Top economist Torsten Slok warns of an ‘inflation mountain’ in a potential repeat of the ’70s

Now he sees a strange similarity – well in Wadi Gharib – between the inflation mountain range in the 1970s and 1980s and the inflation wave in 2021, in addition to what may await us for the American economy. He has Daily spark The newsletter on August 31, Slok noticed the bullish pressure on inflation and inflation forecasts from definitions; The decrease in the dollar and the growing dispute within the Federal Open Market Committee on how to balance the high inflation with the slowdown of employment. (In a note entitled “Ghosts of 2007”, Bank of America Research note that the Federal Reserve rarely reduced rates against the background of increased inflation.)

“The risks rise,” Slok added, where we can see another mountain “inflation” that appears in the coming months. ”

Warning signs show

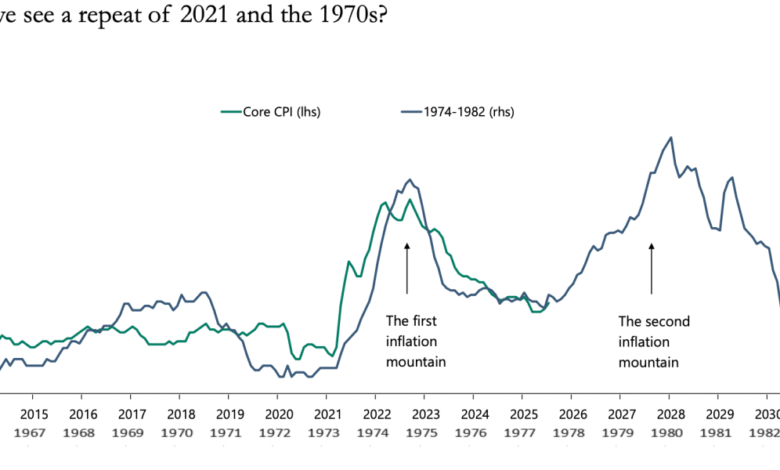

The Slok and Apollo chart plans to the current path of the US consumer price index with inflation periods from 1974 to 1982, which shows a close similarity between the inflation wave in 1973-1974 with 2021-22. As Sluk shows, the first “Mount of Inflation” was followed in the seventies of the last century, which was taken off in 1978. If the pattern continues, the economy will be the result of another peak that approximately in the fall of 2025.

Although Slok does not say this in its observation, the “first inflation mountain” indicates the initial height, while the “second mountain” represents the most slope aspect that followed after several years, driven by external shocks and political lines.

Fears of inflation escalate

These are not the first warnings of inflation from Slok. In late August, he argued that Jerome Powell’s choice of words at the Jackson Hall symposium – which occupies the labor market in “a kind of curious balance” – shows that the Federal Reserve sees structural distortions of customs tariffs and immigration policy. If these forces continue to inflation, it cuts the Powell, as it is under pressure from the White House to do it, Slok wrote that it could be vulnerable to the “seventies”-background-style policy of the second inflation mountain.

In such a scenario, he reminds us of the 1970s, if inflation can rise in the 1970s, which leads to the painful corrective measures that were seen under the ancestor of Paul Paul Volker, who increased aggressive rates and toured severe and double recessions.

The latest reading of inflation, the personal consumption expenditure index, showed that prices rise by 2.6 % in July compared to last year, which is the same annual increase as it was in June and is in line with what economists expected. With the exception of the most volatile food and energy categories, prices increased by 2.9 %, up from 2.8 % in June and the upper number of February, with luckEva Royburg has reported that there is a decline in spending in appreciation categories. The wider consumer price index was 2.7 %, while the product price index was higher than expected as wholesale prices increased by 3.3 %, both during the same period.

These warnings come at a time when economists discuss the shape of the back of the twenties of the twentieth century, and they wonder whether the recession is in the foreground or the “stagnation” that accompanied the mountains of inflation in Slok analysis. UBS sees the risk of high recession in the difficult data of the American economy, reaching 93 % in July – although its average risk of recession is much lower given its own analysis of other conditions. However, Mandi’s economy is expected in the future, such as Bank of America’s research.

Jpmorgan felt anxious about the soft job report in July, saying that a slice of employment demand of size shows a “stagnation warning”. Meanwhile, Mark Zandy, the chief economist of Modi’s analyzes, warned in early August that the United States was on the edge of the recession, noting a lot of the same difficult data as UBS. Recently, Zandy put the possibility of recession at 50-50, and said that the countries that represent nearly a third of GDP are either in a recession or are at risk of this. Slok analysis asks the question: What happens if and when is this turning in the mountain of inflation?

2025-09-02 18:44:00