(Bloomberg)-Illon Musk fans are known for their commitment to Tesla Inc. But in the current path of the stock, even the long -term believers are retreating.

Most of them read from Bloomberg

The retreat from Musk’s Electric Company, which was the largest residency in the S& P 500 this year, was so severe that President Donald Trump intervened on Monday night, saying that he would buy a new Tesla to support Musk.

On Tuesday, Trump chose a red model of Teslas to which he was delivered at the White House. The stock increased by 6 % by 10:45 am in New York on Wednesday, which put it on the right track to expand the gains as it tries to organize a recovery after a 15 % defeat on Monday. But despite the presidential purchase – the clear opportunity to buy The Dip – the believers from Musk are concerned about wandering in cheap arrows, fearing that the bloodbath has ended yet.

Follow Big Take Daily PodCast wherever you listen.

The stock decreased by 52 % of the highest level ever in mid -December as of the closure of Tuesday, and it restored all the gains it achieved after the elections, when traders were betting that Tesla would benefit from Musk’s close relationship with the new president.

“This stock is trading on feelings at the present time and negative pressure wins.” Bian Molberry, the manager of the client’s wallet at Zacks Investment Management Inc, who supervises about $ 21 billion in Zacks Investment Management Inc., which supervises about $ 21 billion in Zacks Investment Management Inc., which oversees about 21 billion dollars, there is more space for the stock in the next 30-60 days.

Zacks held more than 270,000 Tesla shares as of December 31. Mulberry said he could see the arrow dating back to $ 400 next year. But he resides on the margin at the present time.

It is not alone. Since the price decreased less than $ 230 this week, a decrease from more than $ 400 less than two months ago, the Wall Street Teros even some of those who have a purchase recommendation-they take a more cautious position. Immediately during the past week, at least four analysts reduced their price goals on Tesla, while two of the long -term analysts warned of poor sales and “passive” feeling.

One of the few support sources was retail merchants who were among the most reliable fans in Musk. These young investors, on Safi, bought $ 2.8 billion from Tesla shares since last Tuesday, according to Emma Wu, a global strategic expert for derivatives at JPMorgan Chase & Co.

But even here, there were signs of pain. One of the best posts on Tuesday at the Reddit Forum for Tesla merchants: “I am still holding, but at this stage, I started doubting my decision.”

The problem facing investors is that there are few events on the horizon that can improve the feeling

Updates on a fully driving Tesla or Robotaxi, is not expected any time soon. Musk’s preoccupation with the Ministry of Governmental efficiency has led to fears that it was very distorted to manage its car company.

The current republican administration’s opposition to electric vehicles raises a problem with demand in the United States. Tesla sales also decreased worldwide, with huge reports from China, Europe and Australia. In many places, Musk’s increasing participation with global policy is seen as hurting the company’s brand.

The drops were so radical that many analysts have reduced the first -quarter delivery estimates, as Joseph Spac warns of UBS on Monday that the current profit expectations look very high. Chris McNali, an ISI analyst, reduced his estimate for the whole year to deliver vehicles to 1.75 million, from 1.88 million, in a report published on Wednesday.

While these fears have weighed Tesla shares since the beginning of this year, the stock has already lost its influence as the broader appetite for the risks that have been strained during the past few weeks amid the increasing uncertainty about Donald Trump’s commercial policies and fears of economic slowdown.

“Tesla is now a Trump trade agent, unless the market is ready for Trump’s reward and hold their efforts, this shares will continue to decline,” said Adam Saharan, the founder of 50 Park investments. “There is no ground in this arrow now.”

The tables quickly turned on Tesla. After Trump was elected in November, Tesla’s shares soon became the largest beneficiaries of this victory in the stock market. The stock jumped more than 90 % in a little more than a month, although the fact that the company’s business expectations continued to exacerbate.

Even after the Trump wave decreased, Tesla is still trading with much higher complications than its other huge peers. The shares were traded with 75 -time front profits as of the closure of Monday, compared to an average of 25 times for the so -called great shares. The average S&P member trades at about 20 times of profits.

The acute evaluation and the popularity of Tesla between risk traders and momentum makes stocks vulnerable to severe sale, but they also mean that any recovery, when it comes, can be fast and huge.

Currently, even the bulls find little to stick to it.

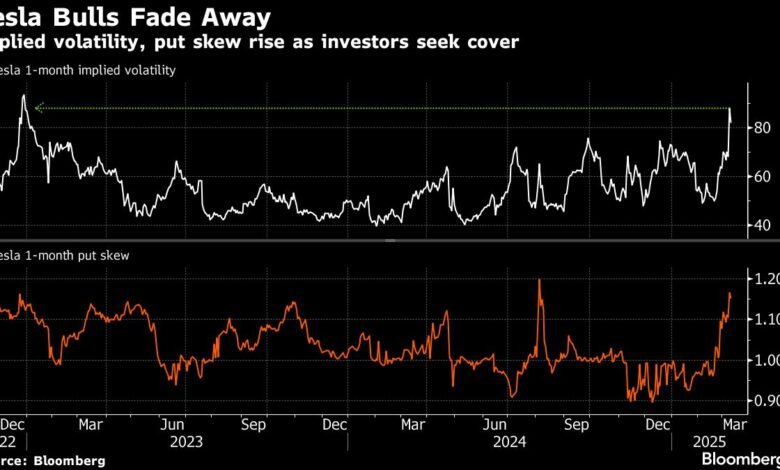

In options markets, most of the flow comes from investors looking for investors looking to protect from additional losses, with trading mode at the highest level for upward calls since the shock of volatility in early August. The implicit fluctuations for a month on Monday reached the highest level since the end of 2022, when the shares fell to nearly $ 100. Both deviation and volatility slightly bounce on Tuesday with stocks.

“Tesla in a free fall at the present time, making the purchase of declines difficult for those who suffer from short -term time horizons,” said Mark Newton, head of the Fundstrat Technical Strategy, and a long -term bull on the arrow. “But those who try to be fast to sell here to buy within a few days play a dangerous game.”

The best technology news

-

Google runs from Alphabet Inc. Final conversations to get Adhawk Microsystems Inc. It is an eye -tracking technology company, which is part of a renewed batch in headphones and smart glasses.

-

Skychip SDN. People familiar with this matter said that the people familiar with the matter are riding on the country’s batch to manufacture its own chips, as they train at the country’s batch to make its own chips, and it is studying the country’s pressure to make the country’s chips to make the country’s chips to make the country’s chips to make the country’s chips to make the country’s chips to make the country’s chips, that looking at a general show in Malaysis, is studying, studying in the first half that the half that is the one Bat

-

According to cybersecurity, according to cybersecurity, according to cybersecurity.

-

Waymo said at Alphabet Inc. At Waymo, it will start transporting passengers in a handful of cities near Mountain View, California, based.

-

Salsforce Inc. To invest a billion dollars in Singapore over the next five years, as it has joined other American technology companies in betting on growth in Southeast Asia.

The profits due on Wednesday

-

Postal profits:

-

Adobe Inc. (Adbe us)

-

Audoeye Inc. (Aeye us)

-With the help of David Marino, Subrat Patnaik, Craig Trudll and Philip Sanders.

(Stock updates move in the third paragraph.)

Most of them read from Bloomberg Business Week

© 2025 Bloomberg LP