LONDON (Reuters) – Cargo makers from sportswear to luxury cars and chemicals drew a bleak picture on Wednesday about consumer and industrial health, adding concerns about the damage caused by US President Donald Trump’s wars and hitting stock prices again.

The increasing definitions of all steel and aluminum imports in the United States entered on Wednesday, when Trump set his campaign to rearrange global trade for the benefit of the United States. Europe quickly took revenge.

Trump’s definitions plans – and their underdeveloped implementation since he took office in January – has raised industries from cars to energy, companies and unsuccessful investors. Fears that high costs will increase inflation, and that consumer morale that can hinder American stagnation has caused a decrease in stock markets.

“Almost everyone is struggling with the economy to understand wild fluctuations in Washington’s policies, and its effects on their daily decisions,” said Stephen Dover, the chief asset expert in Franklin Timbalon.

He said that the ongoing separation of customs tariffs aims the industries of health care and retail trade to agriculture, mining and energy. For example, car manufacturers cannot plan while there is a 25 % threat of tariffs on the ingredients made in Canada or Mexico.

“No reasonable executive official in cars can make such investments if the expected returns can be eliminated at a pen.”

Porsche Germany said on Wednesday that she was evaluating how consumers could transfer the cost of possible definitions – it is expected that it will be 25 % for US imports from Europe – without pressing its margins. This means that prices can be increased to compensate for any decrease in unit sales.

The luxury car maker warned that decreased sales, high costs and commercial concerns would harm 2025 profits. Its shares decreased 4.5 %.

“At the present time, we hope that there will be solutions that lead to a reasonable tariff system between the regions,” Porsche Mali Gucchen Berkner said in a press call after its annual results.

Two South Korean steel makers said they were considering options, including potential investment in operations in the United States, where the metal tariff entered into force.

“Blessed, cannot be expanded”

The chief economist at JP Morgan Bruce Kemman said he saw a 40 % chance in the American recession this year, which would rise to 50 % if Trump continues threats to impose a mutual tariff from April. He also warned of the permanent damage of the United States as an investment destination if management undermines confidence in governance.

When Trump was asked on Tuesday about the recession resulting from his commercial policies: “I don’t see him at all.” On Monday, he refused to exclude one.

European stocks were largely flexible on Wednesday, as investors chanted news that Ukraine accepted an American ceasefire proposal for 30 days with Russia. [.EU]

But the profits from Puma and Malik Zara, Andetx emphasized the concerns that the uncertainty about trade began to hurt the main street, preventing Americans’ spending on everything from detergents and clothes to travel.

The stocks in PUMA lost nearly a quarter of their value, reaching the lowest level in nine years after the German sportswear company expected sales growth this year because of the gentle demand in the United States and China. He highlighted commercial conflicts and currency fluctuations as challenges.

Inditex from Spain reported a slower start for the first quarter from February 1, which raised questions about weakening the demand for consumers, especially in the United States, its second largest market.

Its shares have decreased more than 8 %, to their lowest level since August.

CEO Oscar Garcia Masterras said he was “optimistic” about the American market despite the commercial measures that reach reaching, and that Inditex was in a good position to adapt as needed.

But echoing other executives, he said that changing geopolitical news constantly made long -term predictions difficult.

More than 900 of the largest 1500 American companies have mentioned the customs tariff for profit calls or in investor events since the beginning of the year, according to LSEG data.

Definitions have already identified the prices of aluminum users in the United States to record highlands.

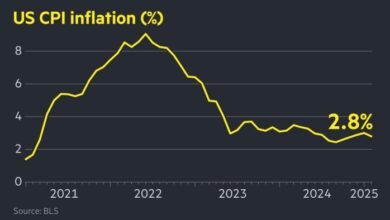

The data showed on Wednesday that consumer prices have risen less than expected in February, although it is expected that the definitions related to imports will be raised the costs of most commodities in the coming months.

Brentag, the German chemical distributor, warned that 2025 would be another year full of challenges, and it is constituted by economic and political uncertainty and economic growth under the world.

CEO Christian Kolbyner said that the company was relatively isolated from import duties because it is the sources of ingredients and sells its products locally.

But what he called the “confusing, which cannot be expanded” makes it difficult to manage business. The VCI Chemical Association in Germany said on Wednesday that it does not expect any recovery this year.

“The great risks are for companies to stop spending and equally with purchases,” said Justin Onokusi, the chief investment official of St. James Place.

(Reuters and library reports; additional reports from Dara Ranasing in London; written by Josephine Mason; edited by Catherine Evans)