Here is What I Found

Have you ever wondered if AI Crypto trading Bots is already working – or if it is just smoke and mirrors?

I spent weeks testing eleven platforms – some strategy engines, others are alerted bridges – all drug addicts on Coinbase Pro or Binance via API. I wanted to see how they were performing in real trading conditions. What has emerged, what has been fluctuated, and which robot may fit exactly what you are looking for? Let’s dig.

Why use Crypto AI?

These robots can work around the clock, clarify the passion from your trading, rear test strategies, and even implement trading based on the complex rules. But hunting chooses a style that suits your trading style-whether you are an investor of his hands or a strategic creator.

How did you experience them?

- Connect each tool via API/Webhook to calculate the test exchange

- Live strategies or alerts ran with small capital

- Focus on use, strategy flexibility, rear test tools, and support

- Compare what every robot has for what it promises to present

⬇ Watch the highest AI AI encryption robots

What really matters in the Robot of a good Amnesty International

- Types of strategy: Network, DCA, follow -up, recognition of patterns

- to implementThe original API trading tracks against the alert paths/Webhook

- Ease of use: The complexity of the preparation, the facade flow

- Transparency: Back tests, risk data, clouds

- Cost and value: Free experience, pricing levels, access to features

Best encryption trading robot: This is what I found

- Aterna ai

- Tuckeron

- Knowectia

- Coinrule

- Tradeideas

- Tradingvief

- Tradesanta

- Kavout

- Reference

- bitsgap

Basic features

- Hand implementation

- Discover the AI-Move Style

- Dynamic risk limit

- Requests ~ 4.3 % monthly return, with less than 4 %, a maximum, based on the results of 2024 verified.

Best for

Practical professionals who want negative automation without constant surveillance.

My opinion

The preparation was smooth, and trades were carried out without noise. The results felt realistic – but general transparency is the light. Promising, but confidence is built over time.

Basic features

- One agents ml

- Detection of candlestick pattern

- Tests

- A day trader built “or” momentum “robots

Best for

Merchants who want an Amnesty International focused on one origin like BTC or Sol.

My opinion

Easy delivery and operation. You can start a NVDA agent and allow it to run. The existing restrictions if you want multi -scarecrow strategies or dedicated configuration.

Basic features

- Swinging trade signals

- InvestGPT Chat Interface

- Coin multiple analysis

Best for:

Traders who rely on data and who prefer decisions led by insight instead of full automation.

My opinion

Signs accurate and useful. Imported the application programming interface-the actions lead to manual or injected trading on the Internet. However, I directed my arrest and changed its size well.

Basic features

- The existing rule if-then build

- Strategy market

- Test

- Integration of exchange including Coinbase and Binance

Best for

Traders who want to automate not to code through multiple exchanges with molds and flexibility.

My opinion

Building a strategy (for example RSI – Cross DCA) on the fly, intuitive hair. Linking and implementing real trading was clean and fast.

Basic features

- Holly AI engine

- Oddsmaker backtesting

- TradeWave momentum unit, alert -based trade signals

Best for

Aadvanced Swing/Day Traders who are looking to scan a deep signal in addition to independent implementation via webhook integration.

My opinion

Intensive market checks, sharp signals – but there is a sharp educational curve. It provides energy as soon as it is mastered.

Basic features

- Constealing of dedicated text texts strategy

- Alerts

- The drawing

- Community script market

- Implementation via conductors (such as Wundertrading)

Best for

DIY merchants build dedicated strategies who want full flexibility with the alert implementation.

My opinion

Very strong if you are comfortable text programming. The strategy synthesis takes the effort. It works surprisingly when associated with the implementation bridge tools.

Basic features

- DCA, network, futures, futures

- Binance and Excination Auto-Connect, Templates, War

Best for

Users are eager to automate simple and reliable bot with template strategies.

My opinion

The preparation was almost guaranteed. Molds work well and have stability – a great option if the coding is not your thing.

Basic features

- Kay’s degree

- Smart signals via encryption and shares

- Natural language InvestGPT chat

- Conservative diagnoses

Best for

Traders give priority to indicating automation.

