Chef’s Line, Glenview Farms Parent US Foods Maintains Revenue Outlook Despite Q2 Miss

US Foods Holding Corp. (NYSE: USFD) shares are traded on Thursday after the company informed the results of the second quarter.

US Foods Holding Corp. Marketing products under different brands, including chef line, stock squares, Metro Deli, Harvest Value, Monarch, Monogram, Molly’s Kitchen, and GlenView Farms. It also distributes food services equipment and services under trademarks such as Chef’stores, Food Fanatic and Smart FoodService.

The profits of the second quarter amended per share were recorded from $ 1.19, overcoming the unanimity of the analyst of $ 1.13. Quarterly sales of 10.082 billion dollars (an increase of 3.8 % on an annual basis) missed the street view of $ 10.166 billion.

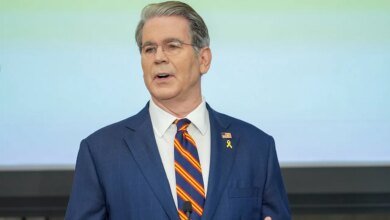

“We have delivered the upper growth and expanded the margin with accumulated shares, which led to the growth of 28 % profitability,” said Dirk Locascio.

Also read: Papa John’s Devitions Ruleing Rishing and Core Pizza Focus to ignite 2025 growth

The seasonal sales growth was driven by the growth of the size of cases and the cost of food cost by 2.5 %.

The total number of cases said 0.9 % over the previous year, driven by an increase of 2.7 % in the volume of independent restaurants, an increase of 4.9 % in the volume of health care and an increase of 2.4 % in the size of hospitality.

The average total profit increased by $ 85 million on an annual basis (an increase of 5.0 %) to $ 1.8 billion. 17.8 % of net sales, compared to 17.6 % in the past period.

View more profits on USFD

The EBITDA rate of $ 548 million, increased by 12.1 %, from the previous year. The average EBITDA margin was 5.4 %, an increase of 40 basis points compared to the previous year.

The company said that it had received more than 50 million dollars in the costs of the cost of goods through the management of strategic sellers, and it is in a position that exceeds its commitment of $ 260 million.

The penetration of special signs increased by more than 80 basis points to more than 53 % in independent basic restaurants, pushing improved margins.

The improved stock controls are expected to provide a total of $ 30 million in 2025, while $ 45 million of indirect savings this year will reduce operating expenses.

The company came out of the quarter with money and bonuses worth $ 61 million, which is above $ 59 million in the last period.

The United States confirmed sales directives in the fiscal year 2025 at 39.392 billion dollars to 40.150 billion dollars, compared to the estimation of the consensus of $ 39.764 billion.

The company also narrowed the modified EPS instructions in 2025 to 3.76 – 3.87 dollars, tightening the previous range from 3.69 to $ 3.88, and compared to the estimation of the street of $ 3.81.

2025-08-07 16:11:00