Best and Worst Stocks to Own Over July 4th Week

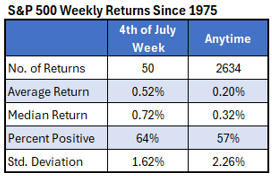

If you are looking for trade in the fourth week of July next week, this article may inspire some ideas. The table below shows that the holiday week has been optimistic over the past fifty years. The average return during the fourth week of July of the S&P 500 (SPX) index was 0.52 %, that is, more than 0.20 % exemplary weekly revenue. Also, eight of the holiday weeks on the fourth of last July were positive, with an average return on 1.30 %.

In the next section, I will dismantle how to perform the stocks when the fourth of July falls on Friday against the other days. Finally, I am the best and worst shares during the holiday week over the past ten years, offering one sector that you may want to avoid.

The July 4 holiday can land on any day of the week, and this year will be on Friday. Is this a difference in how stocks behave? The table below summarizes the weekly return of the S&P 500 based on any day of the week in which the EXCHANGE vacation lands. In 14 times it was Friday, the average index reached 0.44 % for this week. This ranks fourth in the five days of the week, but then the average return by 0.92 % is ranked first.

What highlights is that the July 4th holiday has led to the most volatile returns with the highest normative deviation of the returns and the largest size of both, the average positive return and the average negative return. However, the standard deviation of 1.95 % is lower than the typical and typical normative deviation of the 2.26 % index, as shown in the above table.

The table below shows the individual weeks on July 4, when Friday was the holiday. You can see how the stock market works every day. It tends from Monday to Wednesday to be bullish with the most difficult Wednesday, with a medium yield of 0.27 % with 71 % of positive returns. Merchants appear to be selling on Thursday before the long weekend. The average S&P 500 was a slight loss on Thursday of these weeks with half of the positive revenues.

The table below shows the best S&P 500 performances over the past ten years during the week from July 4. Technology companies have worked well. Bold stocks come from the “software” or “technology devices” sector. There are some of the largest technology shares in the menu including Netflix (NFLX), Amazon.com (Amzn), Alphabet (Googl), Apple (AAPL) and Microsoft (MSFT).

This last schedule is the worst S&P 500 list in the fourth week of July during the past ten years. Oil shares dominate this list with 10 of the first 15 stocks of this sector. Its prices were recently driven by news about Middle East conflicts, next week, with a seasonal opposite wind to deal with it.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-06-25 12:00:00