Trump’s Cambodia Charm Offensive Confronts China in Southeast Asia

For decades, the United States’ relationship with Cambodia has been among the most tense in all of Southeast Asia, a region where the great power rivalry between the United States and China is rapidly escalating. In the past, Washington and Phnom Penh have had strong disagreements over issues such as democracy and human rights, as well as concerns about strengthening Cambodia’s relations with China. However, under the second administration of US President Donald Trump, this is changing – perhaps quickly and dramatically to Washington’s strategic disadvantage and Beijing’s strategic detriment. In fact, recent developments regarding Cambodia indicate that the United States may have finally found a way to attack in China’s backyard.

While attending the annual summit of the Association of Southeast Asian Nations (ASEAN) in Malaysia last week, Trump signed a new agreement with Cambodia (along with Malaysia and Thailand) to secure critical minerals and gradually reduce reciprocal tariffs on select Cambodian exports to the United States. He also chaired an ASEAN ceremony to celebrate the ceasefire (which Trump incorrectly described as a “peace deal”) between Cambodia and neighboring Thailand. In Trump’s July 26 phone call with the two sides to push them to de-escalate their conflict, Cambodian Prime Minister Hun Manet nominated him for the Nobel Peace Prize in August, praising Trump for his “extraordinary statesmanship,” which Hun said was “vital in preventing massive loss of life and paving the way toward restoring peace.” The question of merit aside, the nomination was a smart piece of Cambodian diplomacy given Trump’s obsession with the peace prize.

For decades, the United States’ relationship with Cambodia has been among the most tense in all of Southeast Asia, a region where the great power rivalry between the United States and China is rapidly escalating. In the past, Washington and Phnom Penh have had strong disagreements over issues such as democracy and human rights, as well as concerns about strengthening Cambodia’s relations with China. However, under the second administration of US President Donald Trump, this is changing – perhaps quickly and dramatically to Washington’s strategic disadvantage and Beijing’s strategic detriment. Indeed, recent developments regarding Cambodia suggest that the United States may finally have found a way to make this happen He plays Crime in China’s backyard.

While attending the annual summit of the Association of Southeast Asian Nations (ASEAN) in Malaysia last week, Trump said I fell A new agreement with Cambodia (along with Malaysia and Thailand) to secure critical minerals and gradually reduce reciprocal tariffs on select Cambodian exports to the United States. It is Preside During an Association of Southeast Asian Nations (ASEAN) ceremony to mark the ceasefire (which Trump incorrectly described as a “peace deal”) between Cambodia and neighboring Thailand. Regarding Trump’s phone call with the two sides on July 26 to push them to stop escalating their conflict, Cambodian Prime Minister Hun Manet said nominated Hoon received the Nobel Peace Prize last August, and praised Trump for his “extraordinary statesmanship,” which Hoon said was “vital in preventing massive loss of life and paving the way toward restoring peace.” The question of merit aside, the nomination was a smart piece of Cambodian diplomacy given Trump’s obsession with the peace prize.

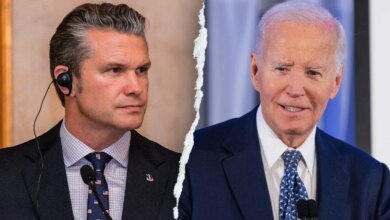

Before the ASEAN Summit, the Trump administration He cuts Cambodia’s initial tariff rate of 49 percent has been reduced to 19 percent, the same as the tariff rate imposed on the Philippines, a US treaty ally. Additionally, in July, US Indo-Pacific Command detained Bilateral defense dialogue with the Royal Cambodian Armed Forces – the first since 2017, and coincidentally during Trump’s first term. During the summer, there were some Chatter US Defense Secretary Pete Hegseth will also visit Cambodia. Although Hegseth’s published itinerary for His current The Indo-Pacific cruise does not include Cambodia, and he may still attend because he is already scheduled to stop in neighboring Vietnam.

This warming trend in US-Cambodia relations is directly attributable to one thing: Trump’s simply authoritarian streak. Align Better with authoritarianism in Cambodia. Following Vietnam’s military intervention in Cambodia in 1978 to overthrow the genocidal Khmer Rouge regime led by Pol Pot, Hun Sen, Hun Manet’s father, became prime minister and ruled with an iron fist for 38 years, ending his term in 2023. Hun Sen is currently a senator and remains an extremely powerful figure in Cambodian politics – even more powerful than his son, despite the latter’s position. In practical terms, this means that Cambodia is accustomed to strongmen and how they undermine democracy, laws and norms – an agenda that Trump has undoubtedly pursued in America.

