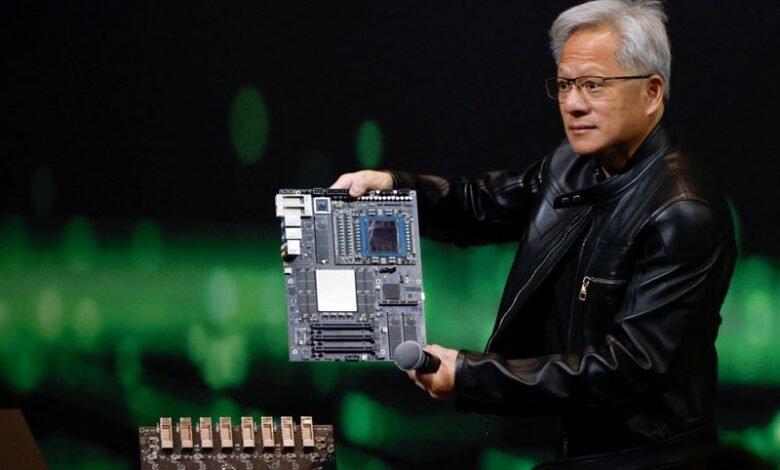

Nvidia earnings take the spotlight

A look at next day in the European and global markets from Ray Wei

The results of the profit from NVIDIA will be the Marquee market on Wednesday, with all eyes about the amount of American technology restrictions on China will cost Ai Belwether.

The company’s observers expect the chips giant to report a 66.2 % increase in revenue in the first quarter to 43.28 billion dollars, but the uncertainty surrounding its business in China is looming on the horizon even with a decline in other regulations to open new markets.

As, traders in market options are preparing to volatility at the level of industry after the results, with defensive options on ETF semiconductor main conductors that attract great attention.

As part, investors have been watching developments in the global bond markets after the request on Wednesday to a 40 -year -old government bond auction since November, confirming the ability of the decreasing market to absorb new debts.

Long returns worldwide has increased in recent weeks on a large sale in bonds, as anxiety over the financial deficit, especially in developed countries such as the United States and Japan, has risen.

Fears of tax discounts and that the policy of the chaotic tariff of the United States will lead to inflation and payment of government spending has made investors increasingly nervous about retaining the long -term sovereign debt.

On Tuesday, the exclusive Reuters report followed that Japan was considering reducing the release of long bonds with a decrease in both revenues and yen.

Japanese government bonds revenues did not change slightly after Wednesday. The US Treasury increased slightly after falling the previous day.

In New Zealand, the central bank reduced the standard interest rate by 25 basis points and a slightly deeper mitigating cycle of what was expected three months ago, confirming the risks of economic growth from a sharp transformation in the American commercial policy.

The main developments that can affect the markets on Wednesday:

* North American profits: NVIDIA, Montreal Bank, National Bank of Canada, Sports goods in Dick, Messi auction * for the United States of the two -year float average, five -year notes * German auction of 15 years of federal bonds * German unemployment data for May * France Q1 final reading, product prices for April.

Are you trying to keep up with the latest tariff news? The new Daily News Digest offers a set of headlines that move the market that affects global trade. Subscribe to the tariff hour here.

(Written by Ray Wei; Liberation by Christopher Kushing)

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-05-28 04:32:00