The ‘forever layoffs’ era hits a recession trigger as corporates sack 1.1 million workers through November

Jobs website Glassdoor warned of “layoffs forever” in mid-November, as small trickles of cuts throughout the year flew under the radar of most newspaper headlines while sowing fear throughout the white-collar ranks. Now, recruitment firm Challenger, Gray & Christmas has added a significant amount of visibility and a big number: 1.1. million. That’s the number of layoffs announced year-to-date, and only the sixth time since 1993 that threshold has been breached. With the notable and understandable exception of the pandemic year 2020, you have to go back to 2009 to find a year that saw a higher number of layoffs, and that was in the depths of the Great Recession.

Technology remains the hardest-hit private sector industry, with more than 150,000 job cuts announced so far this year as companies continue to readjust headcount after boom years while increasingly leaning toward automation. Telecom providers, food companies, service companies, retailers, nonprofits and media organizations are also laying off workers, in many cases by double or triple increases compared to last year.

Specifically, U.S. employers announced 1,170,821 job cuts in the first 11 months of 2025, a 54% increase over the same period in 2024. This makes 2025 one of only six years since 1993 in which announced layoffs through November exceeded 1.1 million, putting it ahead of 2001, 2002 and 2003. And 2009 and 2009. The Pandemic Shock of 2020. November alone saw 71,321 downgrades, the highest level for that month since 2022 and well above typical November levels before the pandemic.

