Microsoft Open-Sources GitHub Copilot Chat Extension for VS Code—Now Free for All Developers

Microsoft is officially fragmented by the Github Copilot chat supplement for the Visual Studio code (VS Code), where she placed a distinguished coding assistant of artificial intelligence in the hands of developers-free of graphics. The entire collection of features that were released under the license of the Massachusetts Institute of Technology has been released, which now requires the subscription available to everyone. This transformation is a major milestone in making improved developers to be extensively available and paves the way for increasing customization, transparency and innovation in coding environments.

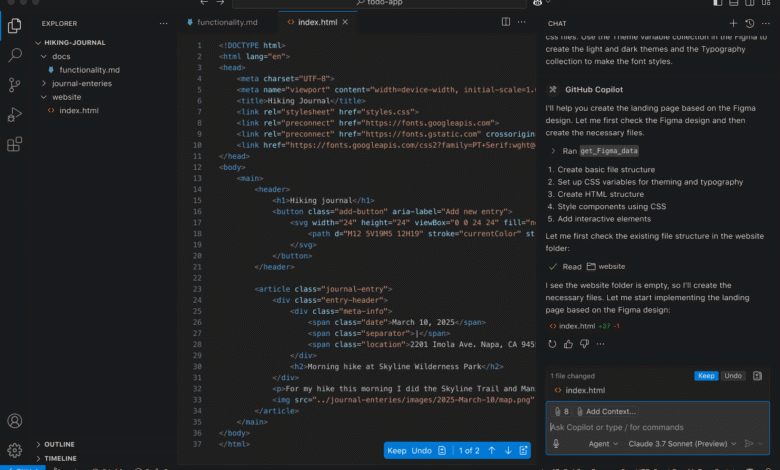

It hosts it on GitHub in Microsoft/VsCode-Copilot-Cat, and the extension includes four basic components: agent mode, editing mode, code suggestions, and chat integration. These components work together to create an interactive coding assistant and consciousness of context that exceeds the completion of the simple code.

1. The agent status: automating the complex coding tasks

The agent’s status is designed to deal with the workflow of multi -step coding independently. Automatic completion or fixed suggestions goes beyond-the developers actively help by diagnosing assembly errors at the time of translation, restart tests, and even repetition of changes until the desired output is achieved.

For example, if one of the developers requests, “carrying out the cache of this application programming interface”, the agent can divide this into sub -tasks: create a interface interface, integrate the cache library, and implement it in the current service logic. In the event of errors or failures, they respond, accordingly – without manual intervention.

This situation works mainly as a co -developer capable of self -correction and adaptation to dynamic coding environments.

2. Editorial mode: natural -powered multi -powered editing

The editorial mode turns how developers interact with their code base. It allows natural language orders to make organized adjustments – multiple files – without writing one line of the icon symbol or mobility code.

For example, a router such as “add registration to all HTTP requests” can be translated into consistent adjustments across different units, with job covers or device logic.

Integration also includes a vivid inspection of changes, allowing developers to review and apply differences selectively. The editing of this conversation flows greatly from repeated or cross -cross changes and reduces the general cognitive expenditures.

3. Code suggestions: awareness of context, and predictive achievements

While the traditional tools for automatic completion provides a special distinctive prediction, the GitHub Copilot icon icon suggestions are directed further by taking advantage of the context and developer’s style to expect to complete meaningful software. The system learns from the current file, the project structure, and even previous amendments to the following logical change.

Suggestions appear smoothly and can be accepted via the tab, making the writing code flow more flexible. Whether writing a boileplate icon, display functions, or new units formula, the system adapts to patterns with a great response.

4. Chat integration: Asking the country’s questions without leaving your IDE

One of the most powerful capabilities is the interface inside the editor, which provides immediate support for the context to the current work area. Unlike LLM chat facades for general purposes, this tool is deeply aware of your project files, dependencies and structure.

You can ask targeted questions such as “Why this test failed?” Or “What does this job do?” It receives the answers included on the basis of the actual symbol. This allows the documents in time, help the correction, and architectural guidance-all without leaving the code against the code.

The effects of the environmental system of the developer

Useful use first, developers and organizations can now host and customize the extension to suit the tasks of the royal workflow or restricted environments. Second, contributions from the open source community call for improving performance, adding features or integration with the unpopular background LLM.

This step also puts access to strong artificial intelligence development tools, especially for developers in educational or unreasonable environments where paid subscriptions are an obstacle.

conclusion

By launching the GitHub Copilot Chat accessory under an open license, Microsoft is reshaping the AI -backed development boundaries. What was previously with a collection of features with gates, is now a strong basis that can be expanded for the functioning of smart coding work – available to everyone.

The developers no longer have to choose between capacity and cost. With features such as Mode Agent, Editorial Mode, Code Introduction Suggestions, and Context Chat can now be accessible, the experience of coding within VS Code becomes faster, smarter and more cooperative.

verify Jaytap page. All the credit for this research goes to researchers in this project. Also, do not hesitate to follow us twitterAnd YouTube And do not forget to join 100K+ ML Subreddit And subscribe to Our newsletter.

SANA Hassan, consultant coach at Marktechpost and a double -class student in Iit Madras, is excited to apply technology and AI to face challenges in the real world. With great interest in solving practical problems, it brings a new perspective to the intersection of artificial intelligence and real life solutions.

Don’t miss more hot News like this! Click here to discover the latest in AI news!

2025-07-09 07:19:00