Demand for Japanese bonds reassures jittery markets

Open Editor’s Digest for free

Rula Khalaf, editor of the Financial Times, picks her favorite stories in this weekly newsletter.

Strong demand for Japanese government bonds helped stabilize Asian markets on Tuesday, a day after hawkish comments from the central bank governor sparked a global sell-off.

The yen stabilized and stock markets stabilized, with investors reassured by demand at the Japanese government bond auction. The broader Nikkei 225 and Topix indices closed 0.1 percent higher, while the yen fell 0.1 percent against the dollar.

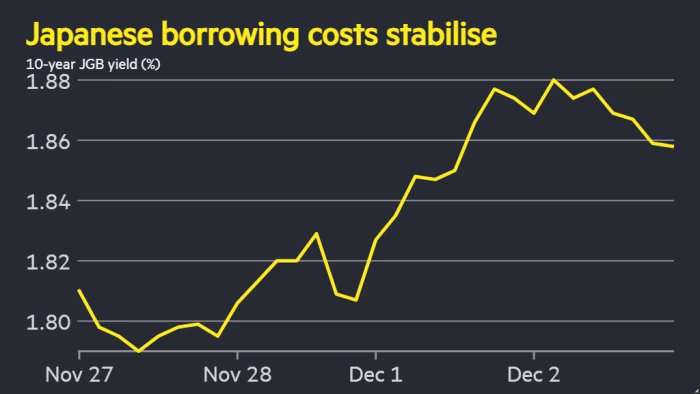

The 10-year Japanese bond auction attracted relatively strong demand, including from pension funds, supported by the 1.88 percent yield on the benchmark paper – the highest level in 17 years – immediately before the auction.

The auction was held a day after statements by Bank of Japan Governor Kazuo Ueda indicated to investors that the central bank is ready to raise interest rates this month for the first time in nearly a year.

“The market seems to think so [a rate increase in December] “It’s pretty much a done deal,” said Shuki Omori, chief desk strategist at Mizuho.

Renewed speculation about the possibility of the Bank of Japan raising interest rates sent shares of Japan’s largest banks rising. Shares of MUFG, the country’s largest bank, rose 2.5 percent on Tuesday, while shares of its closest competitor, SMFG, ended the day up 3 percent.

Analysts said that the continued weakness of the yen against the US dollar will increase the chances of the Bank of Japan moving in December.

“We have a situation where the Japanese Ministry of Finance has indicated that it stands ready to intervene to support the yen if necessary, and we have indications that small and medium-sized companies are feeling the pain caused by higher input costs due to the weak currency,” said Neil Newman, Japan strategist at consultancy Astris. “I think the Bank of Japan should do that in December.”

Ueda’s comments pushed yields on Japanese government debt to their highest levels in years — yields move inversely with prices — and sparked declines in other bond markets around the world. The rise in returns on safer assets contributed to the decline in the price of Bitcoin by more than 5 percent.

Recent sharp moves in Japanese government bond yields, coupled with a steady decline in the yen in the two months since Sanae Takaishi took office as prime minister, have fueled speculation about the unwinding of the so-called yen carry trade. A carry trade refers to the strategy of borrowing yen cheaply to finance investments in other assets.

But Benjamin Chatel, chief economist at JPMorgan, said there did not appear to be any immediate catalyst for such unwinding, and that low volatility in the yen meant investors were likely still placing more carry trades in the yen.

Elsewhere in Asia, the Hang Seng was flat while China’s CSI 300 rose 0.5 percent. Korea’s Kospi rose 1.7 percent.

2025-12-02 08:02:00