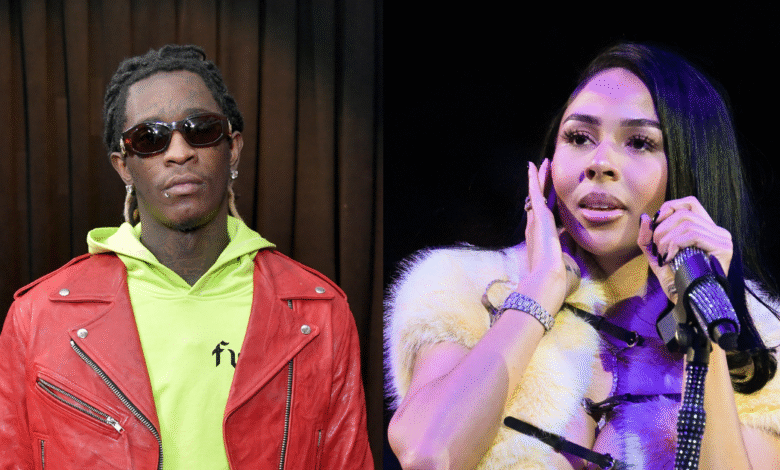

Young Thug’s Photo of Mariah The Scientist Sparks Online Frenzy

Yong’s thug She woke up to feel like her leading lady, Maria the worldYou need some love on Instagram. SIS kept it all over the full legal ordeal of Hugger, which he saw as a detect for more than two years, and it is clear that he feels her loyal. But wonder, Chile … the image you take for this heartfelt moment has the rooms that wonder about the men and the pictures they choose for the important others. This is what happened.

Related: the lesson learned? Young bullying raises a song about growth after the viral apology to Maria Al -Alam (listening)

Maria thugs screaming made everyone speak

On Friday, May 9, the “lifestyle” beaten maker took his IG story with a picture of Maria looks comfortable. SIS sitting, no makeup, washed away the hair on the side, crossed the arms, and giving Vibi as if they were ready to tell someone to fix their position. He added bullying “SoliiiIIDD …” On pre -approval.

How social media responded to Maria’s image

However, Snap Thugger, which was chosen from the camera roll contains social media. The comments are wild, and people are coming to the 33 -year -old for not choosing a shiny snapshot than his important characters. For example, the rooms came out around the pre -approval in the comments section. Here is what some have said about the relevant image.

Thtdarkskingrl books, “Men publish the worst pictures 😂 Tf”

Foundationoflovecc Books, “Men are very because they look like ready to offer PPL taxes.”

@ah.me.yah commented, “It is beautiful, regardless, but he could take a better picture … men do not think.”

Comment @guttta80, “Everyone complains about the picture lacks the whole point. Real women carry a man!

DainMCC added, “Show her how solid with marriage, commitment and sincerity.”

@iam.brianamonique jokingly, “He does not like that girl.”

While Uzziahunique wrote, “How do I take care of my mother that I did not get the chicken out of the freezer.”

Billyraywalker Books, “All women who say this is not a good picture. We take these pictures when Yall looks regular, because when Yall is the bad for us. Do you get it?”

Meanwhile, #maelane .___, “Men only see a sincere woman like hardness if she remains after each bs 😂😩”

Bresowavey added, “Chilling her will feel that there is no makeup on that when the most beautiful” is the most beautiful 😍👸🏻 “

Thugger raises a new song on growth

In a recent video clip obtained by LiveBitez, the Atlanta citizen gave the fans a preview on Instagram Live for a new song that was cooking in the studio. Although he did not reveal the title of the song, Thug left the fans with sufficient materials to hint that he was entering a new era for his return. In this era, the thugs seem to have its mistakes, at least in relation to marital infidelity.

“I told her that I wouldn’t cheat again … I took it [inaudible] Benz/I am on a series of millions of dollars again, “ Thug hears saying on the song while he was referring to the camera on his face coming out in the bathtub.

In another clip taken from Live, Maria, who was outside the camera, can speak to Bo. However, her ideas did not share the path. It should also be noted that while Thug talks about telling someone that he will not cheat again, it is unclear whether these songs are written with the “Burning Blue” position in mind.

Related: Hall! This about Kindrik Lamar, who is dropping it on “Video)

What do you think of the rooms?

Don’t miss more hot News like this! Click here to discover the latest in Entertainment news!

2025-05-10 00:24:00