I Tested SignalStack for 30 Days: Here’s what really happened

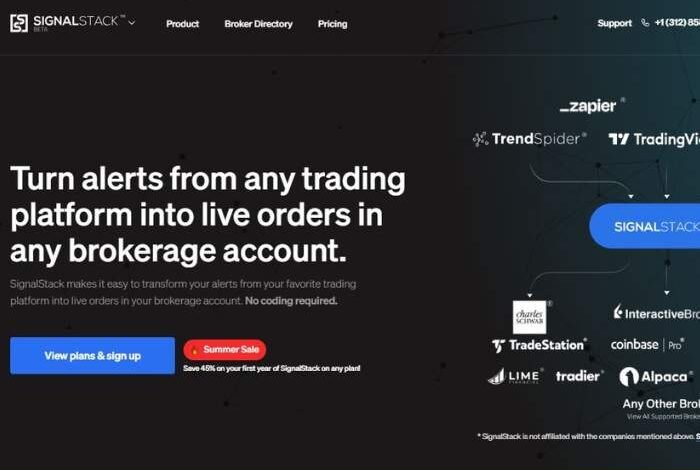

Entry to Signalstack looked like connecting a series of unreliable signals – from TradingView or TrendSpider – to direct mediation deals. Don’t code, just connect Webhooks. Can you really work? It’s time to find out.

What is Signalstack (and what is other)?

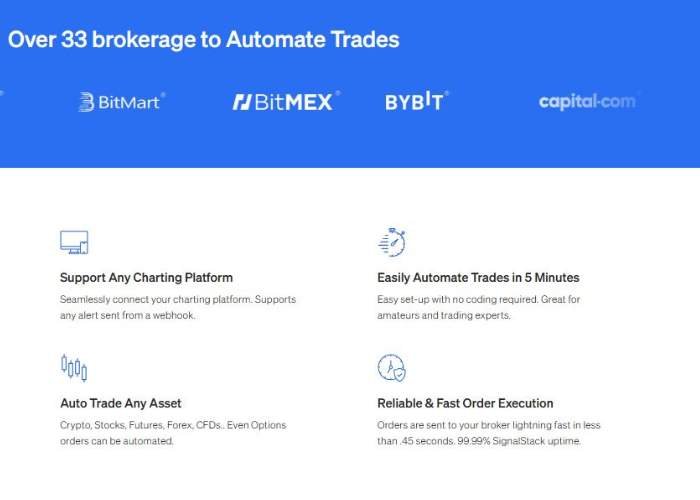

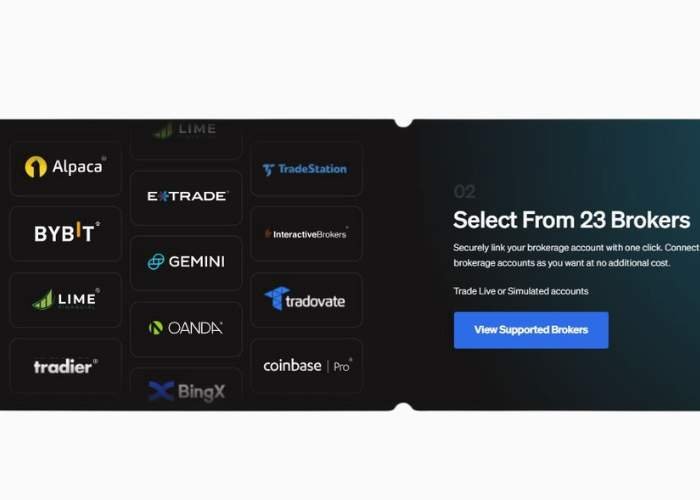

Signalstack is trading automation platform without a symbol,, Which was launched by TrendSpider in 2021. It takes alerts of planning tools such as TradingView or TrendSpider and immediately converted into orders to be executed – ACROSS, Crypto, Forex and future contracts. It connects to more than 30 brokers such as Al -Albaka, interactive brokers, Coinbase, KuCoin, Capital.com, TD Ameritra and more. Hit it: I did this setting in minutes.

Instead of building robots, you can build alerts. He does not think or adapt – it is simply bridges with signals to professions. Implementation hours in about 0.45 seconds, promised to reliable operation time by 99.99 %. (Turn0Search3, Turn0Search10) goal: Remove manual clicks and emotional frequencyDo not replace your logic completely.

How did my test (waves, not sin) go

I created TradingView alert to the outbreak of TSLA, linking it to Signalstack, and connecting my alpine test – and watch it. First hit: bought at the right moment. I felt cheerful. Then: reflecting the market and selling it with a slight loss. Reality examination.

