(Bloomberg) – Halsion days appear in the debts of companies, signs of fading, as commercial wars were destroyed by an uncomfortable demand for credit.

Most of them read from Bloomberg

“The cracks that appeared in the credit market last week have been broken this week,” adding that the markets are now on a stagnation.

Definitions are expected to give up the growth of the global economy and fears increase that policies will lead to recession in the United States. The scrap differences have expanded over the past six months last week, but are still near their lowest levels, which means that they can come out much more if it hit the recession. Some hedge boxes have already stumbled with the high fluctuations and investors accumulating the origins of the haven such as gold.

“Under the surface, the levels of anxiety have just increased significantly,” said Victor Khosla, founder of Bloomberg TV on Wednesday.

Here are five plans to highlight the change of feelings in the debt markets:

Unwanted risk installments

With the rise in the return of the return in the United States, the Goldman Sachs Group Inc. Their expectations of risk installments with increased risk of customs tariffs and White House flags are ready to tolerate the short -term pain in an attempt to address the trade deficit. They now expect the high -yielding jobs to reach 440 basis points in the third quarter compared to 295 basis points. The levels as of March 13 were 335 basis points.

“Recently, we have moved from a market that used to buy rumors and sell facts in a market that buys facts,” said Gotier Remodier, president of Bain Capital Credit Europe.

Converted tablets

Gabriele FOA, director of the forced investment portfolio in February, warned that high -yield credit barters, which protect against the failure to pay, were trading at levels that were not seen only three times in the past ten years and each time a sharp breadth in the six months was followed by nine. Quickly forward now and the Markit CDX North Norman High Limn index, which decreases when the risk of credit rises, has decreased to the lowest level since August.

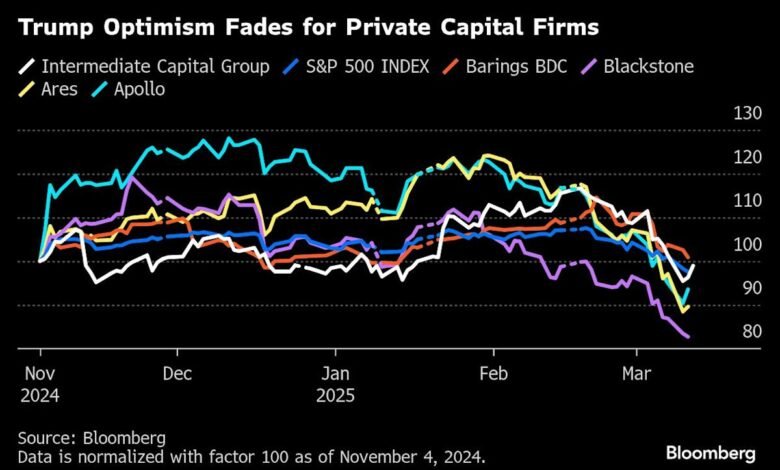

The private markets were struck

The American economic policy makes it difficult for private capital companies to sell their property and added many more expensive debts to their conservative companies, most of which are private credit lenders.

At a conference in London this week, a number of those present spoke on the sidelines of concerns about the rates of interest covering in companies owned by private stocks, and the risks that their companies retain a lot of influence and the need for direct lenders to diversify away from excessive exposure to companies’ credit.

“A lot of money has been transferred to the category of private credit assets,” said Claire Madden, the CONNECTION CAPITAL, who invests in private boxes. “We are still not having a course for a long time. There are still a lot of problems on the road.”

Loans benefit from a decrease

The fall was in the integration and acquisitions, in addition to the exporters in the loan market supported over the past year or so, as the thirsty investors returned to any deals that came to the market, many of which are re -encouraged. Money managers are now more selective, as they retreat from low -rated prices and credits with five deals that have been withdrawn from participating in recent weeks.

