The Matic Robot Vacuum Charms and Sucks (in a Good Way)

Do you remember the first time you used a robot vacuum? I remember mine. It was one of iRobot’s early Roombas. I was transfixed, watching this chunky black disc whiz noisily around, bashing into walls and furniture before zipping off in seemingly random directions like a hockey puck slapped haphazardly across the ice. It wasn’t good at its job, but in a way, its clumsy sort of chaos made it charming.

Nothing is charming about most robot vacuums, now. In fact, most of them are boring as hell. Don’t get me wrong, they can be nice to have. But it feels like manufacturers have made a collective decision to ignore the R2-D2 of it all in their quest to turn their products into Very Serious Appliances. Why that might be is anyone’s guess, but I suspect either it hasn’t occurred to them to make a robot vacuum fun or they want people to see their products as sophisticated, advanced technology. Or maybe it’s just very hard to nail fun.

Whatever the reason, it has led us to this place where robot vacuums all look about the same: the friendly, rounded curves of the early models have been replaced with harder edges and sheer, flat design. Many have sensor clusters jutting out of the top so they actually know where they’re going, unlike my freewheeling Roomba of old. They’re also smarter and less likely to get trapped under your couch, and they’ve got robotic parts that let them get to more places. (See the independently lifting wheels from the Roborock Saros 10R or the periscope-like sensor cluster of the new Dreame Aqua10 Ultra Roller.) And in recent years, their docks have become much more than a place to recharge and maybe empty dustbins—now, they can swap out mopping solutions and even cleaning parts of the robots themselves.

The problem is: Too many of them still suck (pun intended) at basic cleaning tasks. Some are better than others, but generally speaking, they’re still prone to being disabled by misplaced trinkets, leaving obvious trash behind on carpets, or creating a moat of dirt around the edge of a rug. Their automated docks are impressive, but they’re also a constant source of noise. To many of these companies, “better” seems to be synonymous with “busier and more complicated.”

Enter Matic, founded by former Nest engineers who set out to create a robot vacuum, also called the Matic, that can “mimic human perception and self-learning through cameras and Neural Networks” to clean more like a human being—and that does its job locally, no cloud connection needed. The home robotics company has since put out a device that both looks and works better than the vast majority of its competition, albeit for a high price. But it does so with an irresistible charm that I haven’t seen in a gadget in years.

Matic Robot Vacuum

It’s disarmingly charming robot vacuum with great performance and very few minor quibbles.

- Stellar vacuum performance

- Solid mopping

- Immensely charming

- Quiet operation

- Detailed map

- No internet connection required

- It ain’t cheap

- Ongoing costs can rack up

- Form factor limits where it can go

The Matic is a spectacle right from the get-go. It starts with the shipping box: Instead of slicing through packing tape and lifting out a device hugged by styrofoam and wrapped in plastic, you release four tabs on the bottom of the packaging and lift the top to reveal the Matic sitting on a little cardboard platform with a ramp that flops down. It’s not zip-tied or secured in any way, and when you long-press the start button on top, it drives itself off the platform. A display near the button lights up with a message, festooned with digital balloons and ticker tape, that reads (in my case), “Hello, Davis Family.” It feels like a fake robot made for some early-2010s TV show about the near future.

Inside the box’s upper portion, you’ll find replacement parts, like dust bags and an extra mop roller. But Matic also love-bombs you with a tiny 3D-printed Matic robot vacuum key chain, a sticker sheet full of things like dog ears and a name tag (my child took the liberty of naming it “Martie”), a pair of googly eyes, and a set of friggin’ Legos with instructions to build a miniature Matic. The Lego kit doesn’t come with every Matic delivered—Matic CEO Mehul Nariyawala told me in an interview that the company had included them with early orders, but that it’s hard to get the individual pieces at scale, as it had to special order some. I think the company should try, though, because this was a delightful little build:

The Matic itself beguiles you the moment you look at it. Instead of being a giant, squat hockey puck, the Matic’s curvy, blocky cuboid body stands 7.8 inches tall. The easy comparison is Pixar’s Wall-E, although I kept thinking it looked more like M-O, a black-and-white floor-cleaning robot that, driven by an obsession with cleaning Wall-E’s filth, defies its programming by leaving its predefined course.

