Investors glimpse pay-off for Big Tech’s mammoth spending on AI arms race

Big Tech has reduced investor concerns about its historical spending on artificial intelligence, as it published quarterly results that exceeded expectations and showed early signs that artificial intelligence enhances profits.

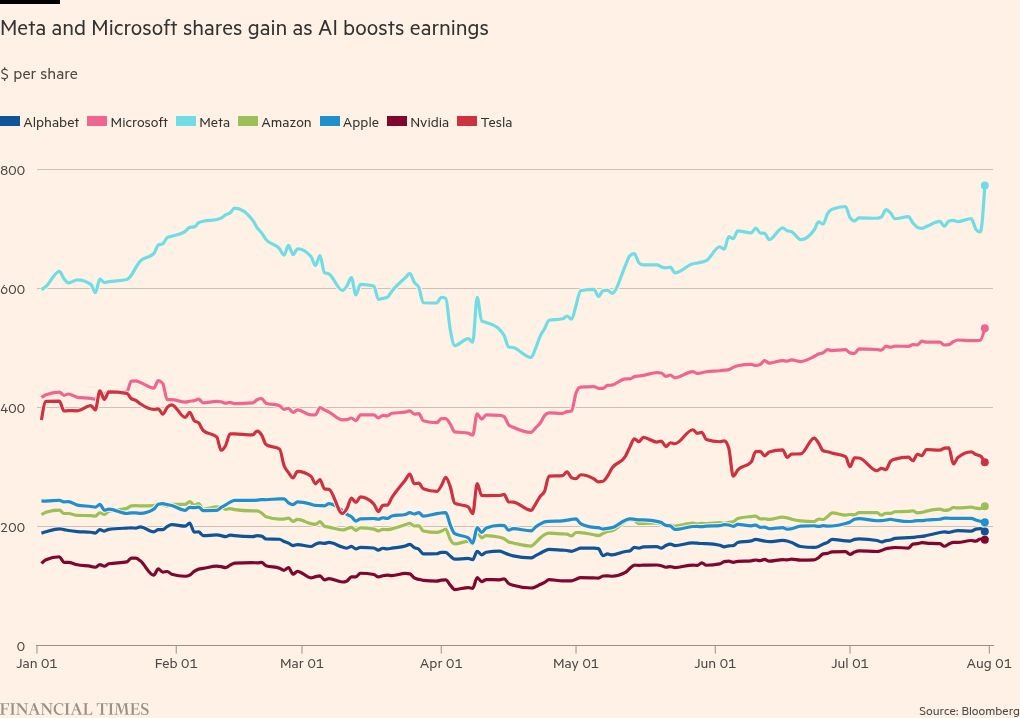

Alphabet, Meta and Microsoft were the clear winners, they combined added more than $ 350 billion in the market value of shares after reporting the increases in revenues and net income. Microsoft has become the second company to $ 4TN in the market value, after the Chipmaker Nvidia maker, while Meta rose by 11 percent only to 2 -Tn.

Strong growth was used in Google and Microsoft cloud computing sections and a height in Meta’s advertising margins to justify another huge increase in capital spending. The trio, along with Amazon, is on the right path to spending more than $ 350 billion this year on data centers and other Amnesty International infrastructure and more than $ 400 billion in 2026.

Satya Nadella, CEO of Microsoft, has pledged to invest $ 120 billion over the next four and “Scale Data Center Statters faster than any other competitor.”

He led Meta to Capex worth $ 105 billion next year, separating from a Manhattan database in Louisiana called Hyperion. Meanwhile, CEO Mark Zuckerberg was attracting his engineers for the “SuperINGENGE” laboratory with payment packages in hundreds of millions of dollars.

In the previous seasons, investors’ reaction was negatively to the vast amounts that are thrown into artificial intelligence, lining that investment does not coincide with increasing profits. This time, however, they have taken the possibility of another expansion in CAPEX in their steps.

They have been encouraged by large technology that indicates strong demand for artificial intelligence computing and customer orders. It also provided greater clarity on how to achieve emerging technology.