Next, I tested the logic of closure: canceling the suspended TP/SL slide – even the relevant deals. This is my mind. I had to cancel and re -create both sides – and got a fee at a time. “Buy CXL/Living Logic” requires DOC clarity.

I also prepared two alerts on the same stomach through different time tires. Signalstack braided in one work. Support is a separate accounts proposal if you mix strategies. I felt tired.

In general: fast, but with risks and friction in complex settings.

The feature of collapse

| feature | What do you do | Take what I have – warning |

| Webhook an integration signal | Discovers are implemented based on alerts from TradingView, etc. | The speed of lightning, but logic merging the risks needs respect |

| Medium coverage and assets | Arrows, encryption, forex, futures, CFD via 30+ broker | Wide coverage – the mediator support varies |

| Non -code | No text programming-Once copy the copies of the copies of the copies | Great for beginners. Successive complex rules for management |

| Signal pricing | The first 25 free signals; Then 0.59-1.49 dollars per sign | Disturbing the flexible cost, but the price if the size is growing |

| Records and alerts records | Detailed records, Webhook/Test feature | Useful, although the records become chaotic if you run many alerts |

| Operation time and speed | Trying trading in less than 0.45s | Rapid Implementation – Waiting for the whip conditions and the mediator market |

Pros and negatives

👍 positives

- Immediate conversion of alerts to professions – no required symbol.

- Supports multiple assets across many brokers – wonderful flexibility.

- Reducing the features of the tree cutting and testing the webhook well from the uncertainty in the preparation.

- Free layer with 5 signals/month – good for experience.

👎 negatives / dodgers

- The logic of the arc orders is confusing: the cancellation of one notice everything.

- Multiple alerts on the same symbol of conflict – they do not mark the strategy.

- Pricing can be rising for each signal quickly if the test size is high.

- Documents feel thin on the edges – support required for basic functions.

Emotional curve

First trade: adrenaline. The perfect storm – not an ideal strategy. Then panic when the market was reflected. This small loss that has been postponed too. After that, the cancellation of the clumsy order leads to frustration-where the logic of the conjunctiva needed to re-shoot and cost me additional credits. annoying.

Then win the smallest restoration of faith. I felt as if I was swimming with evidence – not blind confidence, but move forward. When I tried the alternative solution, kindly supported. I felt reassured: This tool is real people, not just a symbol.

Pricing and what does it mean to you

| layer | Cost Signalbundle | Monthly equivalent | Notes |

| free | 5 signs | 0 dollar | Useful to look at the basics |

| essential | 50 signals @ $ 1.49/signal | ~ 74.50 dollars | Good for the little test |

| Middle | 250 signs @ $ 1.09/signal | ~ 272.50 dollars | Medium -level frequency users |

| Professional | 1000 signals @ 0.89 dollars/signal | ~ 890 dollars | For heavy automated users |

No flat subscription – all signal costs. So if your strategy often shoots, expect this bill. Integration with Tradingview/TrendSpider is required, with an additional cost.

From this platform?

- Traders who Code alerts can In TradingView and you want to automate lean.

- Experienced strategy users who monitor performance manually but need fast implementation.

- Users are comfortable text programming and alert management for every intermediate logic.

probably no Ideal for:

- Beginners who want to connect and operate robots

- Users are multi -strategic who aim to run many strategies on the same symbol with a joint account

- Users who need predictive decisions of artificial intelligence instead of alerting the implementation of the execution

Suggestions for improvement

- Add signals according to the strategy so that the alerts do not collide

- Allow/modify the single bowls of the bow instead of wiping everyone

- Improving documents on edge scenarios

- Participation or subscription form for heavy signals users

- The sermon of the user interface when the code alerts themselves contradict

Final ideas (my opinion)

Signalstack is not magic – it’s a fast plumbing. Trendspider or TrendSpider alerts require them to calculate your broker, and allow them to act with millions again. This alone is strong. But he does not think or liquidate – he is executed.

If you are running simple pipelines-> and you are ready to manage the cancellation, know the logic of the alarm from the outside, and follow the signals wisely, then the Signalstack speeds up and simplifies trading. But if you depend on a complex arc logic or overlapping alert groups, the platform gaps become painful.

Start with free signals, connect a test broker, run some of the live alerts, and do not overlook your account until you test cancellation and demand. If it clicks, wonderful. If not, you learned before the loss.

Do you need help in formulating silent alerts, understanding the brackets, or preparing tests for groups of symbols/multiple time frame? I am glad to walk with examples of web load and best practices.

Don’t miss more hot News like this! Click here to discover the latest in AI news!

2025-08-11 05:10:00