Why gold went through the roof this year

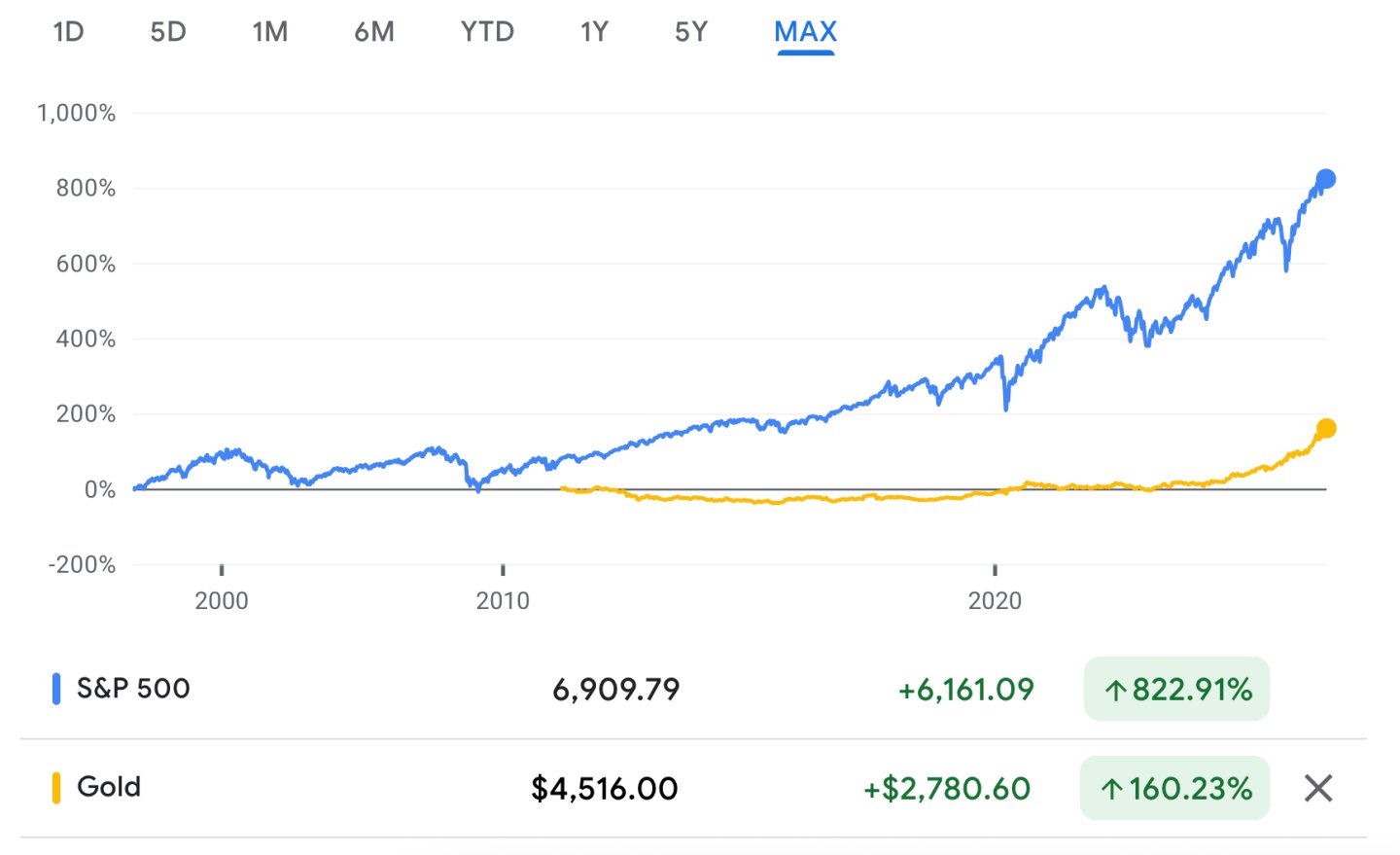

The S&P 500 closed up 0.46% yesterday to reach a new record high of 6,909.79. The index is now up 17.48% for the year. With only a quiet Christmas week remaining before the end of the year, investors will likely record this year in their spreadsheets as a very good one.

Unless they have a friend who bought gold at the beginning of 2025 or before. The price of gold has risen by a staggering 71% year to date, and is currently hovering around $4,514 per ounce. This friend is now making fun of you, you foolish investor, because you’re wasting your money on crap like the Seven Wonders.

