Red state treasurer reveals why state financial officers have ‘obligation’ to combat ESG, DEI

Exclusive: With the transfer of financial officials to the Republican state throughout the country to rid the government of diversity, fairness and integration (Dei), the environment, social and governance (ESG), Fox News spoke to the Utah State Secretary about the importance of restoring merit and credit responsibility to markets and investments.

“ESG offers another motivation or any other motive to address societal issues through capital markets or through investment, and when you do, you violate the credit standards that we all adhere to as financial employees,” said Marlowe Ox in Utah Ox.

Therefore, because of this double mandate, you are really facing problems when you run money for others. If one person wants to do this or the family wants to invest their money in this way, this is their choice. But when you run money for other people, we will not have this option. We have a commitment to doing what is in their financial interest. ”

Oaks were at the forefront of fighting battle against ESG, critics of the principle of investment say that companies and institutions are used for “wake” agendas, Written by several messages On this topic.

The White House highlights more than $ 2 billion in DEI savings during the first 100 days of the Trump administration

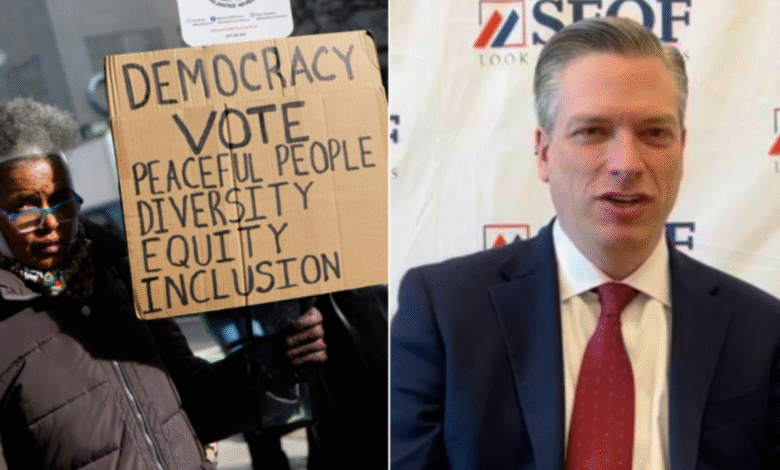

Fox News Digital talks with Utah Marlowe Oks. (Fox/Getty)

“When you talk about money management for the benefit of others, which is what a lot of treasury secretary in the state does, we have a credit duty to work in the interest of the beneficiary,” Oaks explained. “Therefore, we have the duty of loyalty and the duty to care.

“It really focuses on the financial results of the beneficiaries. They depend on this money for their retirement, and therefore, our financial or credit commitment is to dispose of their best interest.”

Oaks said that firefighters, teachers and police officers who rely on government retirement pensions end up when the states or companies invest based on factors other than protecting investors.

Di Mit. This is what should come after that

president Trump has taken movements to reduce de tunnels in the federal government. (Istock)

“ESG provides another motivation or any other motive to address societal issues through capital markets or through investment, and when you do so, you violate the credit standards that we all adhere to as financial employees,” Oak said.

Ox and other republicans at the SFOF conference were also vocal opponents of Dei measures and praised President Trump for his efforts to decline Dei in the government.

Click here to get the Fox News app

I tell Oaks Fox News Digital Esg and Dei closely and that his opposition to Dei is also due to the desire to do what is better for his shareholders.

“Dei – Diversity, Equity, Inclusion – This is in fact the social part of ESG, and again, it is important because many people active in the financial markets are to pay an agenda to American companies, because they are in adopting policies in companies that are not in fact the interest of companies. Ox said that companies have a credit commitment to their shareholders.

President Donald Trump is walking from the Oval Office to one ride in the southern grass of the White House on its way to Florida on March 28, 2025, in Washington. (AP Photo/Mark Schiesfelbein)

“When they present things like Dei, you change employment practices, not for the list of merit, they are transmitted to other discriminatory employment practices and ultimately hurt companies and their financial production. Thus, this ultimately harms teachers, firefighters, and police officers who are trying to help their retirement.”

Ox was one of twenty State financial staff Those who sent a letter in March to the US Securities and Stock Exchange Committee (SEC), asset managers, agents and public companies, and they seem to warn the financial risks of giving priority to a political agenda, such as Dei, for financial returns.

Oaks Fox News Digitter told the state employee, “We are likely to make financial damage.”

“We have seen that with companies like Target, such as Bud Light, as you know, other companies have adopted policies that are not in the interest of the financial shareholders. They have harmed the value of shareholders, and this ultimately harms the results they need.”

Deirdre Heaven from Fox News Digital contributed to this report

Don’t miss more hot News like this! Click here to discover the latest in Politics news!

2025-05-14 21:21:00