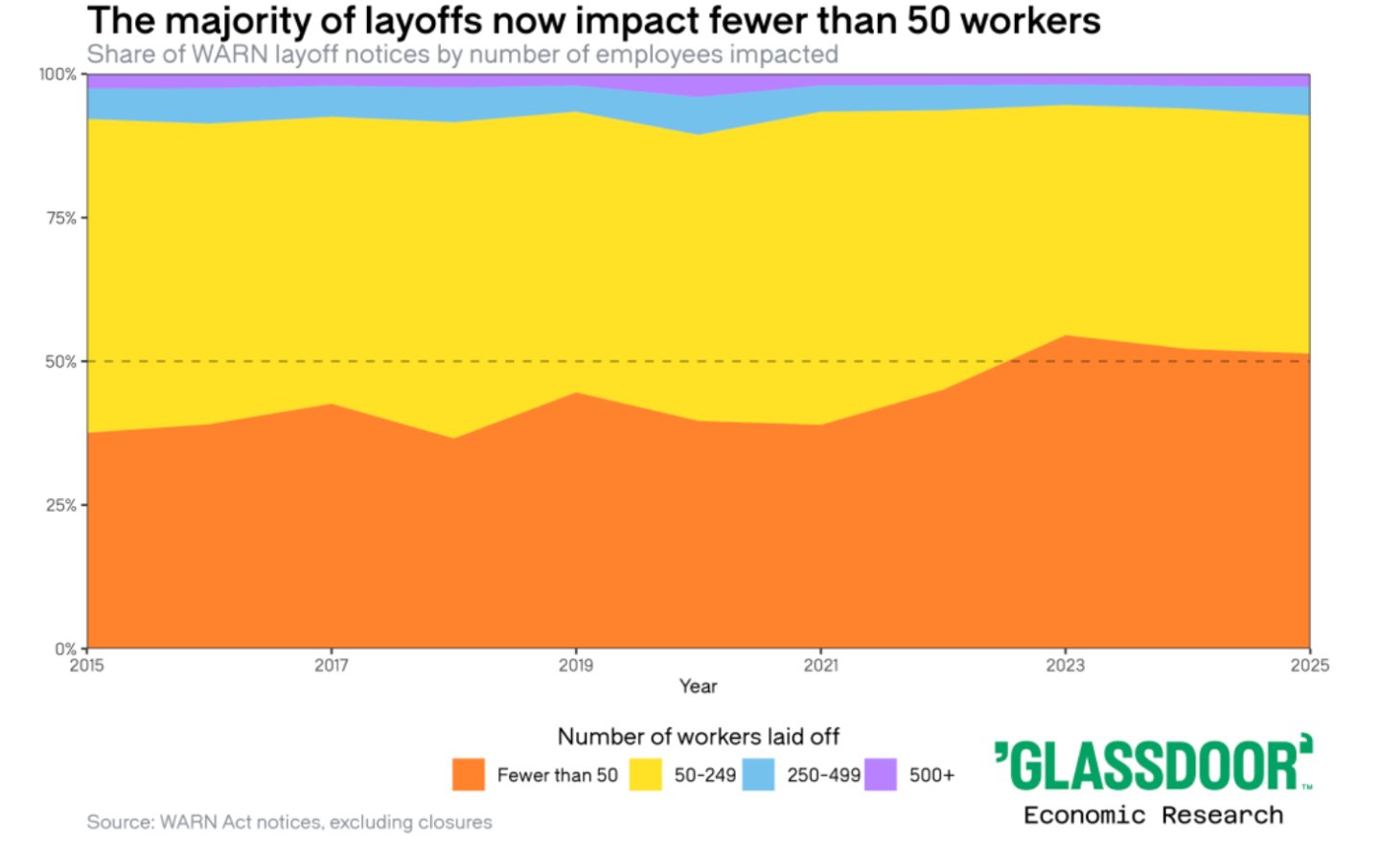

Daniel Zhao, chief economist at Glassdoor, noted in an interview with luck This actually underestimates the typical true number of layoffs, citing federal data from the JOLTS survey in which nearly 1.7 million people were laid off during the same period. “The interesting thing we saw in our research is that the shape of these layoffs is changing,” he said. “So instead of these big one-time layoffs, we’re seeing rolling layoffs and even some smaller layoffs as well.”

“Layoffs” must be considered amid many mixed signals for the economy in 2025, when “affordability” policies appear to reflect mass unrest among vulnerable workers. Fears of an AI bubble have coincided with worker anxiety and Gen Z despair over high unemployment and a dearth of entry-level jobs.

Earnings reports increasingly reveal, as many executives call it, a “split” or “K-shaped” economy, used to describe the different trajectories of the rich and the poor. The wealthiest are spending freely, with the top 10% accounting for nearly 50% of consumer spending (and absorbing higher costs from tariffs), while lower-income consumers are showing increasing signs of stress. Mike Wilson, an analyst at Morgan Stanley, believes that a “sustained recession” has been tearing apart different sectors of the economy, and that from April onwards, a “sustained recovery” has begun in 2025.

Analysts at both Goldman Sachs and Bank of America Research have noted that this recovery is a financial recovery, reflected in higher stock prices and profits — and increasingly in fewer workers needed in white-collar jobs. The era of “unemployment growth” and operations on people is beginning to emerge, thanks to permanent layoffs.

Inside the “forever layoff” model.

Glassdoor’s 2026 career trends analysis describes a structural shift away from infrequent, widespread layoffs toward more frequent layoffs affecting fewer than 50 workers at a time. These “forever layoffs” now account for the majority of reductions in some data, with the share of small layoffs rising from less than half in the mid-2000s to more than half by 2025. The new model allows leaders to continually adjust headcount in response to markets and AI adoption without the reputational and morale shock of a single massive layoff event.

Consultants say staggered layoffs give executives maximum flexibility and can reduce severance and restructuring costs, while keeping operations running by slowly reallocating work rather than wiping out entire teams overnight. But what seems effective on paper, Glassdoor warns, creates a slow-bleed culture where coworkers quietly disappear, survivors’ workloads mount and no one feels truly secure in their role.

Chow described this as “keeping workers in a state of suspense, as they constantly worry about their job security and cannot focus on their work.” Although forever layoffs may sneak under the radar and not generate a lot of negative headlines, “people know internally what’s going on, and they’ll recognize what’s going on.” Ultimately, he said he believes it has a real negative impact on culture, morale and therefore productivity.

