Global stocks lifted by US reprieve for Trump’s tech tariffs

Open the newsletter to watch the White House for free

Your guide to what the American elections mean 2024 for Washington and the world

Global stocks rose on Monday on signs that the consumer electronics imported to the United States from China may escape the most accurate tariff imposed by president Donald Trump on the second largest economy in the world.

The futures that follow the S&P 500 and NASDAQ 100 technology increased by more than 1 percent, after it excluded the White House late on Friday smartphones and other consumer electronics from the sharp tariff that I presented earlier this month, including 125 percent supposed to China.

On Sunday, Trump and Handard Lottennik indicated that these goods will be subject to a separate duty that the White House was preparing for semi -conductors.

It was not clear what level would be placed in the tariffs of chips, but other duties imposed by the Trump administration on individual sectors such as steel and aluminum indicate that they may be much lower than the fees currently imposed on China.

“The markets take any sign of the relief that can be,” said Metol Kochs, head of the kidney strategy on the starting markets in Barclays.

The Stoxx EUROPE 600 increased by 1.6 percent, while the FTSE 100 in the United Kingdom has gained 1.6 percent.

In comments on Air Force One reporters on Sunday, Trump said that his administration would show “flexibility” for some products and indicated that she would speak to the main companies to discuss the definitions.

When asked about the average semiconductor tariff, he told reporters that he will be announced next week. “

Trump’s comprehensive definitions, which were announced at the “Liberation Day” event this month, launched unrest through financial markets and raised concerns about the global recession.

The possibility of a decrease in customs tariffs on popular consumer electronics will be a batch of Apple groups and other technology groups that depend highly on Chinese factories for the manufacture of iPhone and other commodities.

Apple shares jumped approximately 6 percent in the pre -market trade.

In Europe, technology shares have led gains, with Dutch chips makers and ASML by 4.1 percent and 3 percent, respectively.

But in a sign that investors are still concerned about Trump’s chaotic policies and that the tariff of damage it will cause in the American economy, the dollar extended its decline on Monday.

The dollar fell 0.8 percent against a basket of major currencies, including yen and the pound, as investors continued to increase their exposure to American assets.

“It is clear that concerns about American origins are still in place,” said Coticha.

The US Treasury’s return decreased for 10 years, which increased last week, as investors fell from the Trump’s escalating tariff in China, by 0.03 Celsius to 4.46 percent.

Rose the origins of the haven. Gold set a new record of $ 3,245.75 per ounce on Monday before it regained its gains, while the Japanese yen strengthened 0.4 percent against the dollar to 143.

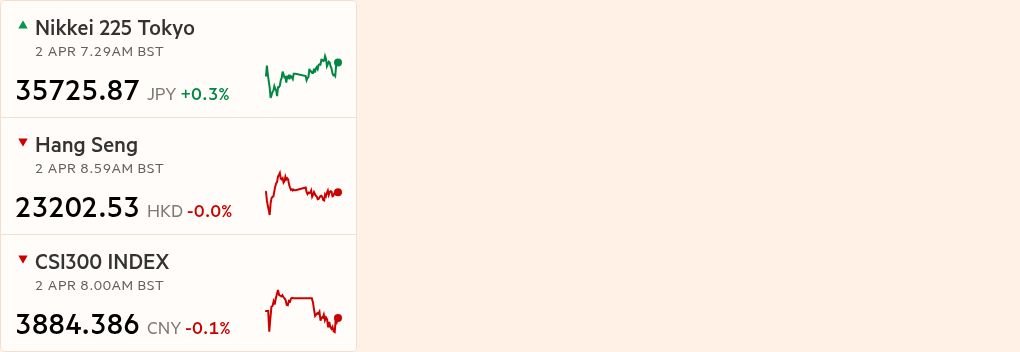

The markets in Asia, led by the Hang Kong Index in Hang Kong, were raised by 2.1 percent, Nikki 225 in Japan increased by 1.2 percent and increased the covenant by 0.9 percent.

The Chinese CSI 300 increased by 0.5 percent, as official data showed exports from the second largest economy in the world that jumped last month amid a rush to send shipments before the definitions entered.

Exports increased by 12.4 percent in US dollars in March in the previous year.

Imports decreased by 4.3 percent, which is less severe than 8.4 percent decreased from January to February.

2025-04-14 08:59:00