Son of Jeff Sperbeck Honors Late Father After Tragic Golf Cart Incident

The son of the legend of the American football Association John ElwayA friend and agent for a long time, Jeff SpearbeekHe breaks his silence after the death of his father.

Spearbek, 62, died in April after falling from a 64 -year -old golf golf cart at Madison Club in La Quenta, California.

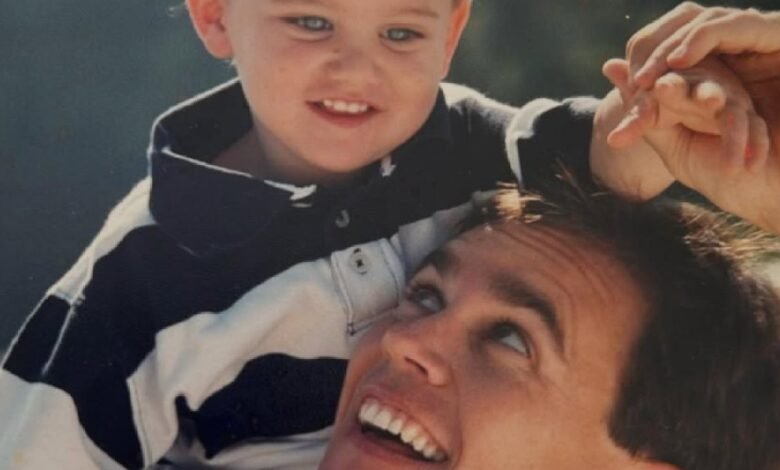

Ibn Spirbek, JacksonHe praised his father on Instagram on Sunday, May 18, and he shares a series of pictures of him and Sperbeck over the years, including a sweet image of Sperbeck that carries Jackson as a child on his shoulders. Other pictures Sperbeck show the dance circuit in a family event and enjoy the ice cream with his children.

“Your steps gave me guidance. I will walk the rest with a goal,” Jackson suspended the carosel. “I love you, dad.”

Spearbick survived his wife, Korean, three children, Sam, Carly and Jackson.

Earlier this month, TMZ reported that the cause of Spearbec’s death was sentenced as a sharp shock to the head, citing the Riverid County Office. And his death was sentenced to an accident.

“I was completely destroyed and saddened by the death of my close friend, work partner and commercial agent Jeff Spirbe,” Elwa said in a statement on April 30.

“My heart and deeper sympathy for the wife of Jeff, Korean; his children Carly Wissam and Jackson; and everyone who knows him and loves him,” the statement continued. “Jeff will deeply lack loyalty, wisdom, friendship and love that he brought in my life and the lives of many others.”

The Spirbe family also issued a statement of the death of the sport agent long ago on the same day.

“We are deeply saddened to share the death of our beloved Jeff Spirbe. He was a great father, husband, brother and friend of many and everyone will miss him deeply,” the family said. “We are sad for this unimaginable loss as a family alongside our best friend The Elways and many other customers called Jeff Friends.”

The family noted that they were “grateful for the massive flow of support” they received from the audience, but they concluded by seeking privacy at this time.

ELWAY Professional Relationship with Sperbeck returns to 1990, seven years after the NFL march in Gortbebeck. The two became close friends during the ELWAY playing days, and they established a Wine 7 Cellars brand together in 2015.

Don’t miss more hot News like this! Click here to discover the latest in Entertainment news!

2025-05-19 07:04:00