I Tested TradingView for 30 Days: Here’s what really happened

You can subscribe to Tradingview in the belief that they are “just charts”, but you quickly discover that it looks like a commercial operating system. It is not an artificial intelligence in the classic sense – it is more like a robot bob Launchpad. You can create strategies in the Pine Script program, test them, and fire alerts that you can webhook in implementation systems. You got the adrenaline pump so far?

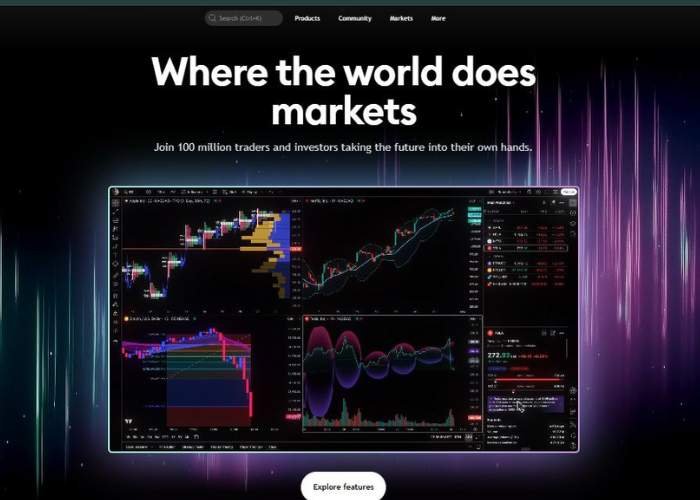

What exactly is TradingView?

Tradingvief is primarily Planning and strategy development platform-Use of stocks, encryption, forex, commodities, indicators-Providing the rear test, text programming, community symbol, and actual time alerts. The trading does not implement the same – but it is tightly integrated with the third robot services via Weberts Alert.

So, yes, it is a tool for building and verifying the authenticity of the artificial intelligence style strategies – but the execution lives elsewhere. Imagine Tradingvief as a engine room where the data meets the decisions and robots outside the orders outside orders when the conditions are fulfilled.

Feature Tour: What he brings (and leaves)

- The creator of a text strategy

Write or modify strategies using a compact or dedicated icon-Rsi Retrocations, MACD, candle patterns, called whatever you want. The rear test directly on the graph. - Webhook alert system

You can determine the conditions, include the URL for Webhook and formatting the beneficial load – then incorporating platforms work to implement real trading. - Society and the market

Tons of joint textual programs and strategies. You can import community tools and read and adapt notes. Big intelligence crowd. - Paper trading simulation

Run your strategies in the experimental mode before risking with real-useful money to correct errors and build confidence. - Data integration and mediator

Reaching historical data in actual time, communicating with brokers through third -party tools such as Tickerly, Cornix, Wunderrtrading, Traderspost, etc.

My journey: from preparing to (almost) live trades

I started in the Simply Crossover Pine Script strategy, ran through the rear test – it looks promising. This tinnitus of plans turns green? Nafis. Then I prepared an alert with Webhook to a trial provider. Set it on paper.

The first week: alerts arose, trades were recorded. Paper P & L? Meh – PIPS Small here, small losses there. I felt like to direct a ship through fog: promising, but mock the nerves when it dries.

After that, the community text program borrowed a reflected candle pattern coinciding with a sudden step in ETH. I saw the alert, I jumped myself – not fully mechanism. I felt 2 % move on paper as if to verify health. High emotional.

But alerts of poor photography one morning (my code error), and this sent me to correct the strategy correcting. Society Forum Lifesaves – had a person. This is sympathy for the code land.

Positive schedule and negatives

| Positives | Diamers / warnings |

| Super pine text editor + | A highly slope educational curve if you do not coded or the text program |

| A huge community and strategy market | Native Implementation – Recovers of the external robot services |

| Supports multiple variables, alerts and detailed logic | Alerts and textual programs often behind the levels of wall payment |

| Paper trading and simulator direct scheme | There is no advantage of implementing direct trade |

| It works through several categories of assets worldwide | The risk of excessive improving strategies in the previous data |

How do you feel

There was an morning to wake up to my phone alerts – such as controlling the mission. At other times, nothing has been launched throughout the day, and I have guessed the second preparation. Emotional fluctuations – well with frustration.

See P & L Zero Out or GO RED hit me more powerfully than expected. However, correcting the software texts – the symbol after a wrong alert – is strangely satisfied. There is a pride in insects, and seeing your logic picks up.

Pricing and value

Tradingvief has gradient subscription plans. The free layer gives the basic scheme. Payed levels, opening alerts, multi -time frame strategies, extended data, and the amount of alert. There is no direct commercial automation cost – but robot services will pay separately. Pits such as Tickerly or Cornix start ~ $ 19-39/month after experiments. (Turn0Search13, Turn0Search2)

Combined, the price is reasonable – you control spending by mixing the construction of the strategy in TradingView with a separate implementation layer.

The final ruling (Sinati)

TradingView is not a AI -Bot key – it’s a fabric where you design robots. If you are cold with writing or adaptation strategies, testing them, and communicating with external implementation tools, then this basic system is gold. He does not do everything for you – but it enables you to do most of it.

If you expect a completely intermittent robot-you need to search elsewhere or build lost pieces.

A proposal to use an approach

- Master of pine scenario via small text programs.

- Back test with strategy test; Correct the issues that have placed a mark.

- Set alerts with the appropriate Webhook and Payload format.

- Use reliable third -party automation services (Tickerly, Cornix, Traderspost).

- Paper trade widely before going directly.

- Monitor records, performance tracking, periodically refine the strategy.

The bottom line: Should you use TradingView?

Yes – if you are ready to learn text programming, accurately test, and manually implement the bridge. It becomes strong in the right hands: an accurate tool for merchants who like to build instead of handing them a black box.

Do you want to help formulate pine text template or prepare alerts for Webhook? I am happy to help him.

Don’t miss more hot News like this! Click here to discover the latest in AI news!

2025-08-03 11:09:00