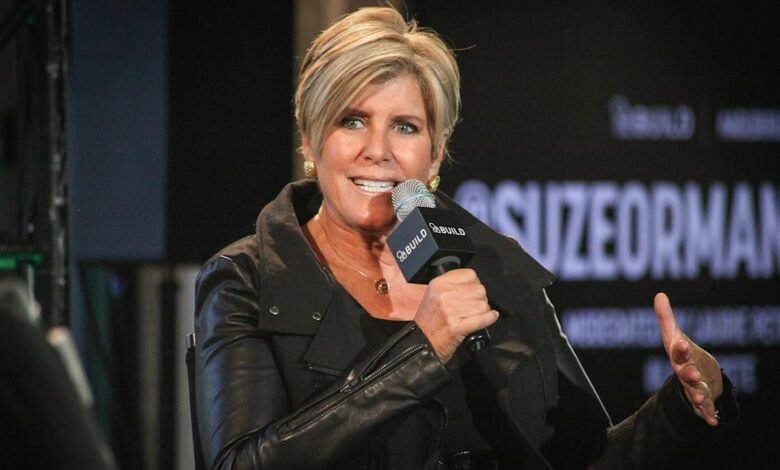

Suze Orman Says This Is the Type of Financial Advisor You Should Have (And What They Should Do With Your Money)

Suz Orman is a personal financial expert made, selling selling and hosts of podcasts who became a broker for flowers after she benefited from it by one. Orman provides advice on many different financial situations, but it is one passionate about it to know if you need a financial advisor – and how to find a good one.

Advertisement: High -return savings offers

It is now heading: Suz Orman says if you are doing this, you “make the biggest mistake in life”

Try this: I am a retired Muslim: 6 bills canceled this year, which was a waste of money

Here is what Suz Orman says about the type of financial advisor that you have to have, and what you should do with your money.

In a recent episode of “The Suze Orman Show”, one of the viewers sent an e -mail to ask if the annual fees are 0.09 % of the financial advisor to receive. Orman noted that this is a common way for consultants to obtain their salaries, and it also motivates the counselor.

“There are many people known as registered investment consultants who receive a percentage of money under management,” said Orman. “Let’s just say that you were given a registered investment consultant $ 100,000. If it is paid by 0.09 % at $ 100,000, is fine. If they take it from 100,000 to 300,000 dollars, they now earn more money. It is paid by 0.09 % on $ 300,000.

“But if they take this amount from 100,000 to 50,000 dollars, they will only be paid by 0.09 % on $ 50,000. So, you earn money, they earn more money. You lose money, it makes less money. I love the way he works.”

Note that 0.09 % fees, or 9 basis points, are very low, and may mean the person who asks the question 0.9 %, or 90 basis points. More on this below.

Discover: I am a financial advisor – 10 terrible things that you can do for your money

Orman goes on to determine that the registered investment advisor who receives a percentage of the administration assets must invest your money in individual stocks, not joint investment funds or traded investment funds.

She said: “You should invest only in the individual stocks for you, and not putting your investment funds in where there are heavy expenses rates because you are paying double, or that they receive commissions or loads on joint investment funds.”

Once you decide that you want to work with a financial advisor, the next step is to find the right step.

A good way to start is by asking their trusted friends and family members. Personal recommendation from someone working with the advisor is better than all ads in the world. Collect some names from the people you know, add a search for Google if you have to.

2025-06-14 14:02:00