AI ETF based on Wedbush analyst Dan Ives’ top picks launches

Wedbush Securities is betting on the ingenuity of research at the best technology analyst Dan Eve with a new ETF launch focused on artificial intelligence.

Investing in the next generation of artificial intelligence winners has become more comprehensive by launching a new exchange for exchange on the basis of 30 stock selection from a major analyst in Wall Street.

In the first of its kind, EVERE ETF Revolution ETF reflects the Royal Research of Dan Evz, Managing Director and Head of International Technology Research at Wedbush Securities.

“During the 25 years of covering technology, I have never seen a greater topic than the artificial intelligence revolution,” IVES told Fox Business: “We have tried to capture our research in our thirtieth research in technology, which includes the best theme of the fourth industrial revolution through semi -clear programs, infrastructure and autonomy. This is in fact the beginning. AI ETF revolution.”

The topic of the artificial intelligence revolution; 30 names to play in the fourth industrial revolution. (Wedbush Securities)

Microsoft, Palantir, Meta, Tesla, Palo Alto and Nvidia are just a handful of names that lead trillions of spending that started with the start of ChatGPT in 2022 and are operated by the giant NVIDIA AI.

| index | protection | last | Changing | % Change |

|---|---|---|---|---|

| Msft | Microsoft Corp. | 463.87 | +0.90 |

+0.19 % |

| PLTR | Palantir Technologies Inc. | 130.01 | 3.16 |

-2.37 % |

| Dead | Meta Inc platforms. | 687.95 | +21.10 |

+3.16 % |

| Timing | Tesla Inc. | 332.05 | 12.22 |

-3.55 % |

| Pano | Palo Alto Networks Inc. | 194.07 | -3.05 |

-1.55 % |

| Nvda | Nvidia Corp. | 141.92 | +0.70 |

+0.50 % |

While some of these names were subjected to trade tensions between the United States and China, as well as fears of other tariffs, this did not change Evis’s view.

The popular nuclear deal in Meta

“The definitions in the background, and continue to create some uncertainty, but this does not change our view that this is a fourth industrial revolution.” “Tilans will be spent over the next three years. Now, I think we are still at the bottom of the first half in terms of this unusual game for artificial intelligence. The beneficiaries of the second and third derivative technology have just started focusing on artificial intelligence.”

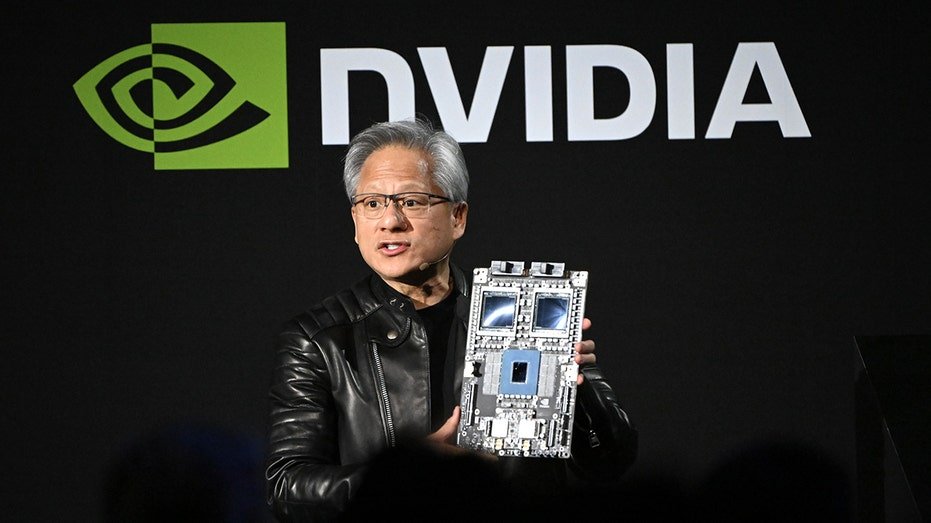

Jensen Huang, co -founder and CEO of Nvidia Corp, holds AI AI chips in the company for data centers. (Akio Kon / Bloomberg via Getty Images / Getty Images)

ETF will be traded by Tecker appropriately, IVES, and will be against some of the great players who have artificial intelligence funds, including ISHARES, Fidelity and First Trust, as it was followed by Vettafi. However, the company believes it will get an advantage with IVES and a box “active vision and negative structure”.

| index | protection | last | Changing | % Change |

|---|---|---|---|---|

| IYW | Ishaares Trust Reg. SS of Dj Us Tech.sec.idx | 162.32 | +0.62 |

+0.38 % |

| FTEC | Fidelity Covington Trust MSCI Information Technology | 185.50 | +0.62 |

+0.34 % |

| FDN | First Trust Excination Tradied Fund Download Jones Internet Index FD | 256.77 | +2.48 |

+0.98 % |

“I think, when you compare us to others who follow this definition, whatever the matter, whatever it is, the obstacles to revenue or the qualifiers based on some third party that has artificial intelligence in the report of their profits, whatever the matter, we get it from the source,” said Colin Rogers, officials of the “Medbush Fund investment. “I think many of them are following trends. We are trying to determine them through the tongue of Dan.”

Get Fox Business on the Go by clicking here

This is the company’s first ETF.

2025-06-04 13:15:00