Trump Tariffs Hurt US Stocks More Than Other Markets

(Bloomberg) – President Donald Trump’s tariff was supposed to make America great again, but they ended up causing more damage to American stocks more than other markets.

Most of them read from Bloomberg

American stocks have achieved the worst among the main classes since Trump took office on January 20, with a decrease in the S&P 500 index of about 8 % and the NASDAQ 100 index slips over 10 %. Other losses include the dollar, as well as Australian and Canadian stocks, while the euro, yen and the Chinese yuan are offered.

It can be said that Trump’s aggressive commercial position, in addition to the existence of relations with the allies, was the largest driver for global markets where investors expect us to imagine our growth. It also planted the president’s policy, sowing fluctuations and enhancing the demand for sanctuaries such as gold and Swiss franc.

“Trump’s tariff policies have alleviated the investor’s confidence and raised concerns about the potential stagnation,” said Manish Bahrgava, CEO of Straits Investment Management in Singapore. “These early market reactions refer to a re -calibration of their expectations on the economic effects of new management policies, especially with regard to trade relations and financial policy.”

The Bloomberg Dollar Spot, which measures Greenback’s performance against a group of advanced and emerging market currencies, has decreased, over 3.5 % since Trump’s inauguration. On the other hand, the pound strengthens 6.4 % to appear as the largest winner. The euro jumped by 5.6 %, thanks to Germany -spending plans in Germany as a reaction to Trump’s position in the Ukraine war.

The slide in Greenback has strengthened even the currencies of some countries targeted by the American tariff. Mexican Peso increased more than 3 % while Yuan acquired more than 1 %. The Canadian dollar did not change a little.

Read: The US share of the global market roof to receding in 2025: MLIV pulse results

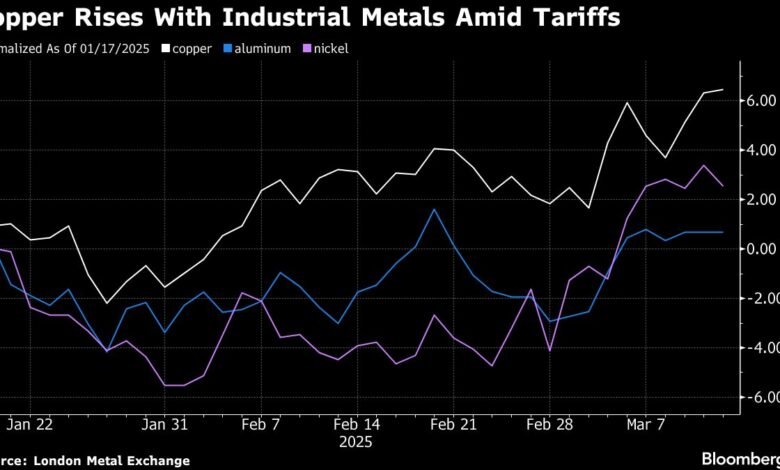

Meanwhile, copper rose to a five -month highest level to lead industrial minerals as investors are offered in distortions stating that the definitions brought by the global trade flow to goods. Also, the turmoil in trade may generate the prices of the main agricultural commodities from soybeans to the atom. Gold has achieved a series of standard highlands since Trump returned to the White House.

2025-03-14 06:13:00