US long-dated debt faces crucial test in $22 billion auction

(Bloomberg)-After weeks of capturing hands about the demand for US debt in the long run, all eyes are in the locker auction for 30 years (^Tyx) for a new reading about whether the escalating deficit caused investors to avoid maturity.

Most of them read from Bloomberg

The sale of $ 22 billion, scheduled for 1 pm New York time, is part of the regular borrowing of the government. However, this will take place as congress considers the huge tax bill for President Donald Trump, which will add some trillion dollars to the American budget gaps, which may require more bonds to finance spending.

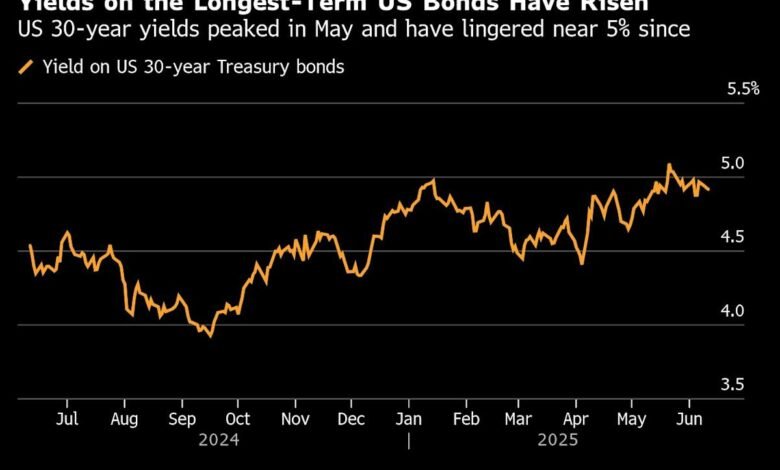

This background, in addition to fears that the president’s trade war threatens to prepare inflation and low global demand for American assets on a large scale, punished the tallest maturity of the treasury in particular. Investors have become more careful than lending to the United States government for a long time, and they demanded the highest returns as a result, which increases a pillow known as the term premium.

A surprisingly bad reception in an auction last month, which is 20 years old, contributed to selling bonds, which paid 30 years to 5.15 % in May, leaving them shy of almost high losses in stocks and dollars. Previous sale for 30 years, last month, also witnessed a fairly weak request.

“Given what happened with 20 years two weeks ago, there will be increasing interest, especially for 30 years,” said Kevin Flaanagan, head of the Wisdomtree’s fixed income strategy.

Data on Wednesday showed that inflation in the United States rose in May with less expectations. The numbers motivated gains in the treasury bonds led by shorter benefits, as traders reinforced the bets on discounts in the rate of interest in the field of federal reserves this year. Strong purchase in the Treasury auction for 10 years (^TNX) helped fuel the progress.

However, inflation remains 2 % higher than the Federal Reserve Bank, and politicians have indicated that they are waiting to know the amount of definitions that raise consumer inflation before lowering prices. Long bonds are particularly vulnerable to threatening the price pressures.

Amid all these risks, bond managers including DouBleline Capital and Pacific Management Co preferred to own treasury bonds with 10 years or less for maturity, with less assignment to the long end.

This week, Pimco has repeated that it remains a long debt for weight over the next half, while Jeffrey Gundlash of Doublelline no longer looked at long -term treasury bonds as legitimate risk -free investments.

2025-06-12 06:15:00