(Bloomberg) – Asian stocks rose after President Donald Trump reduced fears of stagnation, which helped us store in the late recovery phase after overcoming throughout the day.

Most of them read from Bloomberg

Advanced stocks in Japan, Hong Kong and South Korea, while Australian stocks decreased, where the standard S&P/ASX 200 index hovers near a correction. Trump ruled out an exemption from a tariff and aluminum despite the pressure campaign by Australian Prime Minister Anthony Albaniz.

S&P 500 and NASDAQ 100 futures rose in early trading after Trump said he did not see an American economic stagnation, which reduced the Wall Street tensions around his trade war. Treasury bonds and the dollar strength scale rose before reading consumer inflation later on Wednesday, which will give evidence of interest rates.

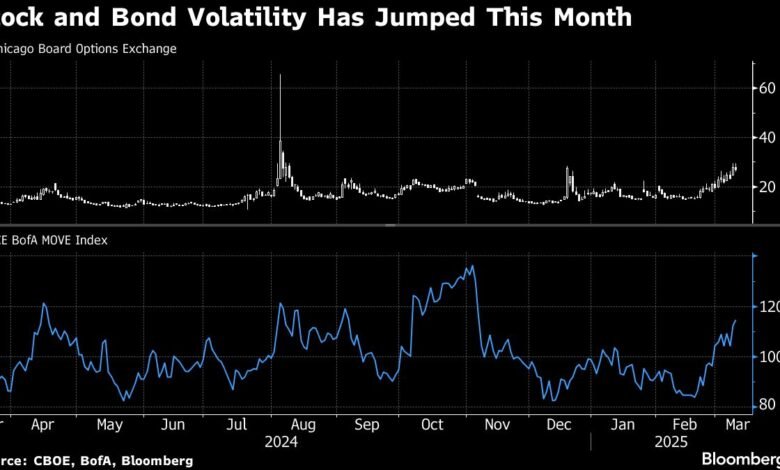

Trump’s tariff policy, the reorganization of the geopolitical on Ukraine, the unknown and unknown speed of discounts in the interest rate in the Federal Reserve, this year, leaving American stocks about to correct. The VIX stock fluctuation is hovering near its highest levels since August, while a measure is similar to weight at levels that have not been seen since November as market participants are still tense for American economic growth.

“Any relief from all this geopolitical noise is good for markets at the present time,” said Ken Wong, an Asian stock portfolio at Eastspring Investments. He said that the news related to the ceasefire in Ukraine and relief in the identification tensions between the United States and Canada are helping. “Things are completely different for eight hours.”

Reducers on the market in banks, including Jpmorgan Chase & Co. And RBC Capital Markets is up to 2025, where the Trump tariff was afraid of slowing economic growth and investing in fiery assessments of major technology shares. The last of which came from Citigroup Inc. strategies. , Who reduced their view of American stocks to a neutral weight gain.

“What Trump is doing was not useful for American stock markets,” said Neel Dutta at Renaissance Macro Research. “At the present time, I do not see the recession. We have never been a stagnation of uncertainty in the same politics. We don’t know yet how the markets will respond if Trump’s rise now leads to the removal of the escalation later.”

In the United States on Tuesday, the S&P 500 index fell 0.8 % and lost NASDAQ 100 0.3 %, although futures increased after the regular circulation ended as Trump tried to moisture attention to stagnation in the American economy.

“I don’t see it at all. He said at the White House:” I think this country will flourish. “He added that the markets” will rise and will decrease. But you know what, we have to rebuild our country. “

The White House also confirmed that the customs tariffs by 25 % on steel and aluminum will apply to Canada and other countries, as Trump has retracted a threat to impose 50 % on the minerals of the trade partner in the United States.

Chinese stocks will also be seen closely with investors continuing to rotate towards the country’s shares from their peers in the United States. A scale of the Chinese shares listed in Hong Kong increased by 20 % this year despite the threat of more American tariffs. Talks between the United States and China on trade and other issues are stuck at lower levels, with both sides failing to agree on the best way to move forward, according to people familiar with the matter.

“Stability in the Chinese real estate market and government efforts to revive the impact of wealth in the system will support consumption,” said Rajev Patra, President of Asia in J. Emourghan, and co -chair of the global shares strategy for startups. “And remember that China still has a dry powder.”

Elsewhere, Ukraine accepted an American proposal to obtain a 30 -day truce with Russia as part of a deal with the Trump administration to raise its freezing on military aid and intelligence Kiev, after eight hours of talks in the Kingdom of Saudi Arabia on Tuesday.

Reading consumers in the United States later on Wednesday, economists expected that it was still high last month after a significant increase in January, which increased evidence that progress in taming prices had stopped. The consumer price index is seen 0.3 % in February after an increase of 0.5 % at the beginning of the year.

Kyle Rodda, chief analyst at Capitalsk in Melbourne, said the markets “will be careful of other signs of sticky prices.” “More evidence of inflation suspended at the current levels will raise fears that the Federal Reserve will lack the volatile space to reduce rates if Trump’s economic policies caused a hasty slowdown in economic growth.”

The main events this week:

-

Canada rate decision, Wednesday

-

US CPI, Wednesday

-

Industrial production in the euro area, Thursday

-

US PPI, Initial unemployment claims, Thursday

-

Friday of consumer feelings at the University of Michigan, on Friday

Some of the main moves in the markets:

Shares

-

S& P 500 futures increased by 0.3 % from 10:08 am Tokyo time

-

Japanese Topix increased by 0.7 %

-

S&P/ASX 200 decreased in Australia 1.6 %

-

EURO Stoxx 50 Futures increased 0.8 %

Currency

-

The Bloomberg index in dollars increased by 0.1 %

-

The euro decreased by 0.1 % to $ 1.0907

-

The Japanese yen did not change slightly at 147.90 per dollar

-

The yuan did not change a little at 7,2339 per dollar

Cross currencies

-

Bitcoin rose 0.2 % to 82,934.32 dollars

-

Al -Atheer decreased by 1.1 % to $ 1,914.57

Bonds

Commodity

-

West Texas Intermediate crude increased by 0.5 % to $ 66.57 a barrel

-

Gold fell 0.1 % to 2,911.80 for an ounce

This story was produced with the help of Bloomberg’s Option.

-With the help of Matthew Burgis, Chris Burke and Epsik Fishnoui.

Most of them read from Bloomberg Business Week

© 2025 Bloomberg LP