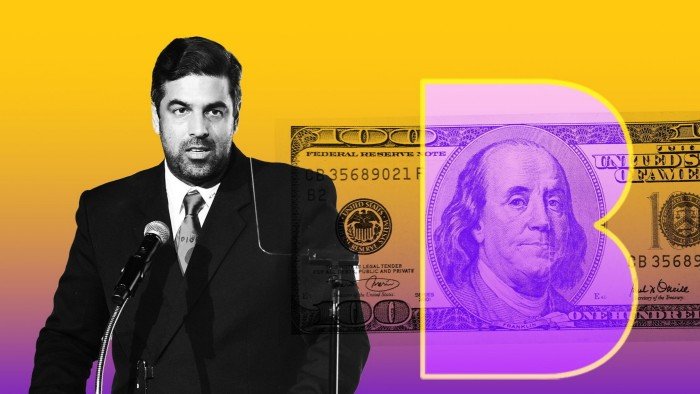

Builder.ai ‘Chief Wizard’ Sachin Dev Duggal made $20mn in share sales

Digest opened free editor

Rola Khaleda, FT editor, chooses her favorite stories in this weekly newsletter.

Sashin Dave Dougal, founder and former CEO of Start-UP Tech, backed by Microsoft, has achieved at least $ 20 million by selling shares at work.

The “main therapist”, which it self -described as the software company, which caused more than $ 500 million of investors to promise to use artificial intelligence to revolutionize the development of applications, which also borrowed against his share in Builder.ai, according to multiple people familiar with the matter.

Those familiar on this issue said that Duggal investment Company, which is more than $ 20 million in selling shares at work.

Most of the stock sales were completed before 2023, when the company raised $ 250 million in a wonderful financing round led by the Qatar Investment Authority, which obtained a builder. AII is evaluating more than a billion dollars and making it in “UNICORN” technology in the United Kingdom.

London -based startup has attracted support for prominent investors including Insight Partners, based in New York and Deepcore unit that focuses on AI in SoftBank.

Builder.ai was provided for bankruptcy protection in the United States earlier this month after an internal investigation was found evidence that possible sales and the company has decreased revenues to a quarter of previous estimates only.

The bankruptcy files in the United States also show that SD Squared Ventures was still the largest contributor to the company at the time of its collapse, with a share of more than 15 percent.

The Hong Kong Eun Pacific investment company also provided Dougal with the funded funds against its shares through the so -called “organized treatment”, which has similar properties of debt, according to the people.

Ion Pacific also bought $ 6 million of shares in Builder.ai from other investors in late 2022, according to Pitchbook.

Ion Pacific describes himself as a “private” investor in investment capital. The company’s website states that it provides “personal liquidity solutions backed by shareholders in the company” for technology founders.

Michael Joseph, CEO of Ion Pacific, said that his company’s money “never had more than $ 10 million in” Builder.ai and this “dramatically” reduced “before the company collapsed.

The Financial Times said last month that Duggal has looked investors on a possible deal for the reports of the company that he founded from insolvency, in a deal that requires less than $ 10 million in initial financing.

There is no suggestion that Duggal broke any rules by selling his shares or borrowing against them. Duggal refused to comment.

Earlier this month, FT reported on the multiple roads suspected of the company, under the duration of Duggal as CEO, to amplify revenues. The alleged practices that have been scrutinized include incorrectly reserved discounts and circular transactions apparently with the main customers.

Duggal’s lawyers said that there is a “serious inaccuracy” in allegations related to the inflation of revenue that FT requested to comment on.

In the weeks before the company reveals, the US Prosecutor’s Office for the Southern Region in New York also requested that Builder.ai deliver documents related to financial reports, accounting practices and customer relationships.

2025-06-25 11:34:00