With Warren Buffett Set to Step Down as CEO, Will Berkshire Hathaway Soon Start Paying a Dividend?

-

Berkshire Hathaway did not pay any profits to the shareholders.

-

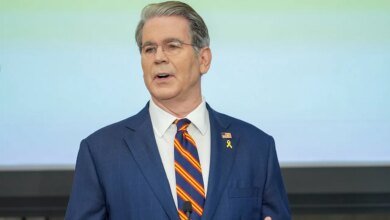

With the appointment of the Vice president of Berkshire Hathaway Greg Abel to replace Buffett, many are already speculating of the accompanying changes.

-

The deployment of capital has become more difficult in Berkchire Hathaway over the years.

-

10 shares we love better than Berkshire Hathaway ›

After an epic show for 60 years on his head Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B)Warren Buffett surprised investors at the annual meeting of Berkashire by announcing that he was planning to step ascend as the company’s executive head at the end of the year. The Chairman of the Board will remain. Vice President Greg Abel is the successor who will try to fill large Pavite shoes. The departure of Buffett from the role of the CEO will end up a wonderful operation that the share of Berkshire has been widely excelled over the broader securities market and turned Oracle Omaha into a legend. While ABEL and Berkshire Team are expected to continue to follow the game that made the giant Berkshire today, the change is inevitable. Berkshire, despite its size and financial resources, has never paid profits. Can this change soon?

The question has been asked on the question several times: Why does Berkshire not pay profits? After all, Berkshire generates piles of money and pays profits that can comply with the Berkshire brand being a conservative and fixed arrow that would wisely publish capital. In addition, Buffett has bought a lot of stocks for Berkshire wallet that pays profits.

Pavite simply believes that there are better ways to spread capital that would grow business and reward for shareholders better. His three priorities in the deployment of capital in Berkshire’s business are re -investigated, acquisitions, and shadow of shares when it is believed that Berkshire shares are sold by a “significant discount on the conservative fundamental value.”

It is difficult to argue with the logic of Buffett at this stage, given that he is seen as one of the best men of the capital in all ages. Between 1965 and 2024, Berkshire shares made an annual annual gains of 19.9 %, compared to S & P 500 10.4 % including profits. In general, Berkshire’s shares were estimated 5,502,284 % in that time period, and based on how things went in 2025, this number may seem better soon.

Berkshire can completely start paying profit distributions as soon as Buffett leaves the role of CEO. Given that Pavite is the greatest investor in all times, investors will take him in his speech when he says that he can spread the capital in more useful ways than paying profits. But Abel, although he is more than a capable successor, may not have the same luxury. “The profit distributions remained unintegrated as long as Pavite managed the offer because he believed it could be a tool better than his successors,” said Greg Warren, an analyst at Morningstar.

2025-05-10 08:41:00