3 Reasons Everyone Needs an Emergency Savings Account

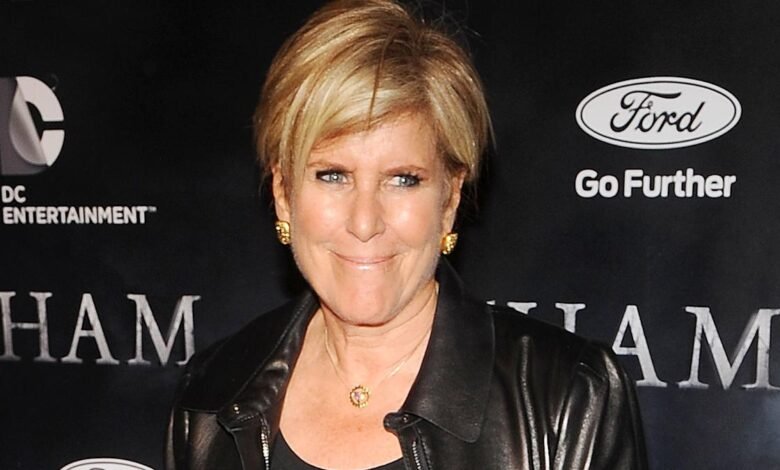

Can your bank account deal with financial emergencies? Unexpected expenses can force you to rely on credit cards, which can lead to debt if you do not have enough savings to cover car repairs, medical bills, home repairs, job loss and more. This is why the great financial decision is to build a fund to save emergency at the present time, according to personal finance expert Suz Orman.

Learn more: Fidelity says this is a sudden danger to get a lot of money – do you have a lot?

For you: 4 brands of cars at reasonable prices that you will not regret in buying in 2025

Orman believes that the presence of an emergency savings account is very vital. “The only thing that every person needs is to calculate the emergency situations. I have been saying it for more than 40 years, and it has become more and more problem.”

It confirms that building emergency savings in a separate account is an urgent necessity, especially with the high economic uncertainty. Regardless of what you have to store short -term or long -term savings plans, it is good to have a set of money that can be easily accessible to all unexpected things.

Your primary financial goal is to start saving now because the money allocated for a rainy day can prevent you from drowning in debt. Here are three great reasons for the financial teacher that each person needs to calculate savings in emergency situations.

Orman has always boded with vital importance to providing emergency situations. However, with the rock economy today, the presence of a cash pillow to cover costs is more necessary than ever. Orman explained, “We live at a time fraught with risks now.”

With the drains of the savings, debt burdens grow and high costs, if you do not have emergency reserves, you may have a cause of anxiety. Your verification account can only go to this extent, and if you face a medical emergency, only a lot will be covered with insurance.

Instead of putting huge credit card bills with high interest rates, you can put the emergency box at unexpected expenses. The emergency fund is an indispensable financial protection when what happens is unexpected. The presence of living expenses from three to six months dedicated can keep you on his feet during income losses, accidents, diseases or other disorders.

Orman warns that people who do not have emergency savings boxes “should be afraid to death.”

Read the following: The 4 best tips from 4 tips for Warren Buffett to get richer

Lady Eitkin’s financial advisor, Lori Eitkin, agrees that the emergency savings have become urgently important, given severe inflation and waves of workers’ demobilization. Those who have no cash reserves may only have a choice but to put regular expenses on high -interest credit cards if they suddenly stop their salaries, and carry high -resolution debts that destroy financial affairs.

2025-09-27 05:26:00