To that end, the Matic has a clear cartoonish face, made up of two RGB cameras up top and a broomy mustache-looking cleaning head—the part with the brush and mop rollers—below. When it’s in mopping mode, it drives backwards, and there’s a face there, too, in the form of two more cameras above an air vent that gives it a Wallace and Gromit-esque smile. The Matic uses those four cameras, along with a fifth mounted on top and several infrared sensors hidden around its body, to navigate and map its world, as well as to identify and avoid obstacles.

The Matic’s charming cartoonishness continues when you send it off on an initial mapping run that I can only describe as delightful. It doesn’t just creep around your house, slowly taking stock of boundaries and building a virtual layout, as most vacuums would. Instead, it seems to dash excitedly from place to place, pausing here and there for whimsical pirouettes. It’s collecting data like any other robot vacuum would, but it feels like a Pixar character awash in wonder at every detail of its new home. It’s a marvelous bit of design excess that’s it’s really hard not to get swept up in.

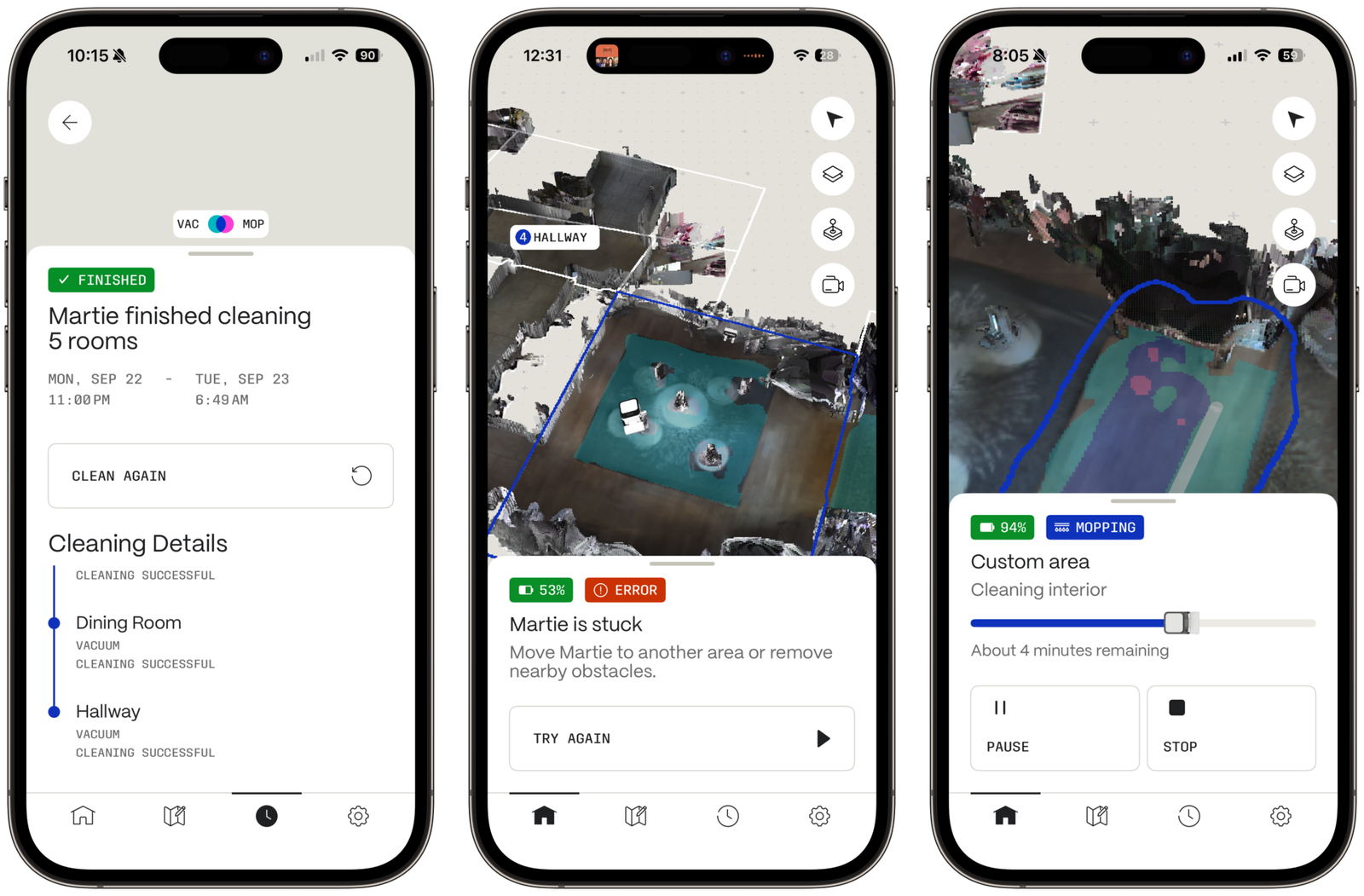

When the mapping is done, you’re treated to what may be the best robot vacuum map in the business. Rather than expressing your home’s layout as a cluster of generic rectangles, the Matic app creates a full-color image from stitched-together pictures of your flooring. It’s almost what it would look like if a giant lifted my roof and snapped a picture of my house (which, again, just makes me think of cartoons), minus the tops of the furniture the robot is too short to see. You can rotate and tilt the map or drive the robot around with an onscreen joystick as if you’re playing a mobile game, and because the details you see in real life are represented so well on the map, it’s always easy to tell where the Matic is and direct it precisely where you want it to go.

This is all extremely handy when the Matic gets stuck—which this robot is definitely wont to do, if perhaps less so than other robot vacuums. In cases where it just can’t get out of a tight spot, you can go into remote control mode to drive it out of trouble. There’s a little latency between your action and the robot’s, but I found that I could still drive it around and be reasonably sure I wouldn’t run it into walls, even if I couldn’t physically see it.

