Nvidia Gives Upbeat Forecast in Sign That AI Build-Out Is Strong

(Bloomberg) — Nvidia Corp. gave a bullish revenue forecast for the current quarter, reassuring investors that spending on artificial intelligence computing remains strong.

Most Read from Bloomberg

Sales will be about $43 billion in the fiscal first quarter, which runs through April, the company said Wednesday. Analysts had estimated $42.3 billion on average, with some projections ranging as high as $48 billion.

The outlook provides a dose of optimism at a shaky time for the AI industry. Nvidia shares have dipped this year on concerns that data center operators will slow spending. Chinese startup DeepSeek also sparked fears that chatbots can be developed on the cheap, potentially reducing the need for Nvidia’s powerful chips for AI.

Nvidia rose less than 1% in extended trading late Wednesday after the report was released. The stock had been down 2.2% this year, following stratospheric gains in 2023 and 2024 that turned Nvidia into the world’s most valuable chipmaker.

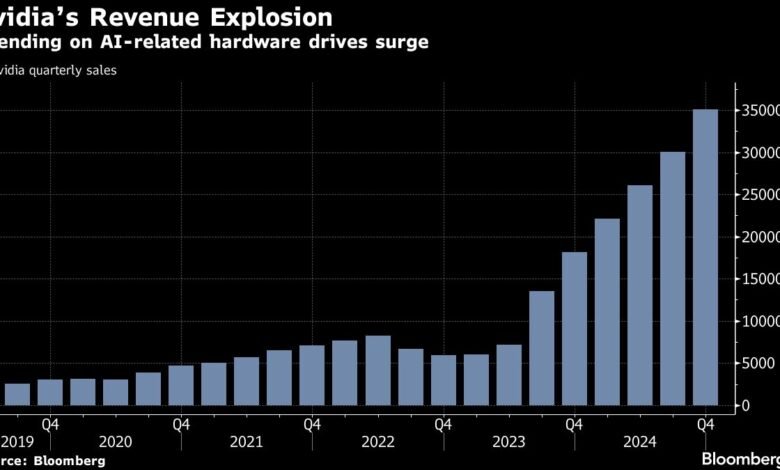

Nvidia has been the biggest beneficiary of a massive surge in AI spending, doubling the size of its revenue the past two years. Many of the largest technology companies are pouring tens of billions of dollars into data center hardware, and Nvidia is the dominant seller of processors that create and run AI software.

Along the way, Nvidia and Chief Executive Officer Jensen Huang have become synonymous with the AI revolution — and the biggest bellwether for how it’s progressing. Huang has spent much of the past two years cross-crossing the world as an evangelist for AI technology and believes it’s still in the early stages of spreading throughout the economy.

Heading into the earnings report, analysts had expressed concern about near-term growth in Nvidia’s biggest business, which serves data center customers. The big question was whether supply constraints and a shift to the company’s latest design, Blackwell, would slow growth. The new technology is more sophisticated, bringing manufacturing challenges.

DeepSeek added to the worries after releasing a powerful AI model that it said required far fewer resources to create. The announcement in late January led to a widespread selloff in AI-related shares. Nvidia shed a staggering $589 billion of capital in one day of trading, a record for the markets.

/>

2025-02-26 21:25:52