But how this translates abroad is also important. Cambodia welcomed Trump’s decision Stop funding Of US-backed programs that support civil society and the closure of Voice of America, which Hun Sen pushed He praised As a “significant contribution to eliminating fake news, disinformation, lies, distortion, incitement and chaos around the world.” Trump’s policies stand in stark contrast to the policies of previous US administrations. During the Biden administration, for example, then-Deputy Secretary of State Wendy Sherman visited Phnom Penh in 2021 to discuss Cambodia’s upcoming ASEAN presidency. Just before her arrival, she wrote an editorial in a state-run Cambodian newspaper Argue Instead of attacking Cambodia over values, the United States should “intensify its development cooperation” and “consider encouraging its investors to invest in Cambodia” as China has done. Today, the second Trump administration certainly behaves more closely to Beijing in terms of conducting foreign policy through the lens of trade, investment, and supply chains above all, with no strings attached when it comes to values. Trump’s strategy appears to be working. Cambodian officials are It is said Now they are more interested in opening their country to American companies, according to an American lawyer who handles such matters. He said that “sentiments changed almost overnight” because of Trump’s policies.

Trump’s success in Cambodia was also driven by deep concerns in the country about over-reliance on China, especially Beijing’s Belt and Road Initiative, which promotes infrastructure and other investments. It is said that Cambodia HostsThere are up to 100 such projects worth tens of billions of dollars. High-profile projects Includes Phnom Penh-Sihanoukville Expressway, Siem Reap-Angkor International Airport, Sihanoukville Special Economic Zone, and Funan Teko Canal, which aims to Calls Mekong River to the Gulf of Thailand – a controversial project not only from an environmental point of view but also from a geostrategic perspective. Regardless, these projects incurred heavy debts that would have to be repaid to China, which contributed to Phnom Penh’s push toward diversification toward the United States. After Trump won the 2024 election, for example, Hon Notice He sought to “take our existing good bilateral relations to greater levels” – a point he repeatedly reiterated.

Despite recent gains by the United States, China’s grip on Cambodia will remain a reality for the foreseeable future. The friendship between China and Cambodia is truly “armored“Given not only their deeply intertwined economic ties, but also Phnom Penh’s previous diplomatic support for Beijing’s initiatives at the United Nations and within ASEAN on sensitive issues such as control of the South China Sea. In 2012, for example, the ASEAN Foreign Ministers’ Meeting did not issue a joint statement due to Chinese pressure on the presidency, Cambodia, to avoid statements inconsistent with Beijing’s policies on the South China Sea and other disputes. When it took over the ASEAN presidency again in 2022, and Cambodia allowed a joint statement to be issued that included some language that was unlikely to please China, suggesting that it sought freedom from Chinese coercion at that moment.

But overall, Cambodia still prioritizes China over the United States. In 2020, for example, Phnom Penh decided to demolish two US Navy facilities at Ream Naval Base to make way for Chinese-funded infrastructure. Although Cambodia strongly to reject There will be a Chinese military presence at the base, commercial satellite images He appears A Chinese military enclave in Ream, and sources on the ground certain The area is off-limits to Cambodians. This strongly indicates that Ream now hosts a Chinese naval base, Beijing The second overseas facility of its kind after Djibouti. Cambodia also did not permission A US Navy port call at Ream, although there has long been a demand for books.

However, the strides Trump has made in Cambodia in just a few short months have been impressive. The regime is not the only one who supports him; And apparently so do the Cambodian people. Buddhist monks, for example, have He walked Crossing the streets with his picture, government and business leaders comparison To Him is none other than God. In fact, there is now a campaign to rename a highway in Cambodia the “Donald Trump Highway” in his honor. If this happens, it will complement the existing “Xi Jinping Street”, highlighting the competitive nature of the relationship with Cambodia.

More importantly, what the United States did recently in Cambodia has broader implications for US foreign policy and grand strategy. Trump’s abandonment of values - in favor of prioritizing national interest and economic transactions above all – similar to Beijing’s approach – could give the United States a decisive advantage in dealing with other countries in Southeast Asia, the broader Indo-Pacific region, and much of the Global South. Indeed, Trump has reached out to other countries that have had fragile relations with Washington, such as Pakistan, about critical minerals.

There are, of course, downsides to Washington’s new strategic advantage. Trump may try to close a significant minerals deal with Myanmar almostWhich threatens to make the civil war there worse as a result. Prioritizing national interests over values by such a wide margin will further erode what remains of the rules-based international order in favor of great power competition.

But in the end, ensuring that Beijing’s new world order —Including its dominance of the Indo-Pacific region and beyond –Not achieving this requires difficult trade-offs, and this is where it starts with More American pragmatism in places like Cambodia.

Don’t miss more hot News like this! Click here to discover the latest in Politics news!

2025-10-31 11:13:00