Is this map’s detailed rendering of my home a bit of a creepy reminder that I’m letting a little mobile camera drive around your house? Absolutely, yes. But Matic has uniquely positioned itself to get away with that by being almost entirely self-contained, only requiring an internet connection for software updates. Other robot vacuum companies, like iRobot, might ask you to submit pictures from inside your home so they can train the models that drive their object avoidance features. Whereas the Matic is equipped with an Nvidia Orin Jetson Nano, a miniature computer made for AI and robotics, to handle object identification and navigation on-device.

Connecting the Matic to your home Wi-Fi network does make the act of controlling it easier, but the company doesn’t punish you for using Bluetooth instead. Apart from not getting software updates, you might never know the difference unless some robot-killing software bug rears its head. The app works exactly the same over Bluetooth; it’s just a bit slower, and the connection gets iffy from one room over and nonexistent any farther than that—at least, in my very old house, which has wireless signal-crushing plaster-and-lathe walls. Or, if you like the way the robot works as-is and don’t mind never getting software updates, you could easily set the Matic to a schedule, disconnect it from Wi-Fi, and then delete the app forever.

The top-mounted display also gives you enough information that you almost always know what it’s up to or why it might be stuck. And, as a bonus, you’ll never have to worry about the Matic collecting and phoning home with pictures of you on a toilet that then end up on Facebook. Matic, the company, could go belly up, and this robot could potentially run and be useful for as long as its parts allow—which, to be fair, wouldn’t be long if you can’t buy the vacuum bags anymore, but we’ll get to that soon.

The Matic is better at vacuuming than I am

Okay, okay, so it’s an adorable little Wall-E with good maps. That doesn’t matter, even a little, if the Matic is just as mediocre at cleaning as so many other robot vacuums. Thankfully, it’s actually very good; I run my Roomba J7 nightly, and even then, the Matic was able to gather enough dust and hair in one day of testing to fill its dust bag, which Nariyawala told me has a 1-liter capacity. After that first day, I went through roughly a bag a week over two weeks of nightly runs and one or two spot cleans a day. My carpets and hard floors looked cleaner and felt nicer to walk on than they ever do with my Roomba J7 or Eufy L35 Hybrid.

