IRS gains ‘powerful new tool’ to evade review, Gorsuch dissent claims

newYou can now listen to Fox News!

Judge Neil Jorman wrote opposition to the Supreme Court’s decision to reduce the authority of the American Tax Court in some IRS cases, stressing that the Federal Tax Collection Service can avoid accountability in the future.

Goroush wrote the opposition to the opinion of the Supreme Court of the Commissioner for the Internal revenue against G. Zush, an issue that focuses on Jennifer Zush’s conflict with the Tax Authority that started in 2012 regarding the agency’s movements regarding depositing federal tax returns in late 2010.

“Along the road, the court’s decision wipes the Tax Authority a strong tool to avoid accountability for its mistakes in future issues such as this.”

In this case, Zuch claimed that the Tax Authority made a mistake, winning $ 50,000 for her husband’s account at the time instead of herself. The Tax Authority opposed and expanded to collect its unpaid taxes with a tax to seize and sell its property.

Supreme Court rules can be accessed to social security information

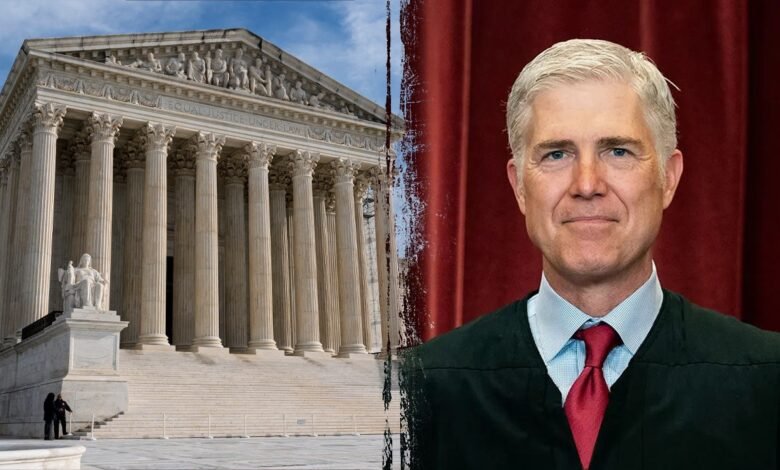

The co -judge, Neil Goroush, stands during a collective photo of the Supreme Court in Washington, April 23, 2021. (Erin Schaff/The New York Times via AP, Pool, File)

Over the years after the conflict began, Zuch has made many annual tax declarations that show excessive payments. Instead of issuing the recovered sums, this Tax Authority applied to its suspended tax commitment to 2010.

Once the Tax Authority settled the distinguished Zuch amount, its responsibility reached scratch, and the Tax Authority no longer has a reason to impose its property.

The Supreme Court of Capitol Hill in Washington, DC, will be seen on December 17, 2024. (AP Photo/J. Scott Applewhite, File)

Then the Tax Authority moved to the refusal of the Zush case in the Tax Court, on the pretext that the Tax Court lacks the jurisdiction because there is no longer a tax on its property. The Tax Court approved.

The Trump official asks the Supreme Court to lift a judicial order that prevents the dismantling of the Education Department

The Supreme Court endorsed that the Tax Court no longer had a jurisdiction without a tax.

“Because there is no longer a proposed tax, the Tax Court properly concluded that it lacks the judicial jurisdiction to solve questions about the disputed tax responsibility of Zuch,” he read the opinion of the Supreme Court.

Signs outside the IRS headquarters in Washington, DC (Samuel Corome/Bloomberg via Getty Images, File)

Goroush wrote in his norm, the decision will not only prevent compensation for her excess batches, which believes that the Tax Authority has kept them wrongly, but the Tax Authority gives a way to avoid accountability.

Click here to get the Fox News app

Al -Adl wrote: “The Tax Authority, and the court supports the view of the law that gives that agency a road map to evade the Tax Court review and not have to answer the complaint of the taxpayer that it made a mistake.”

Don’t miss more hot News like this! Click here to discover the latest in Politics news!

2025-06-12 16:53:00