Aston Martin issues profit warning citing US tariff impact

Digest opened free editor

Rola Khaleda, FT editor, chooses her favorite stories in this weekly newsletter.

Aston Martin on Monday warned of losses and low sales, as the British car maker blames the deficit of higher costs of US president Donald Trump’s tariff and a slower request in China.

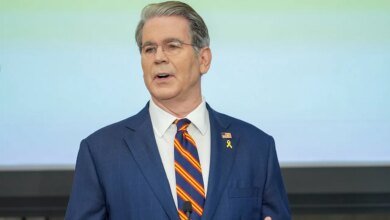

The second profit warning this year is a blow to Adrian Hallmark, which is charged with operating around the company and enhancing its public budget since his appointment as CEO last year.

The company expected that the total wholesale sizes for the year until December will decrease by a “one percentage percentage of one” when compared to 6,030 cars that were sold last year. The shares have decreased more than 7 percent in early trading.

Aston Martin expected that the modified loss before taxes and benefits will be greater than 110 million pounds, which is the lower party to the consensus of analysts.

The company said, “The global macroeconomic environment facing the industry remains difficult,” and it also blames the slowdown in China after the Bijin tax campaign on the wealthy.

Aston Martin is severely exposed to Trump’s definitions because he does not make vehicles in the United States and has to reduce shipments in America earlier this year.

According to the commercial deal of the United States of America, which came into effect at the end of June, Trump agreed to reduce an American tariff by 27.5 percent on cars to 10 percent for the first 100,000 vehicles shipped from the United Kingdom every year.

Although this deal has been widely welcomed by the industry, the shares system created uncertainty because it was allocated on the basis of who comes first to serve first. Aston Martin said the system added, “Another degree of complexity and limits the group’s ability to predict accurately” for the next quarter.

The company said it is no longer expected to generate a free, positive cash flow for the second half of the year.

She also warned of a slower group of Valhalla Supercar hybrid with 150 planning processes in the fourth quarter, compared to analysts’ expectations of more than 200.

On Monday’s note, Bernstein’s analyst Harry Martin said that investors focused on generating positive free cash flow and launching smooth Vallala as a “major proof point” that “things have recently started to operate the corner.”

Martin added: “The failure in this final straw may be for many investors,” Martin added.

The company said it started an immediate review of the future spending after reducing 5 percent of the workforce earlier this year.

2025-10-06 06:35:00