The Matic accomplishes this with little suction—it only pulls air at 3,200 Pa, about a tenth of the 30,000 Pa promised by the Dreame Aqua10 Ultra Roller or the 19,500Pa of the Ecovacs Deebot X11, some of its most expensive recent competitors. Part of that is thanks to its roller brush, which has chunkier fins that dig deeper into your carpet and are angled in such a way that hair and string are shunted to the side instead of wrapping around the roller. It might also be down to how it cleans; rather than just sort of dumbly driving back and forth across a room in rows, navigating around furniture as needed, like my Roomba J7 or Eufy L35 Hybrid, it seems to detect when it has missed something, and it often goes back to try again from different angles. (Here, I thought again of Wall-E’s M-O leaving its prescribed route.)

The Matic even docks well, gliding smoothly over its metal charging contacts, although it can hesitate if there are objects too close to either side. (Matic recommends a foot of clearance beside and above the dock.) Also, it’s quiet—Matic puts it at 55 decibels when vacuuming, or around the volume of normal human speech—although it’s definitely still noisy if something too big to easily get sucked into the vacuum tube finds its way into the cleaning head and bangs around inside until it’s finally sucked up or ejected.

The Matic’s vision-based object avoidance is excellent; it never bumps into walls or furniture, sometimes turning with such tight clearance that I often thought, “Ah ha! This time it will smack that wall,” and was proven wrong. It does a good job ignoring things it shouldn’t suck up—I never once caught it dragging a dangling USB-C cable or a blanket around. You can still get it to run into you if you jam your foot right in front of it while it’s rolling, but otherwise, it’s almost gentle when it comes to living things, slowing if it sees a dog or a person in its path and either going around them or just stopping and waiting patiently for the path to clear.

Its object avoidance isn’t perfect, though; the Matic will still grab things like hair ties, Lego bricks, and other small objects while going around larger bits of paper. And it got stuck once when the handle of a foldable cloth laundry basket that had been left flat on our living room floor got jammed in the cleaning head. But those sorts of jam were rare, and I wasn’t being especially careful to keep them from happening.

When it comes to mopping, the Matic is better than a lot of older mop-bots that just smear plain water across your floor. It actually uses a floor-cleaning solution, though Matic only endorses those made by Aunt Fannie’s. My floors feel and look better after a few scheduled cleans. The Matic has a spot-cleaning feature that lets you give special attention to dried stains or fresh spills, driving slower over them and taking multiple passes. It did a fine job cleaning ketchup I squirted all over the ground and took care of a crusty stain I found under my kitchen trash can. But don’t expect miracles: it didn’t make a dent in a mysterious substance stuck to my dining room floor. In the Matic’s defense, I’m pretty sure the substance was gum mixed with a bit of paint—did I mention I have a child?—and I couldn’t get it up with my manual mop, either.

Matic says one water tank refill is good for about 1,300 square feet of floor. I don’t have nearly that much moppable surface in my home—I’ve got maybe 100–200 square feet—but I’d say it managed close to that across several scheduled and one-off mopping runs during my testing period. You can configure the Matic to go wait by your kitchen sink (or anywhere, really) when it runs out of water, which I find both adorable and convenient. If it takes longer than 15 minutes for someone to help out, the device docks itself, and the app lets you know the thing’s thirsty.

The best can always get better

Nariyawala told me the company wanted to design something that, if sent back to the 1960s, would be recognizable as a robot designed to vacuum. It’s a nice idea and the right instinct. In particular, its height enables those big ol’ wheels that make high rugs or the chunky transition between my dining room and kitchen a nonissue. The taller vantage point of its sensors both keeps them clean longer and gives the robot more information about the stuff it sees on the ground. Those are all intentional parts of its design, Nariyawala said.

But those unorthodox design choices do have their shortcomings. Primarily, the Matic’s height means it may not go under furniture that’s less than 12 inches off the ground, a big limitation compared to most puck-shaped robots. Mostly, that means it’s not cleaning under my couches and chairs as most others can. (Although, it did start going under one of my dining room chairs that’s only slightly higher its top following a software update near the end of this review.) I actually think that’s a fine trade-off, considering how well it cleans everywhere else. The other thing is that without that tried-and-true circular shape, its boxy body can’t spin freely to pick up dirt in very tight spaces. For instance, the Matic won’t even attempt to clean a small nook next to my fridge that my circular robot vacuums handle just fine. It fits, but barely—I suspect its reticence to even try is part of its aversion to touching walls and furniture.

