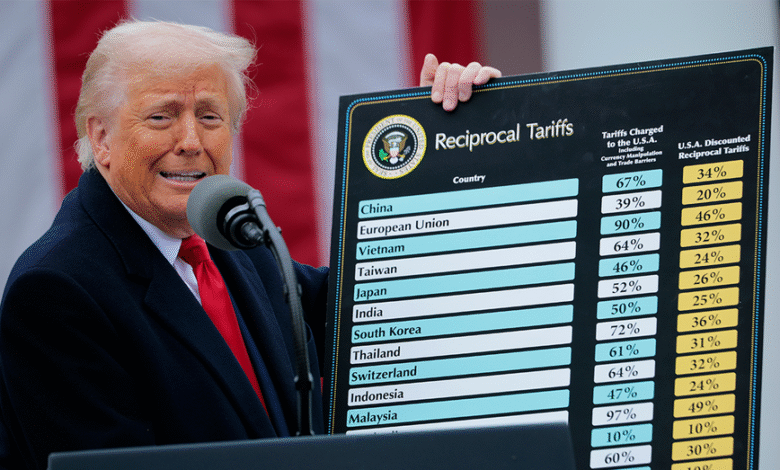

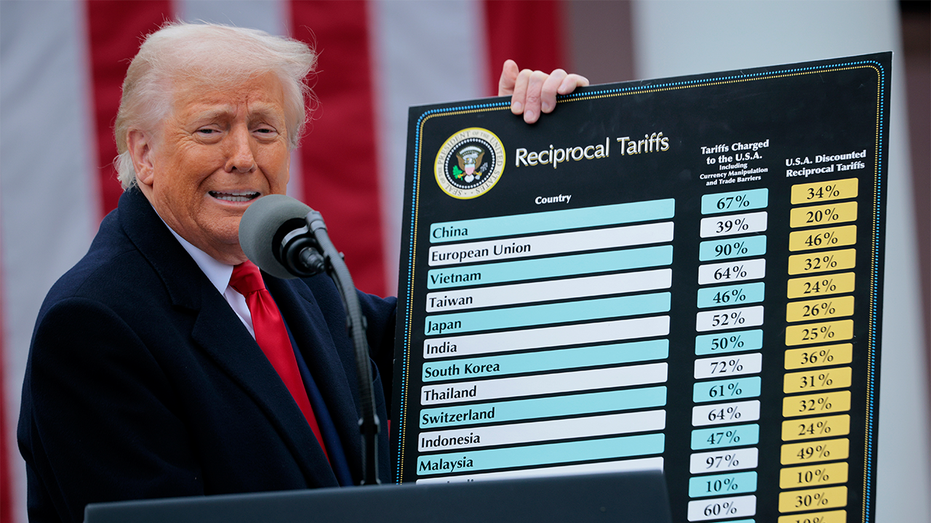

The risks of the market for President Donald Trump have rocked the trade market for US companies’ bonds for several weeks after April 2 announced the large -scale definitions. But it seems that they calmed down the following week for his decision to stop drawing on most countries except China.

US President Donald Trump holds a plan for “mutual definitions” while speaking during a commercial advertising event “Make the wealthy America again” in the Roses Park on the White House on April 2, 2025 in Washington, DC. (Chip Somodevilla / Getty Images / Getty Images)

High -quality bond differences tightened two basic points on Friday to 104 barrels per second, and eight programs per second last week. Meanwhile, the six six of the Internet protocol narrowed to 367 and 49 basis points last week, according to the ICE BOFA index.

Amid the recent market disturbances, who owns treasury bonds?

On Monday, Dan Crater, the chief credit strategy in BMO Capital Markets, indicated that the spread of IG is the most narrower since the presidential election week.

Analysts attributed to a large limit to a clear calm in global trade tensions last week. They also referred to the data that shows a flexible economy and the technology in the market.

High -quality bond differences tightened two basic points on Friday to 104 barrels per second, and eight programs per second last week. (Reuters photos / Mike Cigar / Reuters)

But the market participants still expect links to expand in general in the second quarter and the rest of this year, as Trump’s economic policies and their impacts excel.

“We still believe that spread is biased on a wider scale, although it may grind a little in the short term,” Hans Meccsen, head of credit strategy at TD Ameritrade, said in a Monday morning.

Bess -China, a currency move, says that the “Delverging” is not a systematic problem

The bond market witnessed standard fluctuations in this month in response to the state of customs tariffs, according to Mikelsen. He pointed out that the volumes of investment bond trading increased by approximately 14 % during the same time last year to a record level, while unwanted bond circulation increased by approximately 12 %, but it was ashamed of records ever in March 2020.

Get Fox Business on the Go by clicking here

Analysts expect 30 billion dollars to 35 billion dollars of new high -quality supplies this week, and 150 billion dollars to 160 billion dollars in the total number of May.

It is expected that fifteen companies, including Google Parent Alphabet Inc. Philip Morris and Procter & Gamble with new bonds on Monday.

| index | protection | last | Changing | % Change |

|---|---|---|---|---|

| Googl | Alphabet Inc. | 160.61 | -1.35 |

-0.83 % |

| evening | Philip Morris International. | 169.17 | -1.07 |

-63 % |

| P | Procter & Gamble Co. | 161.86 | +0.86 |

+0.53 % |

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-04-28 19:27:00