Zhao cited the job rejection rate shown in Glassdoor data, which has been declining for two years. “I think what happens is that job seekers realize that they don’t have the leverage to negotiate, or they don’t feel confident that they can find a better offer elsewhere.” The end result is that more people are “settling” for any job, not the right one.

Glassdoor review data shows that employee mentions of “layoffs” and “job insecurity” in company ratings are now higher than they were in March 2020, when the pandemic first shut down the global economy. This suggests that workers in late 2025 are more worried about losing their jobs than they were at the beginning of this once-in-a-century public health crisis. Trust in senior leadership has also eroded, with negative characterizations of executives – such as “perverts” or “hypocrites” – rising sharply since 2024.

Employment plans do not compensate for harm. During November, according to the Challenger report, employers reported 497,151 planned hires, down 35% from the same point last year and the lowest total since 2010. With hiring falling to its lowest level in a decade and cascading layoffs returning, many job seekers are taking roles they previously would have turned down simply to regain a foothold in a less forgiving market.

Zhao rejected the idea of a “jobs stagnation,” although he acknowledged that employment has been “very slow” for much of the past two years, and there is some evidence that job growth has slowed significantly into negative territory, including job losses in some months.

“I think you want to see more evidence before declaring an actual jobs recession,” he said. “A month here and there of negative job growth is not good, but we don’t want to announce a new trend based on just a month or two of data.”

Artificial intelligence, restructuring, and the new balance of power

Behind the cuts, a set of forces are reshaping companies’ hiring decisions. The Challenger report shows that restructuring, business unit closures, and market or economic conditions drove the bulk of layoffs in 2025, with tens of thousands of jobs also explicitly linked to AI adoption. Since 2023, employers have blamed AI for more than 70,000 announced job cuts, as they automate routine work and reorganize teams around new tools.

Glassdoor analysts say this environment has shifted bargaining power to employers after several years when workers could demand flexibility, higher wages and faster advancement. Remote and hybrid employees are now reporting lower career opportunity ratings as promotions increasingly favor in-office employees, forcing many to trade flexibility for perceived security.

Beyond the eternal drumbeat of layoffs, these trade-offs usher in a workplace defined less by pandemic-era empowerment than by chronic insecurity and a “do more with less” mandate that shows no sign of easing in 2026.

This pressure is showing up not only in corporate restructuring plans, but also in real-time payroll data. ADP’s November report, released Wednesday, found that private sector employers shed 32,000 jobs last month — but almost all of the losses came from small businesses, which shed 120,000 jobs, while large companies actually added 90,000 workers.

In the report, Nella Richardson, chief economist at ADP, described the decline as “broad-based,” but stressed that small businesses with limited cash flow and razor-thin margins “already face an uncertain macro environment and a cautious consumer.” Smaller employers faced higher operating costs due to tariffs, utility bills, and the Federal Reserve’s reluctance to lower interest rates, a burden that larger companies were much better positioned to absorb.

This difference highlights the breadth of the K-shape in the labor market. White-collar and corporate jobs are being cut through ongoing under-the-radar layoffs, while small businesses face outright contraction as they struggle with tariffs, rising utility bills, and weak consumer demand. Richardson said small businesses are almost always the first to lay off workers in economic downturns because they feel the decline in spending faster and have much less room to absorb higher input costs.Axios. Larger companies have the cash flow, scale and financing to wait out the uncertainty, even as they quietly restructure teams, but smaller employers are simply running out of margin.

However, Howard Lutnick, Trump’s Commerce Secretary, blamed the data on the “Democrat shutdown,” rather than tariffs, during a Twitter interview. CNBC. The Cabinet Secretary also said that these numbers would “rebalance and will grow again”, claiming that “this is just a near-term event”.

Chao said he believes layoffs for good are contributing to the “distress” workers feel about the economy in 2025. “There is a great deal of uncertainty and anxiety that workers feel about job security and the risk of another layoff occurring in just a month or two.” He added that this means that “workers are in a constant state of tension.”

2025-12-09 15:00:00