Dow jumps 413 points in 5 minutes as Trump reassures markets ‘it will all be fine’

The S&P 500 jumped 1.1%, recovering just under half of its decline from Friday, which was the worst since April. The Dow Jones Industrial Average was up 413 points, or 0.9%, as of 9:35 a.m. ET, and the Nasdaq Composite was up 1.3%.

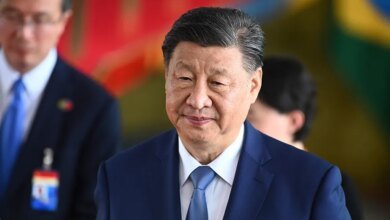

“Don’t worry about China,” Trump said on his social media platform on Sunday. He also said that Chinese leader Xi Jinping “doesn’t want a depression for his country, and neither do I. The United States wants to help China, not hurt it!!!”

It was a sharp shift from the anger Trump showed on Friday, when he accused China of “moral disgrace in dealing with other countries.” He pointed to a “very hostile letter” describing restrictions on exports of rare earth elements, materials used in the manufacture of everything from personal electronics to jet engines. Trump said at the time that he might impose an additional 100% tax on imports from China starting November 1.

Trump’s angrily retreat raised hopes that the world’s two largest economies would find a working relationship that would allow global trade to continue.

The market’s big moves in the past two days mirror its wild swings in April, when Trump shocked investors by declaring a “liberalization day” on global tariffs, but ultimately backed away from many to give time to negotiate trade agreements with other countries.

If this time ends similarly, with trade tensions and uncertainty abating, perhaps even after a sharp decline in stock prices, conditions could allow a sustained recovery to continue into 2026, according to Morgan Stanley strategists led by Michael Wilson.

Granted, the US stock market may have been set for a decline and was just looking for a potential catalyst.

It was already facing criticism that prices had risen too high after the S&P 500 index rose inexorably 35% from its April low. The index, which tracks the movements of many 401(k) accounts, remains near the all-time high it hit last week.

Not only did Trump’s rollback of tariffs in April help stimulate stock prices, but so did expectations of several interest rate cuts by the Federal Reserve to help the economy.

Critics say the market looks too expensive now that prices have risen much faster than corporate profits. Concerns are particularly high about companies working in the artificial intelligence industry, where pessimists see echoes of the dot-com bubble that burst in 2000. For stocks to appear less expensive, either their prices must fall, or corporate profits must rise.

This raises the stakes in the upcoming earnings reporting season for US companies, which are set to determine how much they earned over the summer. JPMorgan Chase, Johnson & Johnson and United Airlines are among the big names on the calendar this week.

Fastenal shares fell 4.5%, recording one of the largest losses in the S&P 500 index, after it announced fourth-quarter earnings that were slightly weaker than analysts expected.

In overseas stock markets, indicators were mixed in Europe after sharp losses in Asia.

Shares fell 1.5% in Hong Kong and 0.2% in Shanghai. China reported its global exports rose 8.3% in September from a year earlier, the strongest growth in six months and further evidence that its manufacturers are shifting sales from the United States to other markets.

___

AP Business Writers Matt Ott and Ellen Kurtenbach contributed.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-10-13 14:33:00