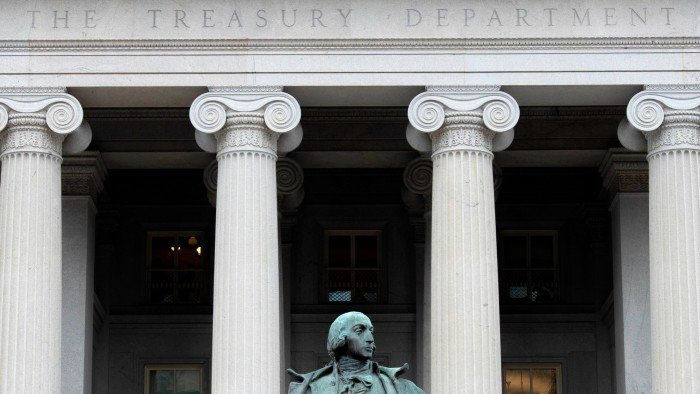

US Treasury asks Congress to scrap foreign revenge tax in Trump bill

Open the newsletter to watch the White House for free

Your guide to what the second period of Trump means to Washington, business and the world

The US Treasury asked congress to cancel a ruling on the budget budget bill in Donald Trump, which would allow Washington to raise taxes on foreign investment, reflecting a plan that warned Wall Street of its markets.

Treasury Secretary Scott Bessin said on Thursday that this measure is no longer required because he obtained concessions for American companies to the new global tax system for the Organization for Economic Cooperation and Development.

Pisent said on X that his agency had asked legislators to remove the so -called section of Section 899 in the Trump Budget Bill “The Great and Beautiful”. The legislation has already issued the House of Representatives under consideration of the Senate, with a vote that is likely to come as soon as the end of this week.

Article 899 allows the US government to impose retaliatory taxes on companies and investors from countries that have considered punitive tax policies – such as those permitted under the OECD system.

Some banks and investors have argued that section 899 may cause a decrease in foreign investment in American companies and markets.

The UK Chancellor Rachel Reeves described the decision of the Treasury Secretary to invite Congress to strike Article 899 as “important”, saying that progress has made “certainty to business.”

Pesin said that the United States had reached an “understanding” with other members of the G7 group of leading countries, which dominate the Organization for Economic Cooperation and Development, which would make Article 899 unnecessary.

Pisent said that the deal related to the lower tax system would prevent the loss of more than $ 100 billion in US taxpayers, according to treasury estimates.

“OECD Pillar 2 will not apply to American companies, and we will work cooperatively to implement this agreement through the comprehensive OECD-G20 in the coming weeks and months,” he wrote.

BAILAR 2 of the new OECD system offers at least 15 % corporate tax rate with measures that allow other countries to collect fees if they are not the original countries of companies. The system started this year.

The minimum global tax is designed as half a pioneering deal approved by more than 135 countries in the Organization for Economic Cooperation and Development in 2021 to prevent taxes by multinationals and modernize the international tax system for the digital era.

The first “column” of the deal, which aims to close the tax gaps of large technology and multinationals groups. The second column, the minimum global tax, was implemented by many countries in 2024.

The Organization for Economic Cooperation and Development deal was supported by the US Treasury during the era of the Biden administration, but it was not passed by Congress, in part due to the resistance of Republicans. When the Trump administration reached power, it took an anti -agreement position.

Republicans have been particularly dissatisfied with part of the Organization for Economic Cooperation and Development deal called the base of improved profits, which will allow other countries to impose taxes on American companies.

The rule, which they described as “discriminatory”, allow governments to increase taxes on a local subsidiary for a multinational group if multinationals are paid less than 15 percent in corporate tax in any other jurisdiction.

Additional reports by Paula Tama in Brussels

2025-06-26 22:27:00