As much as I like the Matic app, its cleaning history section could also give a bit more information than it does. The device stopped mid-clean on a couple of occasions, and I didn’t see specific reasons why. In one of those cases, my partner found a blob of yarn sitting just in front of the Matic, keeping it from leaving its dock, where it had presumably stopped to recharge mid-clean before continuing. The app’s cleaning history said it hadn’t cleaned all of the rooms but didn’t clarify the reason; my Roomba J7’s cleaning history might’ve informed me that the device had stopped cleaning because it was stuck. Another time, I found the Matic sitting still in the middle of my dining room, its display reading “Paused.” I knew I hadn’t paused it, and everyone besides my cat had been asleep when it started cleaning, so a few more details about the proceedings up to that point would’ve helped me figure out if I needed to report a software bug (or just scold my cat.)

The Matic also lacks any sort of smart home integration. Nariyawala told me that the company is looking into implementing that down the road, but admitted that doing so is “at the bottom of the list.” That mainly means no voice control and no access to automations that could incorporate your other smart home devices like, say, turning the lights off when the Matic finishes its job (although it does a fine job cleaning in the dark). Still, the Matic robot vacuum and its app are so good—and Matter’s vacuum support so limited besides—that it doesn’t feel like smart home integration would add much anyway.

The biggest caveat, to me, is the Matic’s ongoing costs, particularly those of its disposable dust bags. I do like the convenience of its 1-liter onboard one, which holds both wet and dry material and has a built-in HEPA filter. That’s more than twice the capacity of my Roomba’s plastic dustbin. But a four-pack of these also costs $12 (and a 12-pack is $36). The company says one bag should last about a week, depending on your usage, which was roughly what I got out of it while cleaning around 900 square feet of my main floor every night. Going through a four-pack every month costs basically as much as an ad-supported streaming plan, and comes on top of the less-frequent replacement of other wearable parts, like the mop, dust rollers and side brush. That’s to say nothing of how much it costs just to buy the thing.

By comparison, a three-pack of 3-liter dustbags for the Eufy Omni E28 costs just $16.99. That’s an expensive robot when bought at its street price of $1,399.99, but as I write this, Eufy is discounting it by $649.99, making it more affordable than the $1,095 Matic.

Whether the Matic is a better buy may come down, at that point, to vibes. The Omni E28 might clean just as well as the Matic; I haven’t tested it, so I can’t say. But thanks to its heavily automated multipurpose dock, it takes up a lot more space and is likely to be a much noisier presence in your home. The Matic, on the other hand, is easy to place, works very well, and is quiet enough that I’m hardly aware it’s even working if we’re not in the same room.

Worth considering, if you can afford it

The Matic is the best robot vacuum I’ve ever used. Its friendly-looking chassis and vibe are enough of a hit in my house that my kid now keeps a clean bedroom floor just so the Matic can come in and vacuum it every night before bedtime. To me, that alone is almost worth the $1,095 price tag.

For others who are willing to fork over that amount of money, the Matic offers top-tier carpet cleaning, solid mopping performance, and an uncommonly well-thought-out app. I’m willing to clean up under low furniture myself if I have a robot that does such a great job everywhere else.

There’s also the fact that, at least according to Nariyawala, when we spoke, the Matic is engineered for longevity and privacy. Build quality is solid, and the fact that it doesn’t need an internet connection to do its job is a huge asset. One of my biggest criticisms of robot vacuums has always been that most of them require the internet to get the full experience, and Matic has shown that’s not necessary: your robot can work great without Wi-Fi if you’re okay with the range and speed limits of a Bluetooth connection.

But it’s the elements of surprise and delight that really push the Matic robot vacuum over the top. I haven’t found a gadget this endearing in a long time. Matic approaches home robotics in a way that others have recognized is necessary—see Samsung’s Ballie, or that Apple Pixar-style robotic lamp research project—but which I’m not convinced anyone has really nailed. I went into this review curious, above all else, how an all-on-device robot vacuum with a funny design would work, and I was surprised to find something legitimately and unabashedly fun. More of that, please.

Don’t miss more hot News like this! Click here to discover the latest in Technology news!

2025-10-19 11:00:00