CA flags GST risk for high UPI payments: ‘Small businesses should be cautious’

One of the legal accountants warned of small companies against accepting high -value payments via the Internet without registering goods and services tax, noting a growing direction of notifications and penalties from the tax authorities. “If the amount exceeds 20/40 rupees for Cham and you do not have the commodity and services tax number, you may face the GST and the penalties,” said Ca Chirag Chauhan on Wednesday.

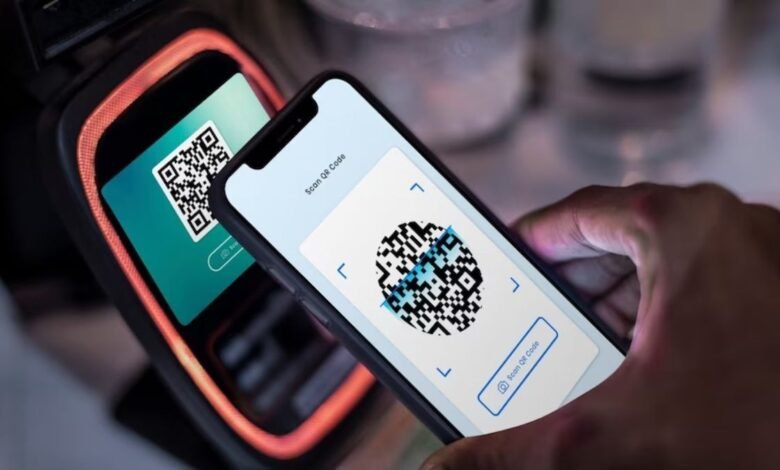

Chahhan put the issue on social media amid emerging reports on the enforcement of the tax and services tax against unregistered sellers. “Small companies should be cautious with online receipts via UPI, GPay, BHIM, PayTM, etc.

His warning comes as many sellers in Bangaluru began to completely move away from digital payments. In many neighborhood stores, rapid response icon stickers are canceled and replaced by observations that read “No UPI, cash only”, according to a report issued by economic times.

The shift is driven by fears of tax notifications. Lawyers and accountants familiar with this case said that thousands of small companies-including the owners of stores, food carts and sellers in the payment vehicle-have received commodity and services tax notifications, some with demands of education from rupees.

“I do a business of about 3000 rupees per day and live on the small profit that I make. I cannot accept payment by UPI anymore,” Horamavu seller told ET.

Under the commodity and services tax law, companies that provide goods must register and pay the commodity and services tax if their annual rotation crosses 40 rupees for Cham. For service providers, the threshold is 20 rupees for Cham. The Commercial Tax Administration in Karnataka has confirmed that it had issued notifications based on UPI data data since 2021-22 for cases whose rotation appears to cross these limits.

According to the administration, the administration stated that in all these cases, companies must register in GST, reveal their taxable rotation, and pay appropriate taxes.

There is also a growing political impulse. BJP MLA S Suresh Kumar said he would write to Prime Minister Siddaramaiyah seeking to intervene. Seller societies say that the enforcement campaign creates fear, as many sellers prefer money to avoid the threats of harassment and evacuation.

Lawyer in Knay K. Serenivasa, the joint secretary of the Union of Associations of Selling Penguro Street, is that this trend worries and affects the narrative economy.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-07-16 10:33:00