ECB holds interest rates at 2%

Open Editor’s Digest for free

Rula Khalaf, editor of the Financial Times, picks her favorite stories in this weekly newsletter.

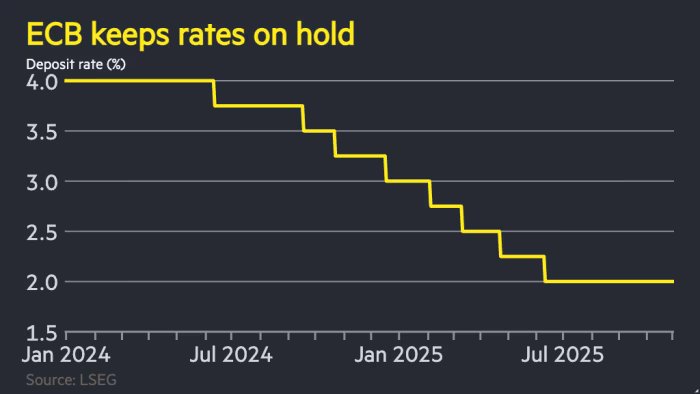

The European Central Bank kept its benchmark interest rate unchanged at 2 percent for the third meeting in a row, as data showed temporary growth in the euro zone.

Thursday’s decision was in line with economists’ expectations and comes after European Central Bank president Christine Lagarde repeatedly said that monetary policy in the currency area is “in good shape.”

“The economy continued to grow despite the difficult global environment,” the ECB said in a statement, adding that the labor market was “strong” and private sector balance sheets were “solid.” He also described inflation expectations as “generally unchanged.”

Eurozone gross domestic product beat expectations to grow by 0.2 percent in the third quarter, data from Eurostat showed on Thursday, after French output expanded at the fastest pace since 2023. However, the German economy continued its long years of weak growth.

Traders’ expectations for future interest rate cuts were broadly unchanged following the interest rate decision, with swap markets estimating a roughly 40 percent chance of another quarter-point cut by June 2026.

Carsten Junius, chief economist at G Safra Sarasin, said it was “surprising” that the ECB’s monetary policy statement did not mention “current downside risks to inflation”.

He added that the absence of “dovish signals” indicates that “an interest rate cut in December has become less likely,” noting that the central bank’s expectations indicate an inflation rate of less than 2 percent next year.

The ECB’s announcement came a day after the US Federal Reserve cut US interest rates by a quarter of a percentage point, but warned that further cuts this year were not an “inevitable outcome.”

Annual inflation in the euro zone, which rose to 2.2 percent in September, is expected to fall slightly to 2.1 percent this month, according to analysts polled by LSEG. Eurostat is due to release its preliminary inflation estimates for October on Friday.

The European Central Bank’s previous interest rate cuts, which began in June last year, pushed borrowing costs to their lowest level since December 2022.

The euro was broadly stable against the dollar at $1.156 after the widely expected decision, and fell 0.4 percent during the day.

“The euro’s weakness, despite encouraging GDP data, is mainly driven by the Fed’s hawkish shift,” said Dimitris Valatsas, chief economist at Aurora Macro Strategies.

2025-10-30 13:26:00