British Steel crisis spurs greater scrutiny of Chinese investment in UK

The ministers must review the security effects of Chinese investment in all national infrastructure and supply chains in the United Kingdom in the wake of the British steel story, and urged senior parliamentarians.

Mrs. Emily Thornbari, head of the work of the General Foreign Affairs Committee, said that the UK’s intelligence agencies should examine Chinese investment in the British nuclear, communications and transportation sectors, after concerns about the behavior of the Chinese -Chinese -Chinese owner.

“We must get advice on any Chinese investment. We must look at the whole thing through a security lens … We must have a principle that it is” security first. “

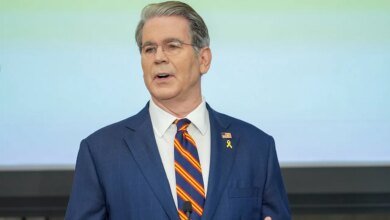

Its intervention came after the UK’s business minister, Jonathan Reynolds, suggested at the weekend that the government should define the sectors that were suitable for the British -Chinese cooperation and that were not.

He said that Chinese companies are no longer welcome in the United Kingdom’s steel sector, after the government intervened to control British steel to prevent Jinji from ending the recent UK annihilation operations at the company’s factory in Scunthorpe.

On Saturday, the deputies agreed to the emergency legislation to enable the ministers to control, and Sir Kerr Starmer spokesman said on Monday that the government was confident that it would secure enough raw materials to preserve the ovens.

While the ministers hope to find a private sector buyer for British Steel, Reynolds admitted full nationalization.

“The episode has given the importance of the supply chain flexibility to sharp.

He added technology security that contains Chinese electronic wireless components that are used in supply chains – which range from cooling units to mobile payment stations – must be examined.

The ministers must be at a state of alert for threats at the “lowest level of what you call the critical national infrastructure … [about] Downey said that he who has the origins, but also provides chains. “

Tan Datsei, Chairman of the Labor Committee, did not release the general defense of Chinese companies, but he said: “British steel should be seen as a detailed moment in assessing the security of our critical industries and ensuring that there is no victim to the whims of external actors.”

The government has promised to conclude “China Auditing” in China, where it draws all areas of Anglo-Chinese bilateral cooperation, but it is still unclear whether all the results it reached will be publicly presented.

On Monday, Downing Street said there were no plans to conduct a new investment in Chinese investment in Britain.

“We already have a very strict review system, especially when it comes to our energy sector – all investments are subject to the highest audit of national security,” said the UK Prime Minister’s spokesman, adding: “We will take a fixed, long and strategic approach with China.”

Chinese companies, whether backed by the country or private, are active in the energy industry in Britain, where they invest in assets and supply devices.

Grangemouth Oil Confinery in Scotland is owned by Petroineos, a joint project between Petrochina and INEOS.

In the event of British steel echo, Petroineos plans to close the refinery in the coming weeks due to financial losses. On Monday, John Sweeney, John Sweeney, called for his transfer to public ownership.

China National Offshore Oil Corp has stakes and management of the main oil in the North Sea and Gasfields, while the state -backed nuclear public is a minority investor at the Hinkley Point C Station for Nuclear Energy that is built in Sumrest.

CGN also had a 20 percent stake in the Sizewell C Nuclear Energy Station, which is evolving by EDF and the UK in Sofolk, but it was purchased by the British government in late 2022 amid concerns about China’s critical national infrastructure.

China -based manufacturers dominate the global supplies of batteries and solar panels on a large scale, playing a major role in UK carbon removal plans in the electricity sector by 2030.

“While talking about not relying on China for steel, the government is leading more dependence on solar energy, wind and batteries,” said Andrew Griffiths, Tory Shadow.

The China -based Mingang Company in China has sparked the construction of a windbreak factory in Scotland to cause concern among some politicians.

Nick Timothy, the conservative deputy, said last year that the ministers should exclude allowing the turbines that may be “controlled by hostile states.”

However, Kate Forbes, Deputy Minister in Scotland, indicated that Scotland is open to potential investment from Mingang, highlighting the important requirements for shifting to cleaner energy.

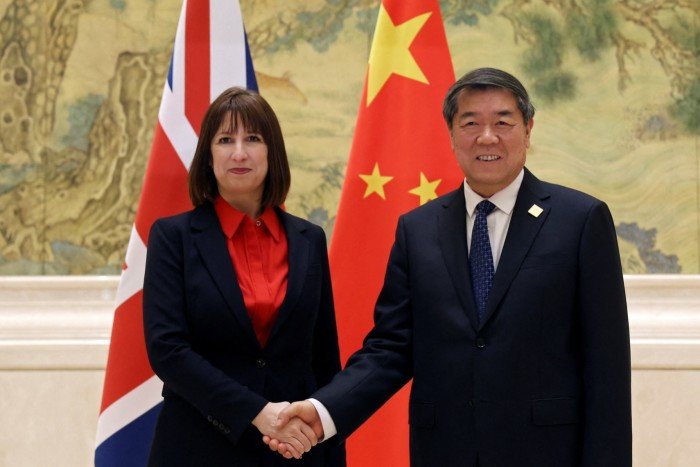

The Workshop government also indicated its interest in strengthening the deepest economic relations with Beijing after a period of tanna during the era of the conservatives, where Chancellor Rachel Reeves is visiting China in January, and Sir Kerr Starmer plans for a trip later this year.

Trade Minister Douglas Alexander is currently visiting China and Hong Kong to promote British exports.

Any future attempt by the UK government may face Chinese investment in certain sectors in Britain legal challenges.

The 1986 bilateral investment treaty provides protection for Chinese companies that invest in the United Kingdom, as is common for investors abroad.

This raises the possibility of transferring the UK government to international arbitration courts on discriminatory treatment or nationalization.

The Chinese Ministry of Foreign Affairs also issued a warning to the UK government not to use economic security to reduce or politicize trade between the two countries.

“We hope that the UK government will treat Chinese institutions that have been invested in the United Kingdom fairly and fairly, and to protect its legitimate rights and interests, and avoid politicizing or compensating the concept of security in economic and commercial cooperation,” said Lin Jian, a spokesman for the Chinese Foreign Ministry, on Monday.

However, the pressure grows on the UK government to take action.

“What the Chinese Communist Party is trying to achieve is the domination of the market and part of that undermines the national infrastructure of other countries, especially as it competes with them,” said Luke de Bulford, Executive Director of the Alliance between Parliamentarians around China, an international group of legislators across the party.

He said that the successive UK governments showed “amazing naivety” on Chinese investment in nuclear infrastructure, water and railway.

Not everyone agrees, but. A consultant for international investors refused to fears that the Chinese were trying to sabotage the British steel industry as a “conspiracy theory.”

In many cases where the Chinese are invested in the origins of the United Kingdom, they are “financial investors with noon and do not participate in daily work.”

“It is clear that you do not want to become an economical dependent on China and do not give the Chinese suffocation, but the question is whether they can cause strategic damage and it seems that there is sufficient protection against that – as the bill has shown on Saturday.”

2025-04-14 17:55:00