My opinion

Refined and disciplined signals. There is no commercial implementation from the platform-but the quality sign is strong to make decisions.

Basic features

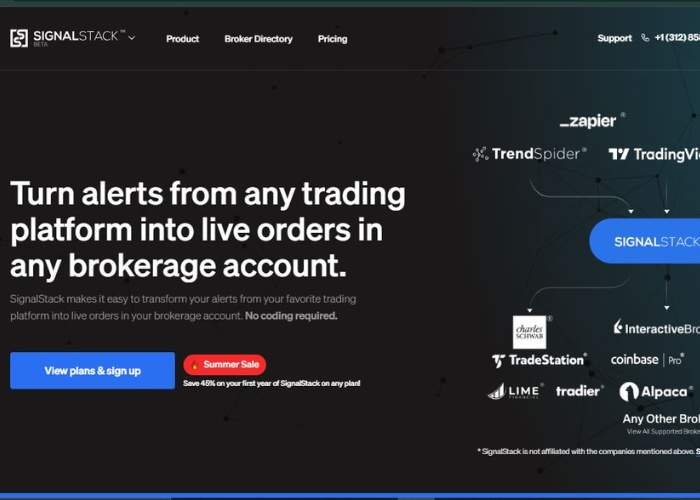

Alerts from TradingView and TrendSpider, etc., convert to automated trading that were implemented at ~ 0.5s via stock exchanges and mediators

Best for

Traders who build alerts and want to implement zero death.

My opinion

Approx and reliable. It looks like automation glue – perfect if you are busy with coding alerts and just need to count the implementation.

Basic features

- Multi -rate support

- Network, DCA, Liberation and Sink Robots, Portfolio tracking and rear test tools – but only encryption, not stocks

Best for

Multi -encoded wallet managers.

My opinion

Excellent for encryption traders using multiple exchanges. But it does not apply to stock users.

Comparison

| tool | Best for | Strategy style | Automation type | Ease of use |

| Aterna ai | Followers of the direction of the hands | Amnesty International, Group and forget | The full original XIC | Very easy |

| Tuckeron | Coin style robots | ML agents (Candlesticks) | Full EXC via the special system | easy |

| Knowectia | Insight swing signals | Feelings and technology ml | Alerts/w optional webhook | moderate |

| Coinrule | Automation of the base without a symbol | If – then the rules of templates | Original exchange robots | A friend of beginners |

| Tradeideas | Environmental scanners are an advanced signal | Artificial intelligence scanning alerts | Alerts -> Exec external | User complicated |

| Tradingvief | Custom strategy builders | Pineic text dedicated | Warning Webhooks via Mosul | Advanced preparation |

| Tradesanta | Trusted template robots | Network, DCA, futures contracts | The original automation | Very easy to use |

| Kavout | Signal analysis | Registration signals | Alerts/manual | Focus on insight |

| Reference | Warning the implementation bridge | Any logic alert | Webhook Trade implementation | Appeals and reliable |

| bitsgap | Multi -exchange encryption programs | Network, DCA, Liberation and Sink | The automation of the original exchange | The ability to focus on encryption |

Conclusion and the highest 3 recommendations

My best choices on the basis of real test:

1. Coinrule To get flexible automation, without a symbol via the stock exchanges. The best combination of use and performance.

2. Tradesanta – If you want to reliable network/DCA/futures for automated pilot. A little friction, reliable implementation.

3. Signal heap – Ideal for those who have customized signal systems only want to implement rapid and painless. Maintains complexity in the strategy, not plumbing.

Other tools also shine:

- Knowectia It is gold if you can look at automation

- Tuckeron Useful to focus one assets

- Tradeideas It is unparalleled in the depth of the wiping once you contact it

If you are new – start with Coinrel or Tradesanta. If you are customizing strategies – use Tradingvief + Signal Stack. If you want to see the signal based-fit better detection. Choose based on the amount you want in Code VS molds, control for Autopilot, and Insight Vs Execution.

Don’t miss more hot News like this! Click here to discover the latest in AI news!

2025-08-09 04:16:00