Foreign flow credit

Decreases come even with overall flow of credit rates in recent months, which contributes to narrowing of differences. But the loans that were used in the United States witnessed the first outflows this year in the week until March 12, according to Lseg Lipper, while investors withdrew funds from high -yielding bonds at the highest rate in about two months. Of course, this may prove an edge if investors are going on credit amid correction of the stock market.

However, debt markets “walk negative”. “This is not good” because when this money becomes very large, the market becomes “very directed to flow for the basic.”

Click here to listen to Credit Edge with Goldthorpe of BC Partners

Week in the review

-

Credit markets worldwide weakened this week with the sale of stocks, amid escalating commercial wars. A series of companies delayed bond sales in the United States. He was on the vow from Barclays Plc to Goldman Sachs Group Inc. Review their spread on a larger scale.

-

Global banks seem to give major customers special information to win commercial businesses for companies, according to a new study showing that the market is of $ 56 billion per day stacked in favor of the most active investors with the broader agents networks.

-

Investors are increasingly looking to profit from bets on the recent destroyed European companies with high coupons, given that fleeing on high -yielding bonds has been close to the wealthy years, and there are little new debts. Money managers call the trend to “go out for garbage.”

-

Rio Tinto Plc sold $ 9 billion of US investment bonds, collecting money for just acquired Arcadium Lithium PLC.

-

Elsewhere, Morgan Stanley seemed to be investors with a potential debt package of $ 4 billion to re -financing loans to Finastra Group Holdings Ltd.

-

The Ardag Group collection is holding conversations with its creditors to obtain a debt restructuring deal that will witness that the Irish billionaire Paul Coulson is losing control of part of the packaging company.

-

A group of banks led by UBS Group AG launched a billion dollar debt package on Wednesday to acquire Celsius Holdings Inc. Alani Nutrition LLC.

-

The EW Scripts Companyy provider has suspended a deal with lenders to pay or extend about $ 1.3 billion of its loans in the range of $ 1.3 billion, and got a $ 450 million loan from investors including KKR & Co.

-

Money managers who buy advanced bonds supported by American companies ’loans increasingly find that they should not only pay attention to how companies perform, but also how the mortgage debt market in the United States does. The guaranteed loan obligations began to appear expensive for guaranteed mortgage obligations, which may limit future gains in the foreground.

-

Deutsche Bank increases the large number of risk transfer associated with a group of loans to German medium gain companies, according to people who have knowledge of the issue, in the latest indication of high demand for investors in the asset category.

In this step

-

Bank of America promoted Neha Jouda to the head of the US Credit Strategy, a newly created role after the departure of Ait Melintif from the high -return credit strategy.

-

JPMorgan Chase & Co. Using the rented processes and acquisitions Jay Harris from the American Corp. As the largest lender in Wall Street, it is pushed to cover smaller and medium companies more comprehensive.

-

The Canadian imperial trade bank has appointed Harry Kulham to succeed CEO Victor Dodge, who will retire in November after he led the fifth largest lender in the country for more than a decade.

-

HSBC Holdings Plc Alex Paul was appointed to lead the integration and internal acquisition team. Paul will be in Hong Kong and the new role will start next month.

-

Deutsche Bank employs James Wilkenson bond dealer from Goldman Sachs as part of re -focusing on the market’s credit.

-

Millennium Management benefited from one of the most profitable merchants in Eisler Capital to manage money from abroad.

-

Citigroup Inc. The promotion of Chris Cox to the head of investor services, as it follows more growth in services after record revenues in 2024.

-

Banco Santander SA Peter Huber has appointed its new international insurance president to replace Armando Paweuro, who comes out of the Spanish lender.

-

Goldman Sachs Group Inc. Citigroup Inc. Veteran Tetsuya OKA to enhance investment banking business in Japan.

-With the help of Sonyi Basak, Kat Hidalgo and Rhea Rao.

Most of them read from Bloomberg Business Week

© 2025 Bloomberg LP