There’s a hackneyed narrative to explain why gold is rising: We’ve had a volatile year as president Trump’s tariffs have disrupted global trade; Russia’s ongoing invasion of Ukraine; There is a bubble in the shares of technology companies related to artificial intelligence. Bitcoin hasn’t gone anywhere this year (down 7%); Inflation is on the rise. And gold is a safe haven investment for nervous investors who want to hedge against almost all of that.

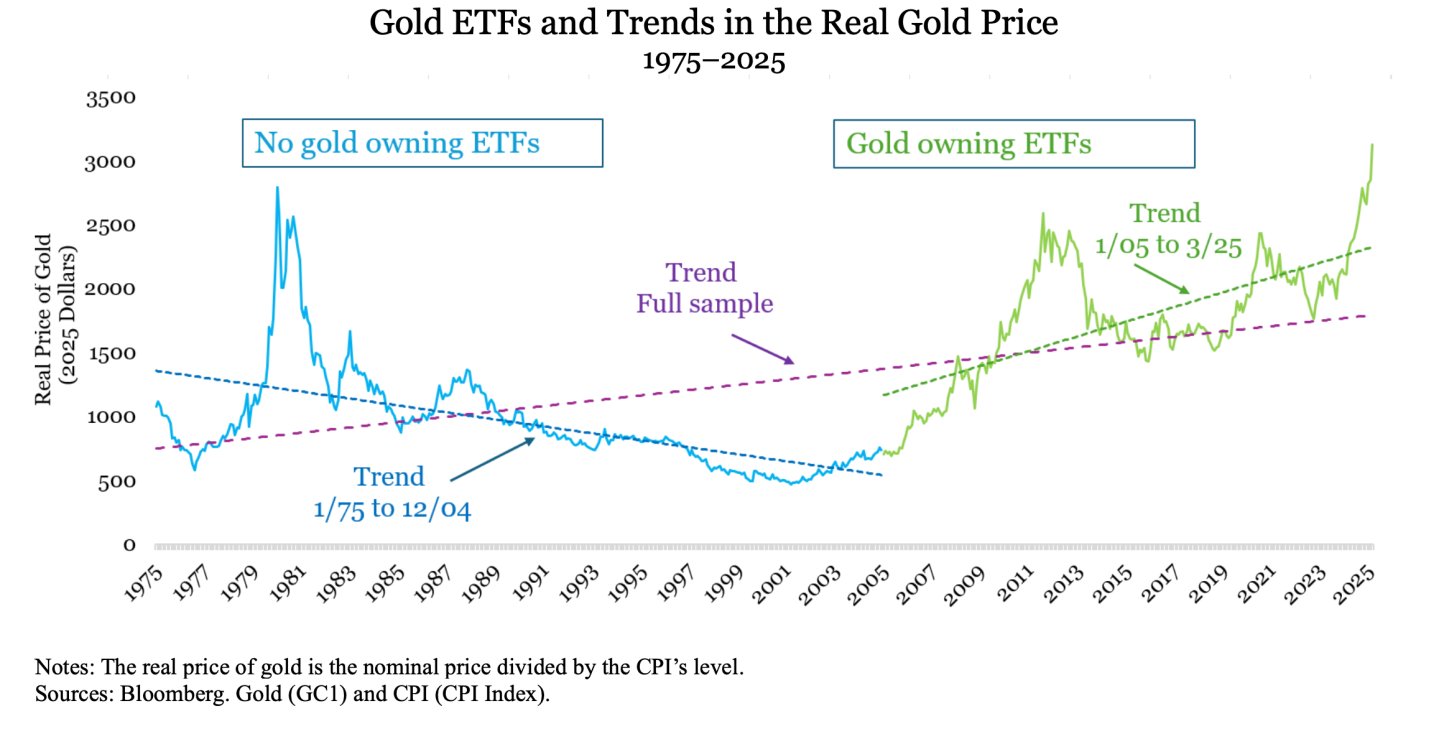

In fact, this is only partly true, according to recent research by Claude Erb and Campbell Harvey of the Fuqua School of Business at Duke University. The truth, they say, is that the 2004 advent of gold exchange-traded funds—which make buying gold as easy as buying stocks—permanently pushed the price of gold higher.

“North American gold ETFs total approximately $200 billion, and non-US gold ETFs account for another $175 billion in gold,” they said in an October 2025 research paper.

This chart shows the clear impact on the price of gold after the introduction of gold ETFs. The chart shows the “real” price of gold, as inflation deflates its price:

They say the more recent introduction of gold stablecoins – crypto tokens backed by gold reserves and thus linked to the price of gold, which can be “staken” or locked up as investments in other risky assets such as bonds – is likely to push the price higher.

But don’t get too excited.

