American consumers are still buying like crazy, but the largest credit card companies are stashing funds away for a rainy day

- With the stock market remains volatile In the aftermath of the “Liberation Day” definitions called by president Donald Trump, consumer spending was not greatly affected, at least not yet. During the quarterly profit calls, credit card companies provided strong expectations regarding spending on consumers, but many of them took measures to reduce losses amid a possible economic shrinkage.

Since President Donald Trump’s commercial policies contributed to stock market turmoil, the repercussions of the so -called “liberation day” definitions did not reach the quarterly financial reports of the largest lenders in the country where consumption spending patterns are

The profit reports for credit card companies remained strong, as consumers borrowed, spending them and opened credit cards more than the previous year.

“The consumer is still flexible and distinguishes his spending,” said Mark Masson, Citigram Finance Director, during the company’s quarterly profit call. Mason also emphasized the revised consumer feelings.

“We have seen a shift towards the basics and away from travel and entertainment,” Masson said.

JPMorgan Chase has announced a 7 % increase in credit and decision on an annual basis, but they noticed that people were holding high credit cards. In addition, the Bank of America set a 4 % bump in spending on the credit card and deduction from the previous year, as well as a decrease in the late payments of loan holders during the previous quarter.

Despite the positive growth, the main credit card companies are preparing for economic shrinkage, and the jewel has already rises to its highest level in five years.

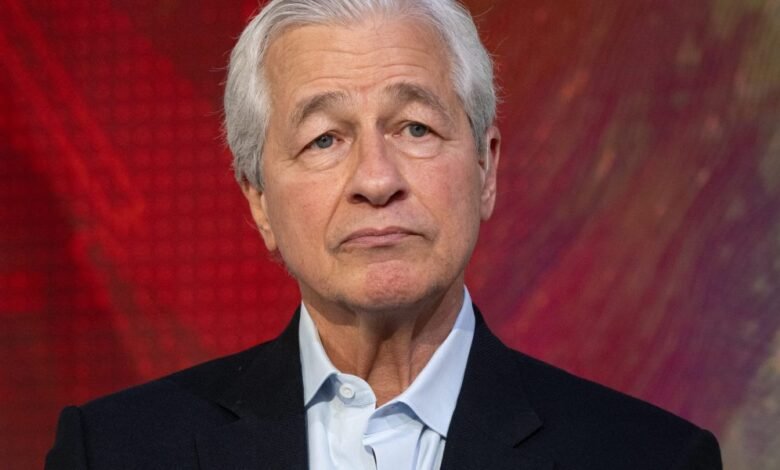

Jeremy Barnum, President of JPMorgan Chase Finance, Jeremy Parnum, President of Jeremy Parnum, leader of Jeremy Barnum, leader of Jeremy Barnum, leader of Jeremy Barnoum, President of Jeremy Barnoum, the bank’s profit head on April 11:

Since JPMorgan bears the risk of recession by 60 %, the bank added to its rainy daily funds in the event of future losses by increasing its credit losses (ACL) by $ 973 million, amounting to its total net reserves to 27.6 billion dollars.

In addition, the company allocated $ 3.3 billion in loan loss provisions – an increase of 73 % over $ 1.9 billion issued to combat unpaid loans from a previous year. JPMorgan also maintains $ 1.5 trillion of securities and marketing securities.

Jpmorgan did not immediately respond to wealth Request to comment.

In addition to Jpmorgan, Citi maintains security in the event of an economic shrinkage. The bank increased the cost of credit by more than 15 % from the previous year to $ 2.7 billion.

In addition, Citi has strengthened its total reserves at $ 1 billion in the first quarter, from 21.8 billion dollars to 22.8 billion dollars, in search of security if the US economy went south. The bank also maintains strong liquidity and capital position with cash levels of up to $ 960 billion.

City is no longer immediately wealth Request to comment.

This story was originally appeared on Fortune.com

2025-04-24 01:20:00