Goldman Sachs says gold demand ‘grounded in fundamentals, not frenzy,’ draws comparison to Nixon era

The recent rise in precious metal prices is not fool’s gold. Lena Thomas, a commodity strategist at Goldman Sachs Research, said in a video posted on Thursday that the rise in the price of gold is more than just hype.

“The rally is still based on fundamentals, not frenzy,” she added.

The price of gold rose 65% in 2025 due to economic uncertainty caused by tariffs that devalued the dollar, which was previously favored as a safe haven. On Friday, the asset reached another record high of around $4,242 per ounce after trade tensions between the US and China escalated and talk increased about impending interest rate cuts. Central banks also continued to hoard gold reserves to reduce exposure to the US currency.

Goldman Sachs expects the price of gold to reach $4,900 by the end of 2026.

While gold is often viewed as a hedge with no ability to pay interest or dividends, it shines in times of economic uncertainty as a safe haven asset because it is a finite commodity with a high assigned value. The recent interest in gold has led Wall Street to reluctantly give in to investors’ desire to buy gold. Jamie Dimon, CEO of JPMorgan Chase, who does not typically buy gold and does not encourage others to do so, recently changed his tune.

“This is one of the few times in my life it doesn’t make sense to have some in your wallet,” he said. luck Editor-in-Chief Allison Shontel on Wednesday at the Most Powerful Women Conference.

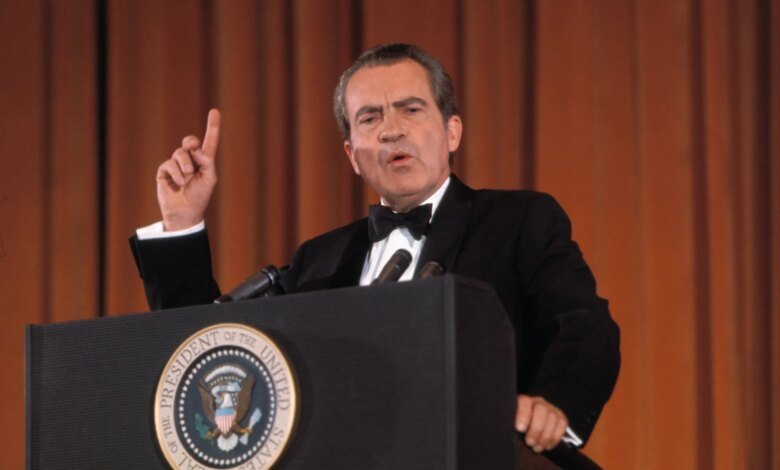

1970s déjà vu

Thomas, a commodities strategist at Goldman, made a comparison between today’s gold rush and the rush of the 1970s. Under former president Richard Nixon, and later former President Jimmy Carter, gold prices rose from $35 in 1970 to $850 in 1980, an increase of more than 2,300%. This followed Nixon’s ending of the gold standard – which tied the value of the US dollar to precious metals – in 1971, as well as a combination of factors that led to economic instability, including oil shocks following unrest in the Middle East and high inflation.

“At the time, financial concerns and political uncertainty prompted private investors to look for a store of value outside the system,” she said. “If these concerns arise again, we could see the global trend toward diversification intensifying.”

Thomas added that the gold market also pales in comparison to the size of the stock and Treasury markets, meaning the price of the metal could rise more quickly.

Canadian businessman and legendary gold investor Pierre Lassonde said he not only sees similarities between the 1970s and today, but that the United States was just entering a bull market cycle when gold prices began rising half a century ago. In 1975, for example, the price of gold began its meteoric rise that continued until the end of the decade, when it was worth about $161.

“We are now in the year equivalent to 1976 in that four-year bull market,” Lassonde said in an episode of the program. Wealth podcast earlier this month. “I think we have three years to go, and the price will go up a lot.”

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-10-17 17:52:00