Erb and Harvey argue that gold is not actually a great hedge against inflation in the long term. The gold price is characterized by high volatility, while inflation is a low-volume phenomenon. Gold investors can therefore spend years losing money if they are trying to beat inflation:

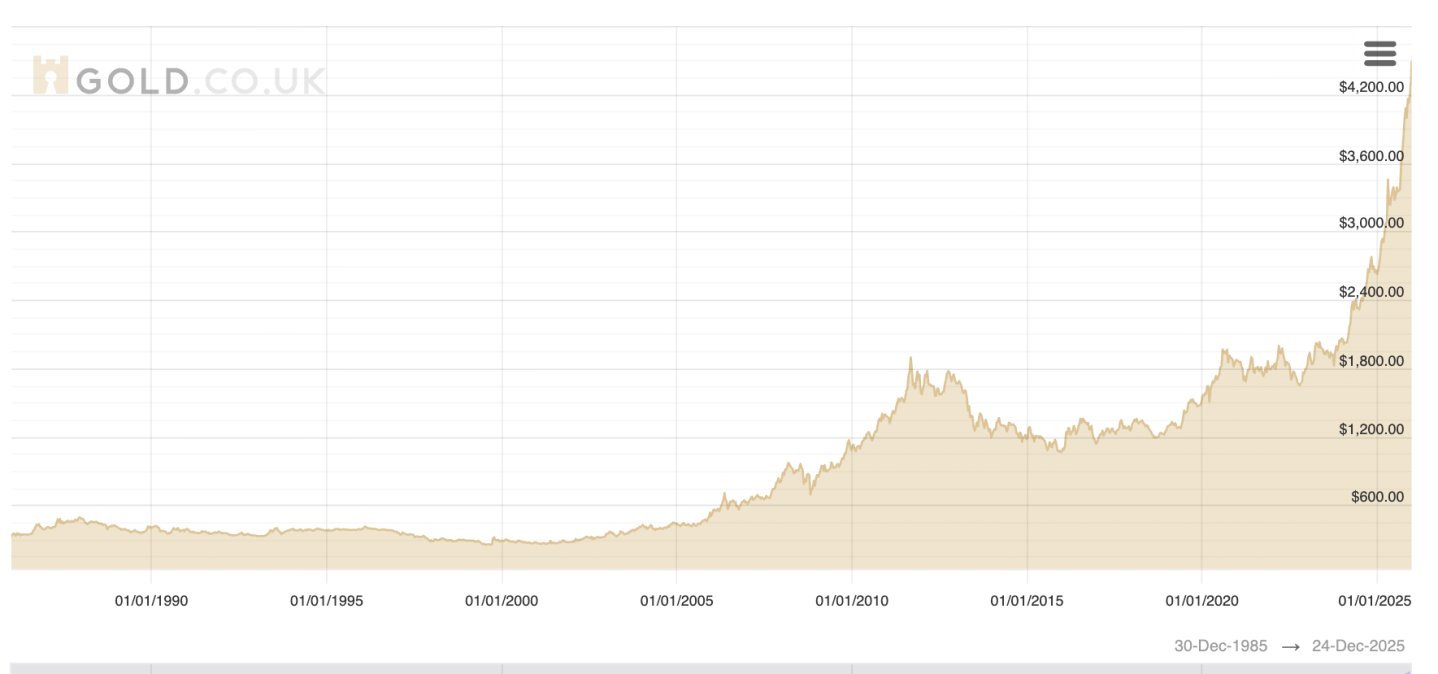

Then there is the performance of gold overall, in nominal dollar terms, versus stocks. This chart shows the price of gold over the past 40 years. Note that gold can spend years and years in long-term price declines:

Here is the continuous COMEX contract of gold versus the S&P 500 over the past 20 years. Obviously the winner is not gold:

Has gold reached its peak? Nobody knows, obviously. But interestingly, investment banks such as Société Générale, Morgan Stanley and Mitsui have all expanded their precious metals trading teams this year, and others are exploring a return to the “vault” business of storing gold reserves, the Financial Times reported.

Here’s a quick snapshot of the markets before the opening bell in New York this morning:

- Standard & Poor’s 500 futures It was flat this morning. The last session closed up by 0.46%, recording a new record at 6909.79.

- Stokes Europe 600 It rose by 0.39% in early trading.

- UK FTSE 100 index It fell by 0.12% in early trading.

- Japan Nikki 225 Decreased by 0.14%.

- China CSI 300 It rose by 0.29%.

- South Korea Cosby Decreased by 0.21%.

- India Stylish 50’s Decreased by 0.14%.

- Bitcoin It was at $87,000.

Don’t miss more hot News like this! Click here to discover the latest in Business news!

2025-12-24 12:40:00