Half an Elon Musk is still better than none

Digest opens free editor

Rola Khaleda, FT editor, chooses her favorite stories in this weekly newsletter.

The Tesla Council does not look to replace Elus Musk as CEO. He said this on Thursday, in response to the article Wall Street Journal mentioned otherwise. The point that gives up, though, because it should not try.

Musk, famously, is not just an executive of cars. It is also a pie in the face of corporate governance advocates. For decades, they have cooking policies aimed at making corporate managers and executives better in creating value. Tesla faced some of its most holy principles, and the shareholders who voted mostly in its annual meetings have agreed.

To Whit: He had multiple functions, as he was running the Spacex missile maker and visiting Xai even before he went to the head of government efficiency management Donald Trump. Companies may welcome CEOs who go to public service. Jpmorgan, for example, is allowed for senior people who go to Washington to keep their rewards. But these roles are usually consecutive, not synchronous.

Musk also wrote many checks that later failed to do so, from the targets of connecting vehicles to the date of the entire self -driving cars. Then there was a reward of $ 56 billion that the council approved amid what the judge called “Al -Muharaf” – a word that rejected the Tesla Robyn Denholm chair.

Investors do not care collectively. The company currently has five independent managers, as the average of the United States was nine, according to Spencer Stewart, had no significant impact on the share price. A person stops $ 1 in Tesla’s shares 10 years ago now has approximately $ 20. The same dollar in the S&P 500 deserves $ 3.

It is not that corporate governance does not matter. But there are times when other considerations prevail. There is an older saying in banking services that when the customer cannot pay a loan of $ 100, this is his problem; When they cannot pay a billion dollar loan, the bank’s problem.

Something similar to Tesla applies, as musk is too big to come out, as well as very value. Take 11 billion dollars Tesla profits for 2027, which were collected by the visible alpha. Even in a very generous double of 45, similar to luxury companies such as Ferrari and Hermes, the result is the market value of $ 500 billion, compared to $ 884 billion from Tesla.

This indicates that an additional $ 400 billion or so reflects the implicit value of the musk itself. This is logical: Without it, the company may manufacture cars, but it may not be the connected human or robotics, all the things that investors appreciate today as if they were real.

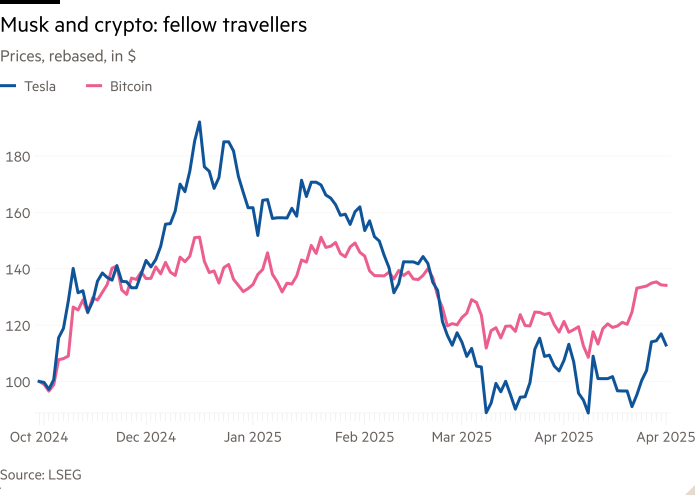

Moreover, due to the musk that benefits the evaluation of Tesla from the support of the heavy retail merchants. As Barclays analysts, the stock was sometimes traded more in line with Bitcoin more than the broader market. The rules of the old car industry do not apply to Tesla; We like or not, nor the rules of good judgment.

john.foley@ft.com

2025-05-01 13:19:00