(Bloomberg) – Asian stocks have risen for the third day, supported by progress in Japanese stocks, as investors have put new bets on Chinese technology companies.

Most of them read from Bloomberg

Hong Kong stock standards in Asia outperformed with about 2 % gains, reinforced by BYD Co. In a record after it revealed a new charging system for electric cars. Japanese standards were more than 1 %. This is after American stocks rose to the second day, as industrial and energy stocks rose.

The stock gathering in China may get a new catalyst of a large number of technology profits, where Xiaomi Corp has been assigned. And Tencent Holdings Ltd. In reporting this week. While Beijing’s briefing on consuming consumption was seen as disappointing by some, the market reaction on Tuesday indicates that investors remain positive on expectations. The BYD technology progress also enhances a narration of the global competitiveness of Chinese companies.

Things indicate a slowdown in the United States, but in China “the direction of travel is largely looking to stimulate growth.” “So I am in the angle of saying, we look at the great axis from the United States to China at the present time.”

The return on treasury bonds did not change for a few years a little after a basis point slide to 4.30 % on Monday. The Bloomberg Index in dollars rose. Futures in the United States declined in Asia’s circulation.

In Japan, the shares of the largest trade role rose after Berkshire Hathaway Inc. From her share. Financial stocks also gained along with high revenues before the Bank of Japan’s decision on Wednesday. The central bank is expected to maintain a 0.5 % policy average, according to economists surveyed by Bloomberg.

“The BOJ team must closely monitor very slope in yield,” said Junki Iwahashi, Sumatomo Mitsoy’s Sumitoi Trust. He said, referring to the Boj ruler: “It will pay close attention to the interest in UEDA’s comments on this when he speaks to the briefing,” referring to the Boj ruler.

In other news, President Donald Trump said Chinese leader Xi Jinping will soon visit Washington, amid trade tensions between the world’s largest economists.

Retail sales

S&P 500 and NASDAQ rose about 0.6 % for each on Monday, as the gains in small stocks outperformed a slide in the amazing seven regiment.

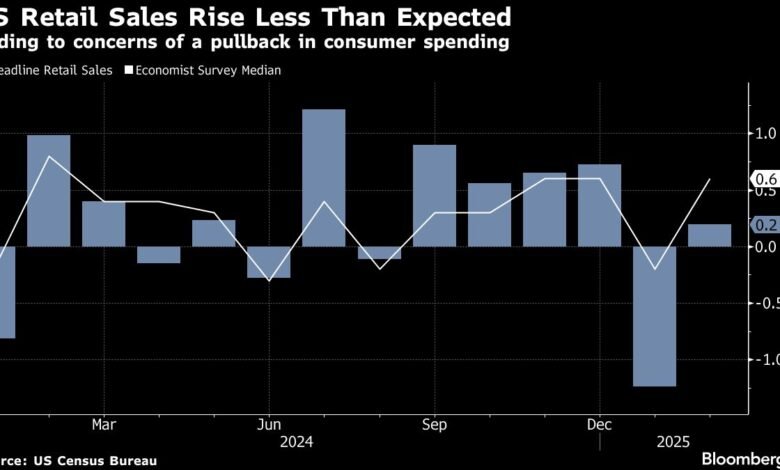

US retail sales have risen less than expectations in February and the previous month was revised. However, the alleged control group sales-which feed at the expense of the government to spend goods for gross domestic product-increased 1 % last month, reflecting the previous decline.

“While gossip in stagnation may seem exaggerated at the present time, the American economy remains in the slowdown, while maintaining assessments under careful scrutiny,” said John Rong Yap, a market strategy in IG Asia.

The feeling of waiting and seeing from politicians this week may arise in their first evaluation of how Trump’s commercial policies affect the economy. With the federal reserve officials on Wednesday, the market will focus on the updated economic expectations of officials and president the press conference Jerome Powell to obtain evidence on the next road.

Meanwhile, oil was stabilized after two days, with expectations for the Chinese economy and geopolitical risks in the remaining Middle East. Gold nodes near $ 3000 an ounce.

The main events this week:

-

The American housing, the import price index, and industrial production begin on Tuesday

-

Japan Bank average decision, Wednesday

-

Federal Reserve Price decision, Wednesday

-

China loan initial prices, Thursday

-

The decision of the Bank of England, Thursday

-

Philadelphia Factory Index in Philadelphia, unemployed demands, current homes sales, Thursday

-

Consumer confidence in the euro area, on Friday

-

John Williams speaks on Friday

Some of the main moves in the markets:

Shares

-

S&P futures decreased by 0.2 % from 10:43 am Tokyo time

-

Japanese Topix increased by 1.6 %

-

S&P/ASX 200 increased in Australia 0.3 %

-

Hang Kong Hanging increased by 1.9 %

-

The Shanghai compound increased by 0.2 %

-

EURO Stoxx 50 Futures increased 0.4 %

Currency

-

The Bloomberg index in the dollar has not changed a little bit

-

The euro did not change a little at $ 1.0915

-

The Japanese yen decreased by 0.2 % to 149.48 per dollar

-

Yuan did not change a little at 7,2318 per dollar

Cross currencies

-

Bitcoin fell 1 % to 83,091.42 dollars

-

The ether decreased by 1.7 % to $ 1,903.01

Bonds

-

The return on the treasury bonds has not changed for 10 years by 4.29 %

-

Japan’s return has not changed for 10 years at 1.505 %

-

Australia’s return for 10 years decreased one basis point to 4.40 %

Commodity

This story was produced with the help of Bloomberg’s Option.

-With the help of Paul Allen, Heidi Lun Woeni Has.

Most of them read from Bloomberg Business Week

© 2025 Bloomberg LP