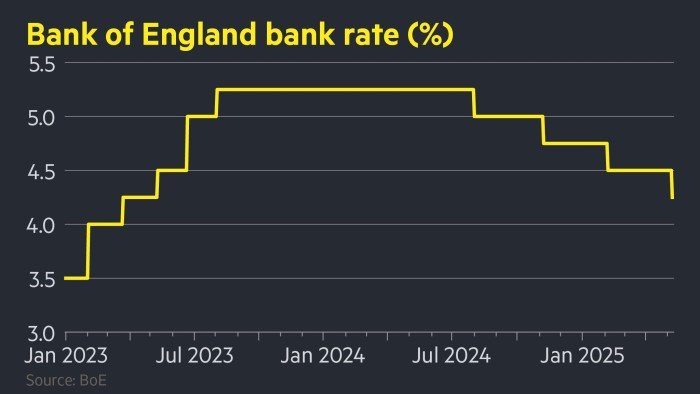

Bank of England cuts interest rates by a quarter point to 4.25%

Stay in view of the free updates

Simply subscribe to UK interest rates Myft Digest – it is delivered directly to your inbox.

The Bank of England reduced interest rates by a quarter to 4.25 percent, but stressed that it was not on a prior road to more cuts, as it is preparing for the impact of US President Donald Trump’s policy.

The Monetary Policy Committee of the Bank of England has been divided into three ways to the decision, which comes before the announcement of a commercial deal for the United States of America, which London hopes to limit British exports tariff.

While it was expected to reduce a quarter -point on Thursday, the MPC insistence to retain a “gradual and accurate approach” to reduce additional prices pushing merchants to trim their bets on greater price cuts this year.

“Interest rates are not on the automated pilot – it cannot be,” said Andrew Billy, the governor of the Bank of England.

Traders are now pricing two other price cuts this year, with an opportunity of approximately 40 percent in a third – a decrease from 80 percent before the meeting, according to the levels involved in exchange markets.

“This is more than division,” said Sanjay Raja, UK’s chief economist in Deutsche Bank. “The probability of successive discounts must decrease to successive prices on the back of this.”

Although most of the five MPC members supported a quarter, two preferred a larger and a half reduction, points and two rates required to survive by 4.5 percent.

“It is generally, it is a noisy surprise,” said Francesco Pissol, a strategic expert by the Foreign Labor Organization in Inge, with highlighting that the Senior Economists of the Bank of England is among those who vote unchanged.

The pound rose above $ 1.33 after voting, and placed it in a positive area for today.

The return on a two -year doctrine, which turns back to the price and reflects the interest rate expectations, increased 0.06 percent to 3.87 percent.

The Bank of England is competing with the influence of prices and economic activity of 40 billion pounds of taxes, announced by Chancellor Rachel Reeves in the October budget, as well as the uncertainty resulting from Trump’s tariff plans.

The central bank also faces the possibility of high inflation in the coming months, partially driven by increased family bills. In a new set of expectations issued on Thursday, the Bank of England expected that it would be 3.5 percent peak in the third quarter before returning to the central bank of 2 percent in 2027.

This week’s meeting was the first since Trump’s announcement last month of the global customs tariff, which the Bank of England said you have helped weaken the possibilities of global growth – although it added that “the negative effects on the United Kingdom’s growth and inflation are likely to be smaller.”

UK officials suggest that a deal on Thursday with Washington may be limited in the range and largely focusing on car and steel industries. Pelly said the deal would be “welcome.” “This will help reduce uncertainty, and this is important,” he said.

The underlying Bank of England in the UK GDP has slowed since mid -2014, expecting that the economy will expand by 1 percent this year and weaker than expected by 1.25 percent in 2026.

New Bank of England assumes that the so -called mutual definitions in Trump on countries around the world will remain suspended after the current stop for 90 days, but the high barriers between the United States and China will continue.

She expected to reduce global trade tensions from the level of GDP in the United Kingdom by only 0.3 percent within three years, a relatively small effect.

Bank of England’s expectations depends on the market expectations that show that its main average will decrease to a little more than 3.5 percent in 2026 – a more slope of price discounts, which was built into the forecasting round in February.

Billy voted with the group that defends a quarter of a point reduction, while external members-Swatei Dengra and Alan Taylor-sought to reduce half a point.

In calling for prices to stay by 4.5 percent, Catherine Man, an external MPC member, indicated concerns about “continuing inflation” alongside the flexible labor market and high home inflation expectations.

2025-05-08 12:58:00