“Although there is no end on the horizon for spending, the narration has turned significantly, as these companies are now offering revenues,” said Jim Terney, head of the focused US Development Fund at Alliacebernstein.

He said that the positive market reaction was “really wonderful”, driven by a “double sensation” of high cloud revenue and artificial intelligence services sales.

Meta jumped after Facebook’s father showed concrete evidence that artificial intelligence was helping her targeting ads and turning more in their favor as a result. Its price increased for each 9 % on an annual basis, while the number of ads that served 11 percent.

The initial general offering of the Figma Design Manufacturer enlarged the noise around technology. Its shares increased by 250 percent on their appearance for the first time on Thursday to evaluate more than 60 billion dollars, three times the price offered by ADOBE, when he tried to buy the startup in 2022.

“If we are not already there, we are about to be enthusiasm. Markets are very optimistic. No one wants to think about the negative side. They just want to be part of this,” said Drew Dixon, founder of Albert Bridge Capital. “But the truth is that everyone cannot win, and that spending on artificial intelligence is not necessarily a drug.”

Brent Thil, an analyst at Jeffrey, said that investors will make alert again if the pipeline of the demand for the prosecution’s cloud computing declines.

“[But] “As long as the revenue and reservation numbers are present, they can spend everything they want. It is the continuous Capex war. There are like five companies that can spend in the size needed to be in the race. Most investors believe that if not one company, another person will do it.”

Amazon was alien in the profits of the quarter. Her shares decreased by 7 percent after her profit report, a reminder that feelings about artificial intelligence are fragile if growth and high costs slow.

The e -commerce giant led the road to spending in the second quarter at 31.4 billion dollars, and Jeffrez estimates that this will reach 106 billion dollars this year.

Although financial estimates are overcome, analysts criticized “disappointing” momentum in the leading AWS Cloud unit in the market, compared to the fastest growth in Microsoft Azure and Google Cloud.

CEO Andy Jassi also warned of more uncertainty about Donald Trump’s tariff policies. Late Thursday, the US president restored the periods of customs tariffs on dozens of countries where he pressed them to conclude commercial deals.

Apple surprised the market with an increase of 10 percent of the revenues, as IPhone sales remained flexible. Executive officials also promised to spend more on artificial intelligence to address criticism that they have alleviated efforts to merge them into devices so far.

However, stocks failed to get a lot of traction. The company is still especially vulnerable to Trump targeting China, Taiwan and India from its supply chain – with punitive definitions.

Other obstacles that can hinder the Silicon Valley track remain.

Organizers in the United States, the European Union and the United Kingdom to combat monopoly are continuing a set of monopolistic lawsuits against the sector that could see technology blocs disintegrate or open for competitors.

The Federal Trade Committee seeks to force Meta to strip WhatsApp and Instagram. Microsoft Cloud works in the United States and Britain. FTC filed a lawsuit against Amazon for the alleged price manipulation. Apple faces lawsuits from the Ministry of Justice to create an unimaginable ecosystem on iPhone, despite hopes that Trump may crush the Biden era.

Alphabet faces the largest problem, after it has lost three consecutive cases to combat monopoly against research, advertising and application store. Google Parent may have to sell Chrome browser and share its index data with its competitors.

The Great Technology Company for the report will be NVIDIA in late August. The $ 4.3 million chips giant was the main beneficiary of the spending boom, as the battle of its peers to secure the supply of graphics processing units used to train and operate artificial intelligence models. Revenue is expected about $ 45 billion in the second quarter, an increase of 50 percent over 30 billion dollars reported a year ago.

“Technology explodes numbers, so it continues to get all the attention,” Dixon said.

“When they built the railways in the 1980s, the stock values were initially silent until the reality began, the same story for radio stocks in the twenties of the twentieth century, and” Dot -coms “in the 1990s. “We will get to that stage with artificial intelligence that we have seen over and over again. Everything is raised today by tide. There will be in the end two winners and losers, but this will not be clear for a while.”

Additional reports by Rafe Uddin, Tabby Kinder and Hannah Murphy

2025-08-01 04:00:00